Whales with a lot of money to spend have taken a noticeably bearish stance on Coinbase Glb.

Looking at options history for Coinbase Glb COIN we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 12% of the investors opened trades with bullish expectations and 87% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $356,730 and 12, calls, for a total amount of $954,574.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $520.0 for Coinbase Glb over the last 3 months.

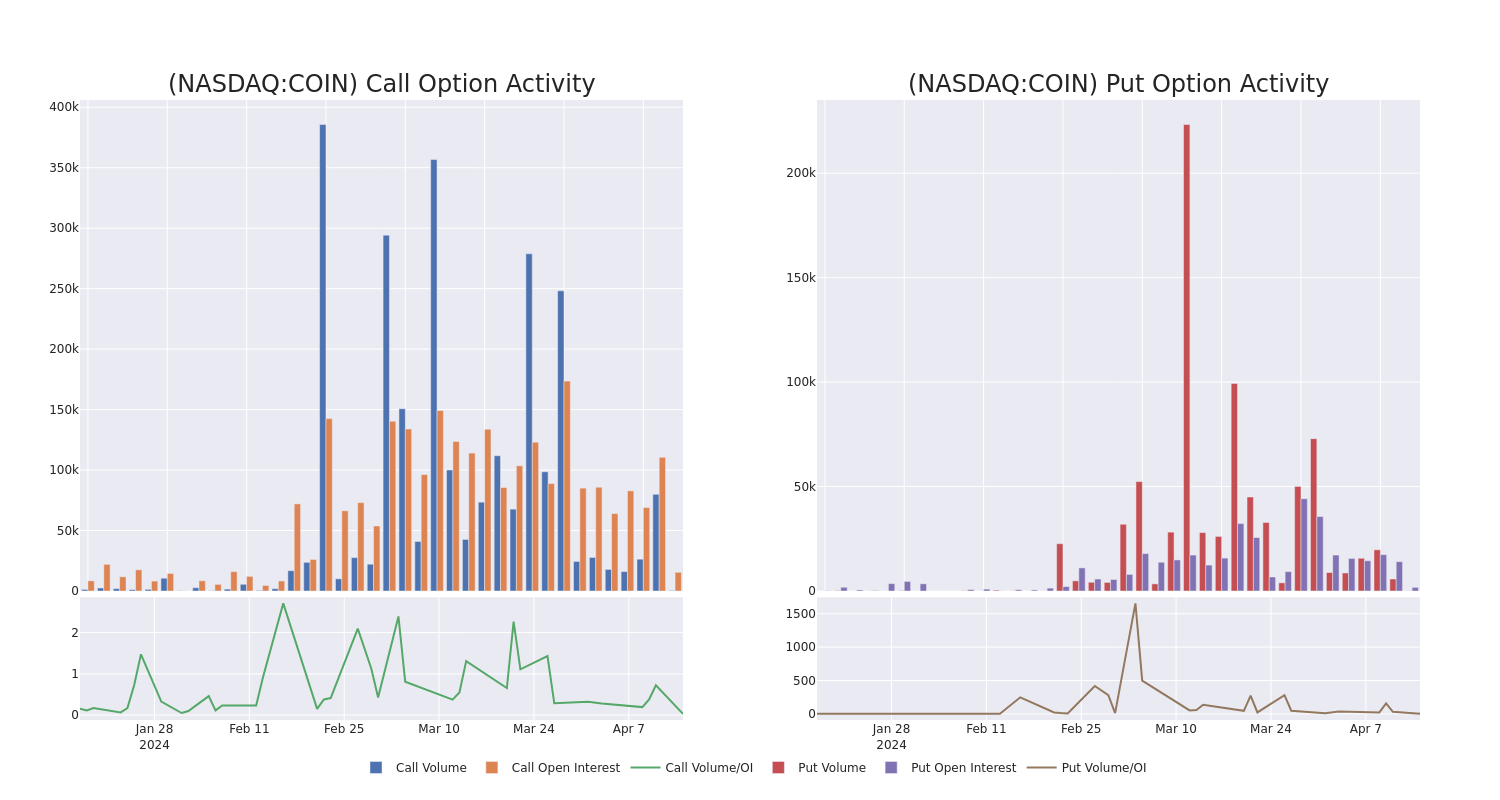

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Coinbase Glb's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Coinbase Glb's whale trades within a strike price range from $160.0 to $520.0 in the last 30 days.

Coinbase Glb Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COIN | CALL | TRADE | BULLISH | 06/21/24 | $62.75 | $62.0 | $62.75 | $200.00 | $282.3K | 3.7K | 46 |

| COIN | CALL | TRADE | BEARISH | 01/16/26 | $109.75 | $99.75 | $100.0 | $250.00 | $140.0K | 158 | 14 |

| COIN | PUT | SWEEP | BEARISH | 05/17/24 | $14.0 | $13.55 | $14.0 | $220.00 | $135.8K | 810 | 3 |

| COIN | PUT | TRADE | NEUTRAL | 06/21/24 | $44.35 | $43.3 | $43.9 | $260.00 | $105.3K | 232 | 24 |

| COIN | CALL | TRADE | BEARISH | 01/17/25 | $23.6 | $22.75 | $22.96 | $520.00 | $91.8K | 626 | 40 |

About Coinbase Glb

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage and data analytics.

Having examined the options trading patterns of Coinbase Glb, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Coinbase Glb

- Trading volume stands at 1,060,101, with COIN's price up by 0.42%, positioned at $246.78.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 17 days.

Professional Analyst Ratings for Coinbase Glb

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $211.8.

- Maintaining their stance, an analyst from Keefe, Bruyette & Woods continues to hold a Market Perform rating for Coinbase Glb, targeting a price of $230.

- An analyst from Barclays persists with their Underweight rating on Coinbase Glb, maintaining a target price of $179.

- In a cautious move, an analyst from Canaccord Genuity downgraded its rating to Buy, setting a price target of $240.

- An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $300.

- An analyst from B of A Securities persists with their Underperform rating on Coinbase Glb, maintaining a target price of $110.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Coinbase Glb with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.