Whales with a lot of money to spend have taken a noticeably bearish stance on Morgan Stanley.

Looking at options history for Morgan Stanley MS we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 62% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $216,267 and 3, calls, for a total amount of $185,330.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $87.5 to $100.0 for Morgan Stanley during the past quarter.

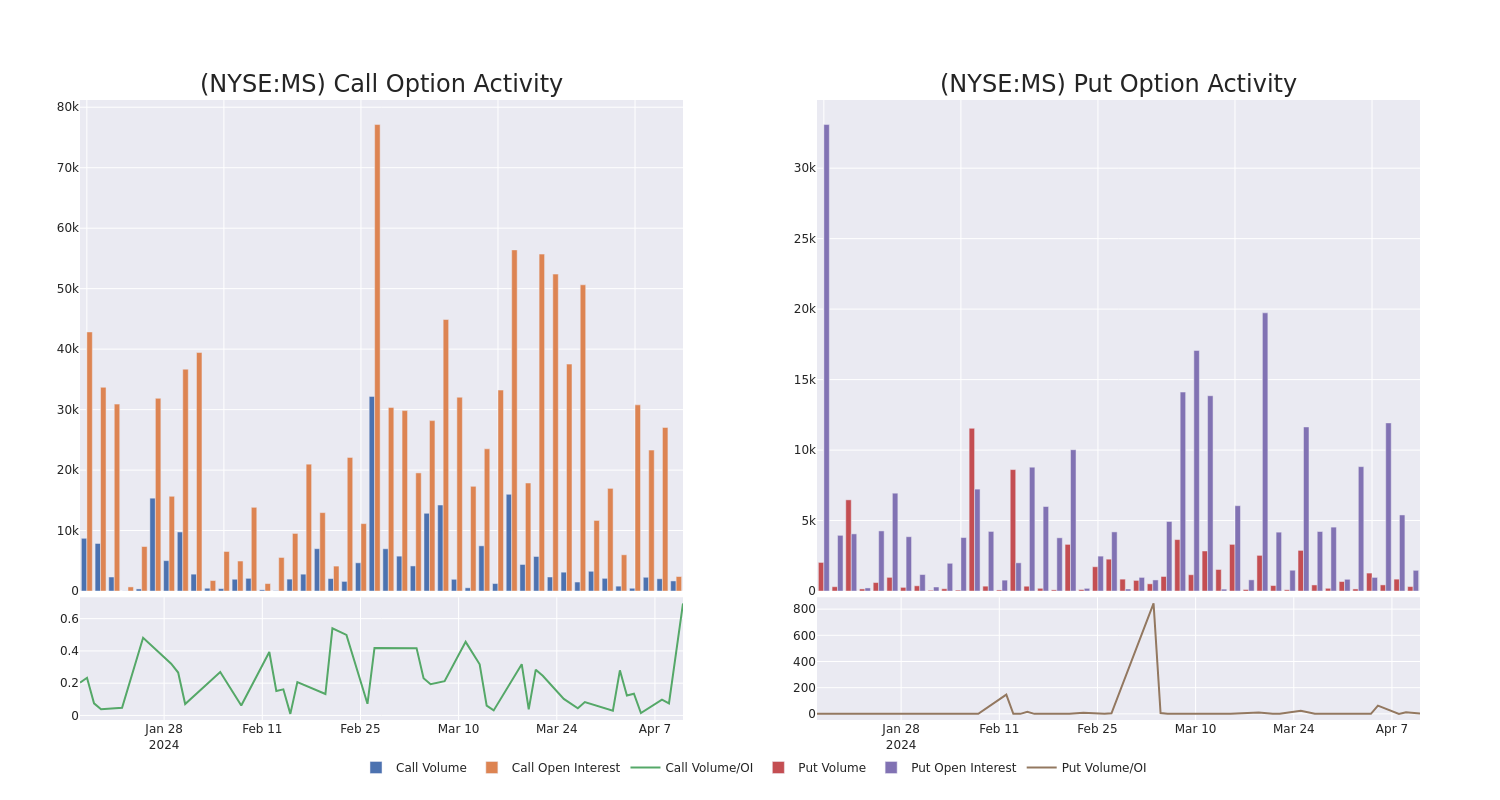

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Morgan Stanley's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Morgan Stanley's significant trades, within a strike price range of $87.5 to $100.0, over the past month.

Morgan Stanley Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | TRADE | BULLISH | 05/17/24 | $5.45 | $5.35 | $5.45 | $87.50 | $92.6K | 1.7K | 0 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $13.85 | $13.6 | $13.85 | $97.50 | $67.8K | 7 | 11 |

| MS | CALL | SWEEP | BULLISH | 04/12/24 | $0.95 | $0.91 | $0.95 | $90.00 | $50.7K | 649 | 1.0K |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $12.25 | $12.1 | $12.25 | $95.00 | $49.0K | 133 | 104 |

| MS | CALL | SWEEP | BEARISH | 04/12/24 | $0.94 | $0.91 | $0.93 | $90.00 | $41.9K | 649 | 628 |

About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments. The company had over $4 trillion of client assets as well as over 80,000 employees at the end of 2022. Approximately 50% of the company's net revenue is from its institutional securities business, with the remainder coming from wealth and investment management. The company derives about 30% of its total revenue outside the Americas.

Current Position of Morgan Stanley

- With a volume of 731,806, the price of MS is up 0.27% at $91.9.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 5 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Morgan Stanley options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.