Financial giants have made a conspicuous bearish move on Walgreens Boots Alliance. Our analysis of options history for Walgreens Boots Alliance WBA revealed 14 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 57% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $464,159, and 9 were calls, valued at $498,935.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $50.0 for Walgreens Boots Alliance over the last 3 months.

Insights into Volume & Open Interest

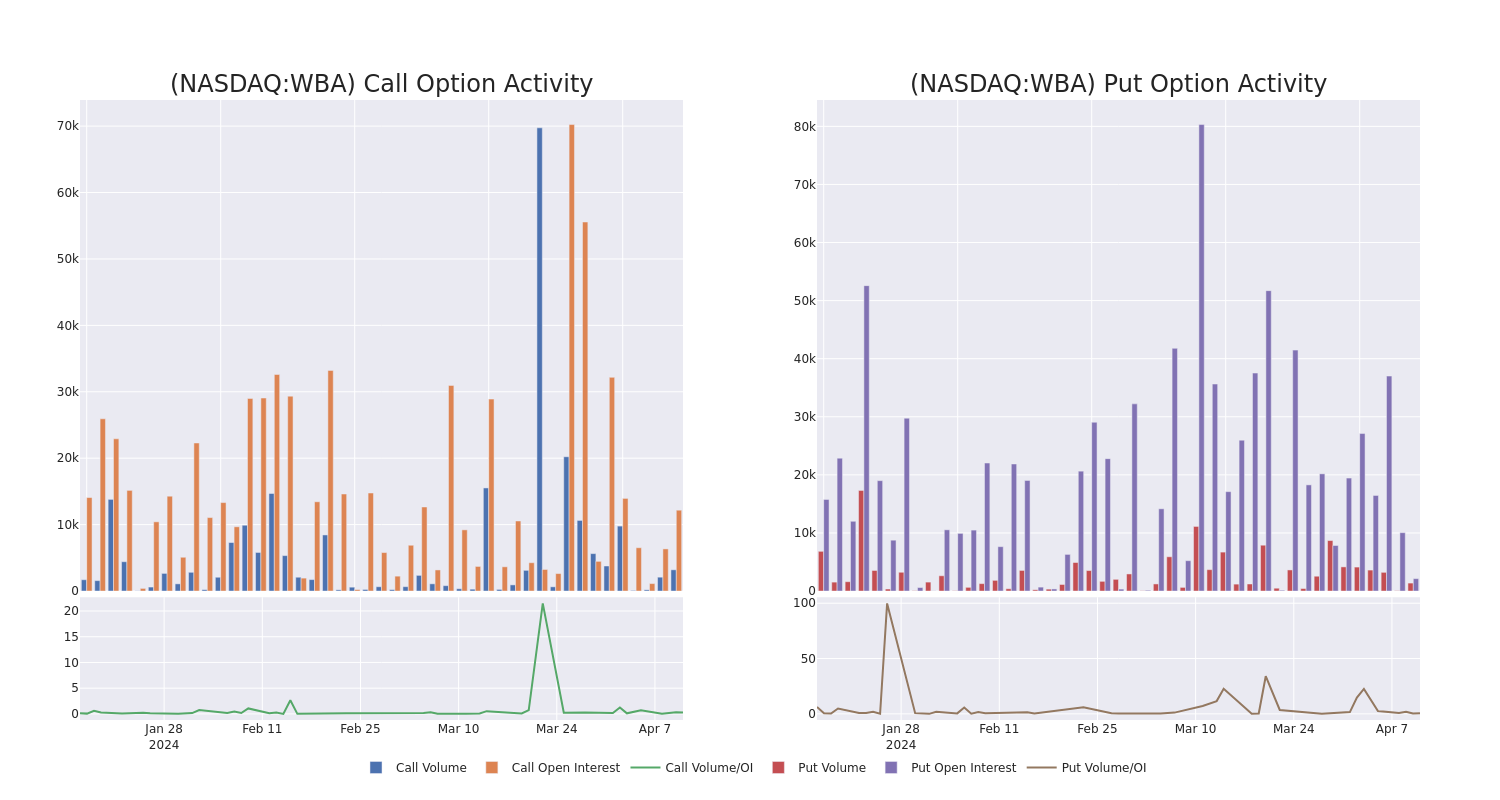

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Walgreens Boots Alliance's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Walgreens Boots Alliance's substantial trades, within a strike price spectrum from $15.0 to $50.0 over the preceding 30 days.

Walgreens Boots Alliance Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBA | PUT | SWEEP | BEARISH | 10/18/24 | $7.45 | $7.35 | $7.45 | $25.00 | $180.3K | 2.1K | 243 |

| WBA | CALL | SWEEP | BULLISH | 06/20/25 | $4.75 | $4.65 | $4.75 | $15.00 | $142.0K | 1.8K | 58 |

| WBA | PUT | SWEEP | BEARISH | 10/18/24 | $7.5 | $7.4 | $7.5 | $25.00 | $141.7K | 2.1K | 320 |

| WBA | CALL | SWEEP | BULLISH | 06/20/25 | $4.85 | $4.75 | $4.85 | $15.00 | $98.9K | 1.8K | 570 |

| WBA | PUT | SWEEP | BEARISH | 10/18/24 | $7.5 | $7.4 | $7.5 | $25.00 | $72.0K | 2.1K | 510 |

About Walgreens Boots Alliance

Walgreens Boots Alliance is one of the largest retail pharmacy chains in the U.S., with over 8,500 locations. Nearly three quarters of Americans live within five miles of a Walgreens location. Roughly two thirds of revenue is generated from prescription drug sales; Walgreens makes up 20% of total prescription revenue in the U.S. Walgreens also generates sales from retail products (general wellness consumables and its own branded merchandise), European drug wholesale, and healthcare. With more locations incorporating additional services like Health Corner and Village Medical, Walgreens creates an omnichannel experience for patients and positions itself as a one-stop healthcare provider.

In light of the recent options history for Walgreens Boots Alliance, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Walgreens Boots Alliance

- Currently trading with a volume of 8,210,234, the WBA's price is up by 0.33%, now at $18.08.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 75 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walgreens Boots Alliance options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.