Whales with a lot of money to spend have taken a noticeably bearish stance on MicroStrategy.

Looking at options history for MicroStrategy MSTR we detected 61 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 25 are puts, for a total amount of $1,473,880 and 36, calls, for a total amount of $3,075,653.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $3800.0 for MicroStrategy over the recent three months.

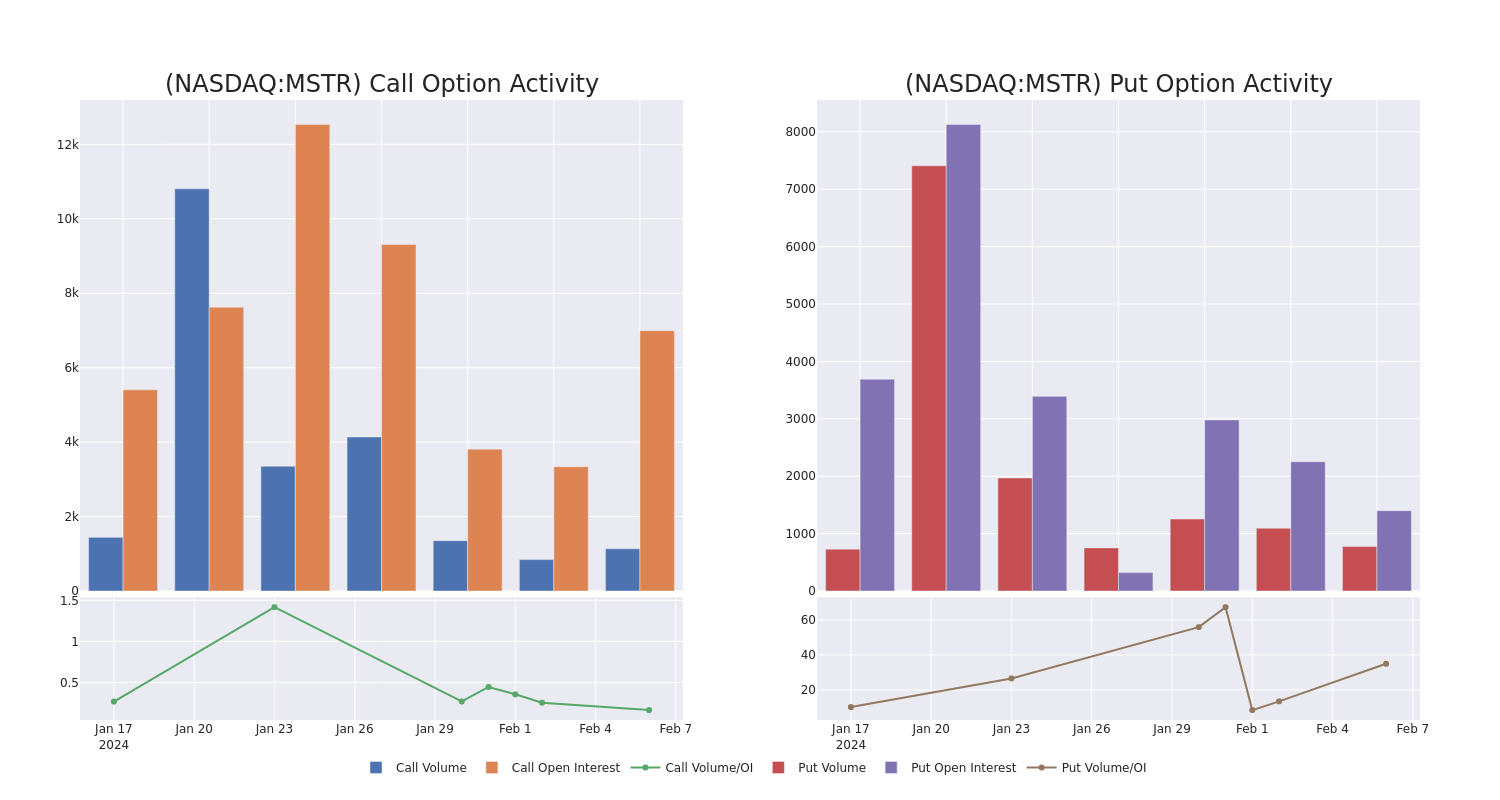

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for MicroStrategy's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MicroStrategy's whale trades within a strike price range from $200.0 to $3800.0 in the last 30 days.

MicroStrategy Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | SWEEP | BULLISH | 06/21/24 | $271.95 | $268.5 | $271.95 | $1500.00 | $1.0M | 425 | 40 |

| MSTR | CALL | TRADE | BEARISH | 06/21/24 | $285.0 | $280.0 | $280.0 | $1500.00 | $336.0K | 425 | 66 |

| MSTR | PUT | TRADE | BULLISH | 01/17/25 | $117.0 | $109.0 | $109.0 | $700.00 | $218.0K | 395 | 20 |

| MSTR | PUT | SWEEP | BEARISH | 04/19/24 | $174.0 | $159.0 | $170.0 | $1600.00 | $204.0K | 169 | 12 |

| MSTR | CALL | TRADE | BEARISH | 04/19/24 | $39.2 | $35.2 | $36.11 | $1600.00 | $86.6K | 514 | 86 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

In light of the recent options history for MicroStrategy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is MicroStrategy Standing Right Now?

- Trading volume stands at 150,232, with MSTR's price down by -0.23%, positioned at $1476.22.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 14 days.

Expert Opinions on MicroStrategy

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1733.75.

- Maintaining their stance, an analyst from TD Cowen continues to hold a Outperform rating for MicroStrategy, targeting a price of $1450.

- Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for MicroStrategy, targeting a price of $1875.

- In a cautious move, an analyst from Canaccord Genuity downgraded its rating to Buy, setting a price target of $1810.

- An analyst from BTIG has decided to maintain their Buy rating on MicroStrategy, which currently sits at a price target of $1800.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.