Investors with a lot of money to spend have taken a bullish stance on Cameco CCJ.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 12 options trades for Cameco.

This isn't normal.

The overall sentiment of these big-money traders is split between 75% bullish and 25%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $89,700, and 11, calls, for a total amount of $447,402.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $33.0 to $70.0 for Cameco over the last 3 months.

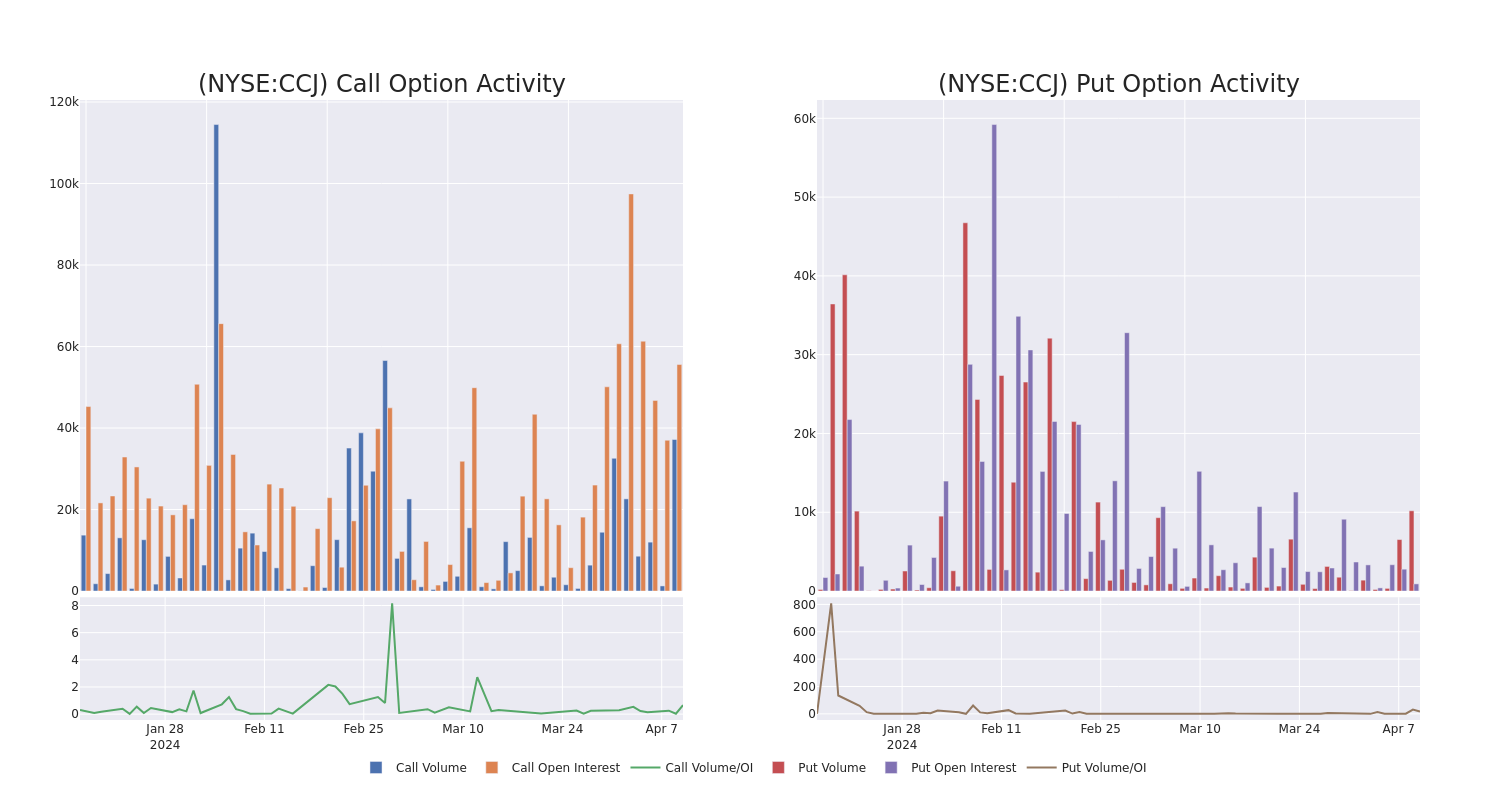

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cameco's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cameco's substantial trades, within a strike price spectrum from $33.0 to $70.0 over the preceding 30 days.

Cameco Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | CALL | TRADE | BULLISH | 09/20/24 | $1.16 | $1.1 | $1.14 | $70.00 | $102.6K | 633 | 900 |

| CCJ | PUT | SWEEP | BEARISH | 01/16/26 | $3.45 | $3.35 | $3.45 | $33.00 | $89.7K | 875 | 0 |

| CCJ | CALL | SWEEP | BULLISH | 01/17/25 | $8.2 | $8.15 | $8.2 | $50.00 | $69.6K | 7.4K | 235 |

| CCJ | CALL | TRADE | BULLISH | 04/12/24 | $1.32 | $1.24 | $1.32 | $49.00 | $39.6K | 1.2K | 1.4K |

| CCJ | CALL | SWEEP | BULLISH | 01/17/25 | $6.25 | $6.1 | $6.25 | $55.00 | $35.0K | 18.5K | 64 |

About Cameco

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. Cameco has three reportable segments, uranium, fuel services and Westinghouse. It derives maximum revenue from Uranium Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia and United States.

In light of the recent options history for Cameco, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Cameco's Current Market Status

- Trading volume stands at 2,706,517, with CCJ's price up by 0.61%, positioned at $49.46.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 19 days.

What Analysts Are Saying About Cameco

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $55.0.

- In a cautious move, an analyst from Goldman Sachs downgraded its rating to Buy, setting a price target of $55.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cameco with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.