Deep-pocketed investors have adopted a bullish approach towards e.l.f. Beauty ELF, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ELF usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for e.l.f. Beauty. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 61% leaning bullish and 38% bearish. Among these notable options, 4 are puts, totaling $226,930, and 9 are calls, amounting to $534,830.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $185.0 for e.l.f. Beauty during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for e.l.f. Beauty options trades today is 213.22 with a total volume of 890.00.

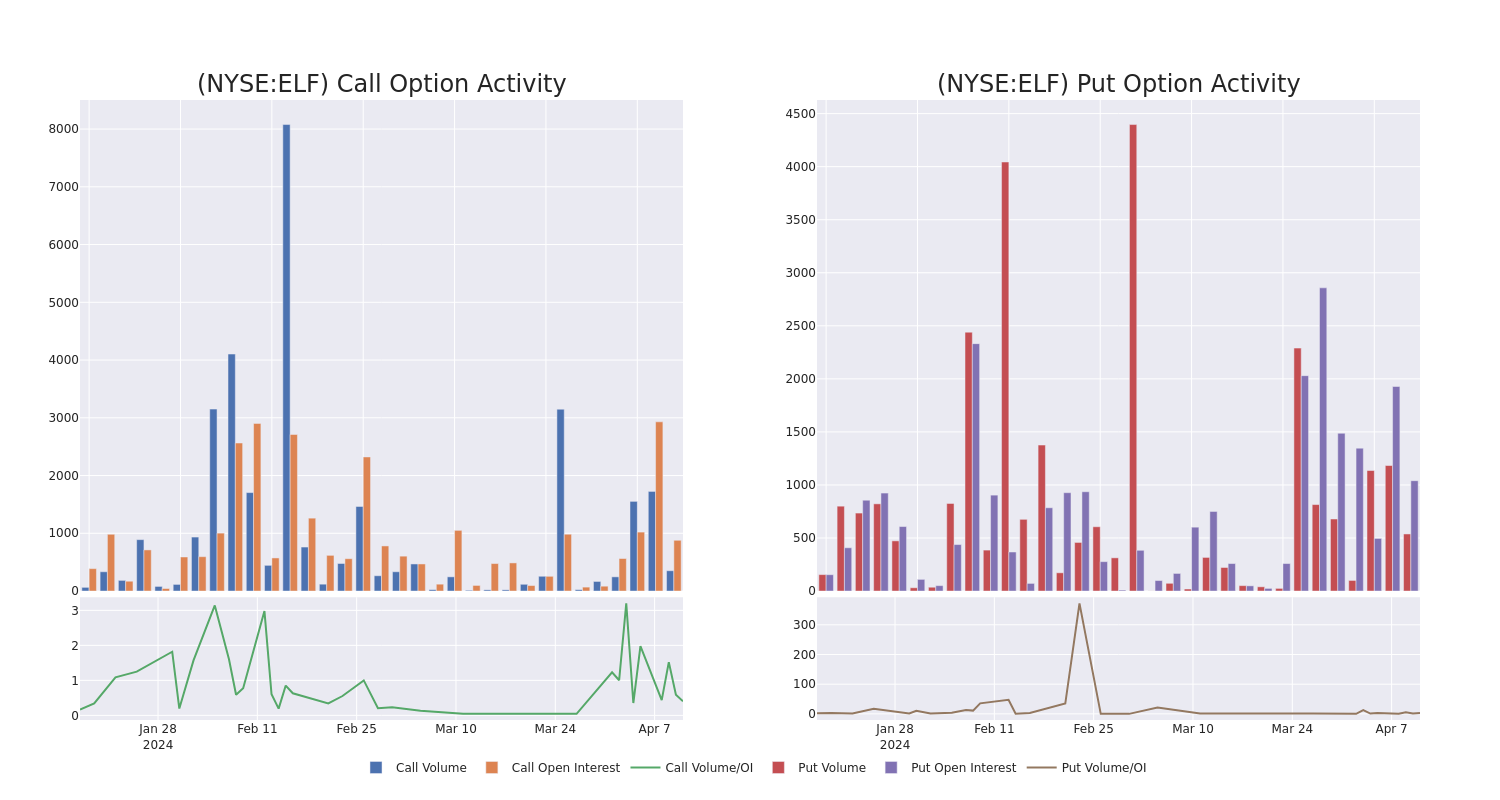

In the following chart, we are able to follow the development of volume and open interest of call and put options for e.l.f. Beauty's big money trades within a strike price range of $150.0 to $185.0 over the last 30 days.

e.l.f. Beauty Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ELF | CALL | SWEEP | BULLISH | 07/19/24 | $20.8 | $20.6 | $20.8 | $170.00 | $104.0K | 34 | 60 |

| ELF | CALL | SWEEP | BEARISH | 08/16/24 | $34.5 | $34.0 | $34.11 | $150.00 | $102.3K | 75 | 50 |

| ELF | PUT | SWEEP | BULLISH | 04/26/24 | $9.6 | $8.6 | $8.6 | $170.00 | $86.0K | 205 | 152 |

| ELF | PUT | SWEEP | BULLISH | 04/26/24 | $8.4 | $8.0 | $8.0 | $170.00 | $80.0K | 205 | 352 |

| ELF | CALL | TRADE | BULLISH | 10/18/24 | $38.2 | $36.9 | $38.2 | $150.00 | $76.4K | 3 | 20 |

About e.l.f. Beauty

e.l.f. Beauty Inc is a cosmetic company based in the United States. The company offers cosmetic accessories for women which include eyeliner, mascara, false eyelashes, lipstick, the foundation for the face, moisturizer, cleanser, and other tools through its stores and e-commerce channels. The products that the company sells are marketed under the e.l.f. Cosmetics, W3LL PEOPLE and Keys Soulcare brands. It carries out the sales within the US and internationally, out of which maximum revenue is generated from the US.

After a thorough review of the options trading surrounding e.l.f. Beauty, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is e.l.f. Beauty Standing Right Now?

- With a volume of 731,351, the price of ELF is up 1.09% at $169.0.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 41 days.

What The Experts Say On e.l.f. Beauty

5 market experts have recently issued ratings for this stock, with a consensus target price of $221.0.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Market Perform rating on e.l.f. Beauty with a target price of $220.

- An analyst from Piper Sandler downgraded its action to Overweight with a price target of $225.

- Consistent in their evaluation, an analyst from DA Davidson keeps a Buy rating on e.l.f. Beauty with a target price of $220.

- Maintaining their stance, an analyst from DA Davidson continues to hold a Buy rating for e.l.f. Beauty, targeting a price of $220.

- Consistent in their evaluation, an analyst from DA Davidson keeps a Buy rating on e.l.f. Beauty with a target price of $220.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest e.l.f. Beauty options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.