Whales with a lot of money to spend have taken a noticeably bearish stance on American Airlines Gr.

Looking at options history for American Airlines Gr AAL we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 55% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $348,716 and 3, calls, for a total amount of $104,525.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $11.0 and $17.0 for American Airlines Gr, spanning the last three months.

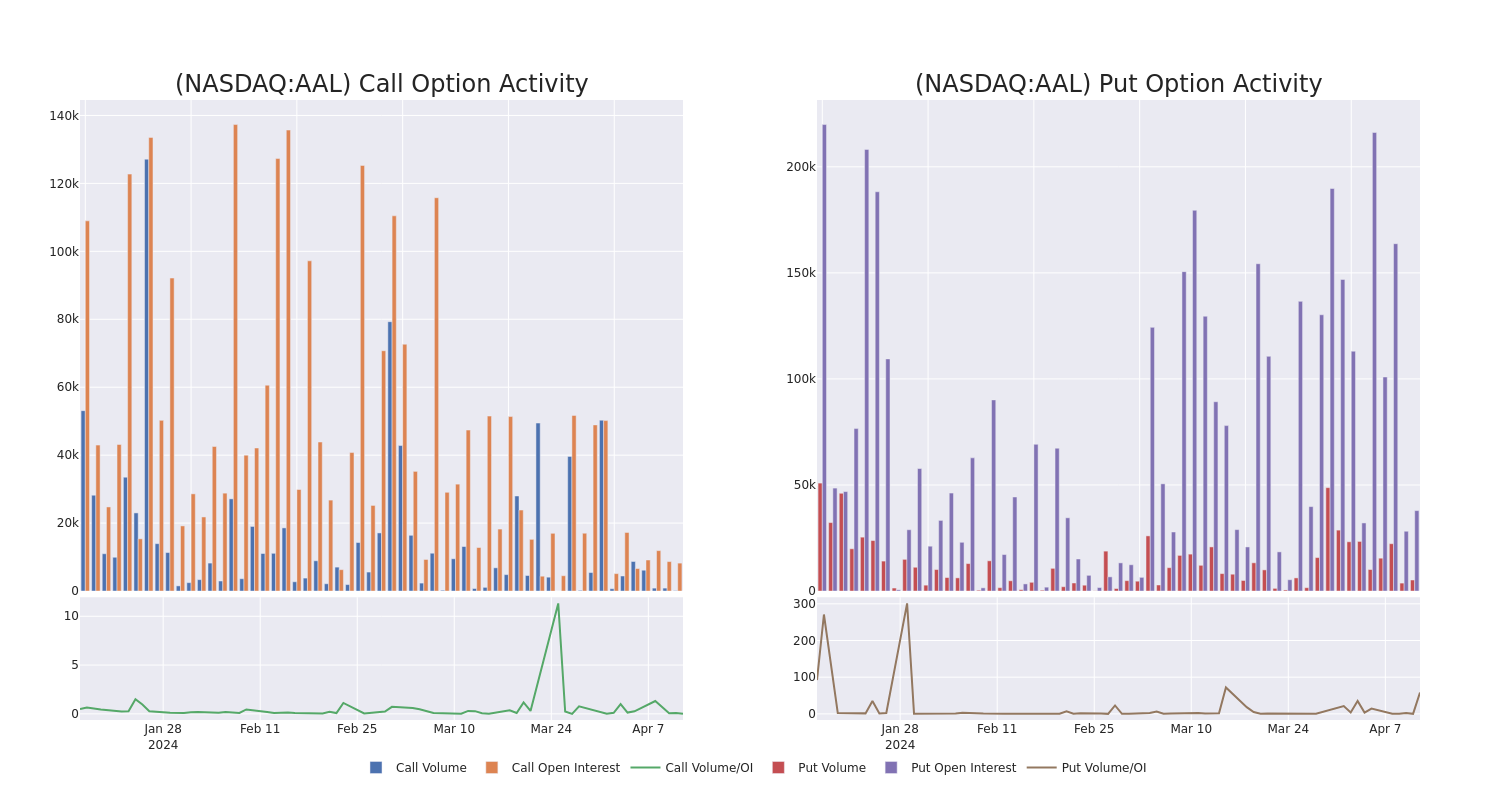

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for American Airlines Gr options trades today is 6592.0 with a total volume of 5,315.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for American Airlines Gr's big money trades within a strike price range of $11.0 to $17.0 over the last 30 days.

American Airlines Gr Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | PUT | SWEEP | BULLISH | 11/15/24 | $4.1 | $4.0 | $4.0 | $17.00 | $115.2K | 5 | 288 |

| AAL | PUT | SWEEP | BEARISH | 05/17/24 | $0.64 | $0.63 | $0.64 | $13.00 | $85.1K | 17.0K | 120 |

| AAL | CALL | TRADE | BEARISH | 11/15/24 | $2.59 | $2.55 | $2.55 | $12.00 | $49.7K | 128 | 0 |

| AAL | PUT | SWEEP | BULLISH | 04/12/24 | $0.86 | $0.82 | $0.82 | $14.00 | $47.2K | 5.5K | 1.1K |

| AAL | PUT | SWEEP | BULLISH | 04/12/24 | $0.88 | $0.8 | $0.82 | $14.00 | $34.8K | 5.5K | 177 |

About American Airlines Gr

American Airlines is the world's largest airline by aircraft, capacity, and scheduled revenue passenger miles. Its major U.S. hubs are Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, D.C. It generates over 30% of U.S. airline revenue connecting Latin America with destinations in the United States. After completing a major fleet renewal, the company has the youngest fleet of U.S. legacy carriers.

In light of the recent options history for American Airlines Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of American Airlines Gr

- With a volume of 6,381,777, the price of AAL is down -3.49% at $13.14.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

Expert Opinions on American Airlines Gr

In the last month, 1 experts released ratings on this stock with an average target price of $19.0.

- In a cautious move, an analyst from UBS downgraded its rating to Buy, setting a price target of $19.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest American Airlines Gr options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.