Whales with a lot of money to spend have taken a noticeably bearish stance on Riot Platforms.

Looking at options history for Riot Platforms RIOT we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 60% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $893,386 and 6, calls, for a total amount of $867,321.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $6.0 and $20.0 for Riot Platforms, spanning the last three months.

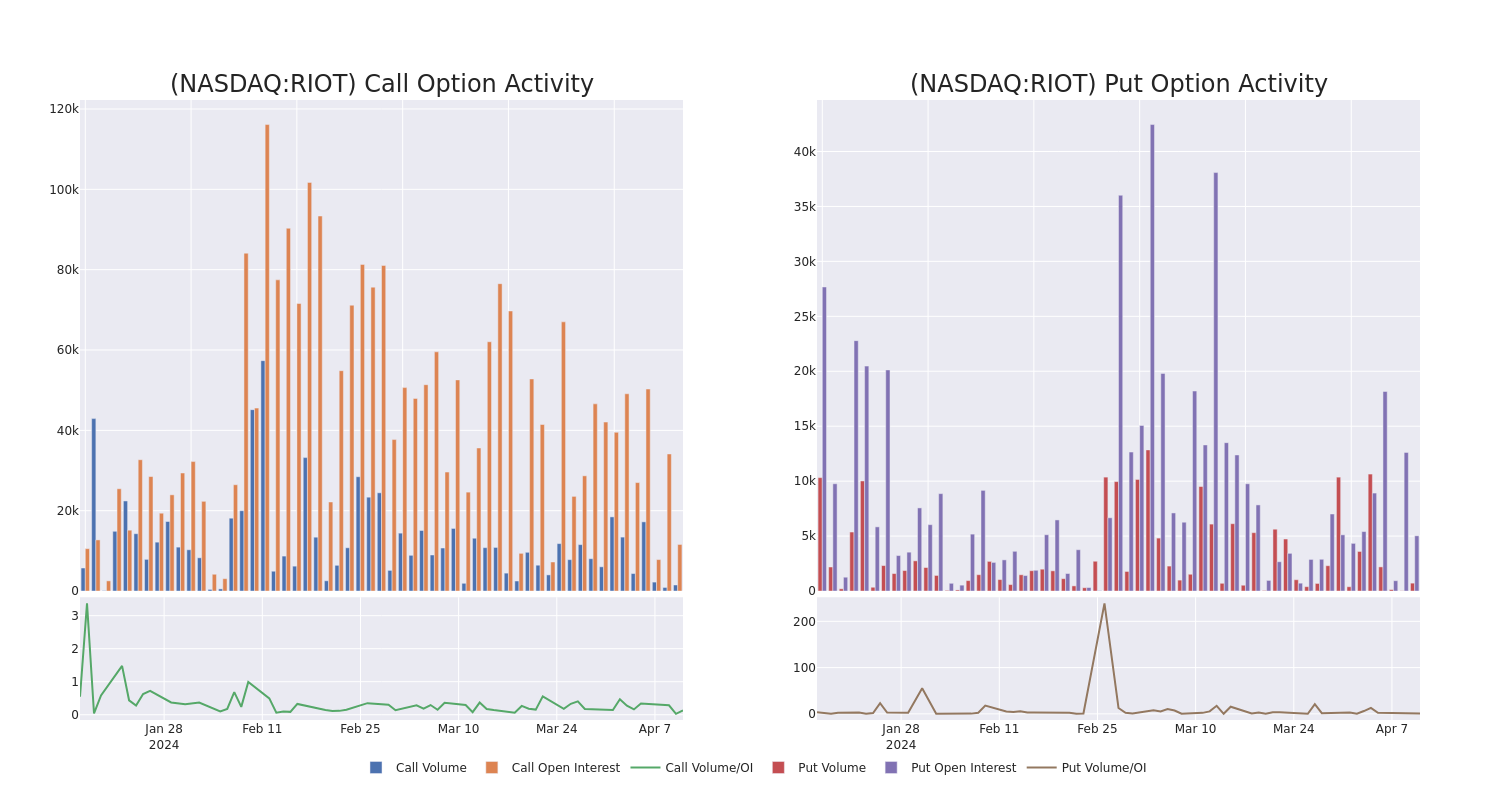

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Riot Platforms's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Riot Platforms's whale trades within a strike price range from $6.0 to $20.0 in the last 30 days.

Riot Platforms Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIOT | CALL | SWEEP | BEARISH | 04/12/24 | $4.05 | $3.8 | $3.8 | $6.00 | $495.1K | 50 | 227 |

| RIOT | PUT | TRADE | BEARISH | 06/21/24 | $10.55 | $10.5 | $10.55 | $20.00 | $359.7K | 950 | 341 |

| RIOT | PUT | TRADE | BULLISH | 09/20/24 | $10.0 | $9.9 | $9.93 | $19.00 | $338.6K | 1.0K | 0 |

| RIOT | CALL | SWEEP | BULLISH | 01/16/26 | $5.5 | $5.35 | $5.5 | $10.00 | $137.5K | 6.0K | 47 |

| RIOT | PUT | SWEEP | BEARISH | 01/17/25 | $11.5 | $11.45 | $11.45 | $20.00 | $100.7K | 1.9K | 88 |

About Riot Platforms

Riot Platforms Inc is a vertically integrated Bitcoin mining company focused on building, supporting, and operating blockchain technologies. The company's segments include Bitcoin Mining; Data Center Hosting and Engineering. It generates maximum revenue from the Bitcoin Mining segment which generates revenue from the Bitcoin the company earns through its mining activities.

Current Position of Riot Platforms

- Currently trading with a volume of 3,730,411, the RIOT's price is down by -1.11%, now at $9.76.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 27 days.

What The Experts Say On Riot Platforms

In the last month, 5 experts released ratings on this stock with an average target price of $17.3.

- In a positive move, an analyst from JP Morgan has upgraded their rating to Overweight and adjusted the price target to $15.

- An analyst from B. Riley Securities persists with their Buy rating on Riot Platforms, maintaining a target price of $16.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Riot Platforms with a target price of $15.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $20.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Riot Platforms options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.