Deep-pocketed investors have adopted a bearish approach towards MercadoLibre MELI, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MELI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 27 extraordinary options activities for MercadoLibre. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 25% leaning bullish and 74% bearish. Among these notable options, 12 are puts, totaling $589,027, and 15 are calls, amounting to $787,862.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $900.0 to $2100.0 for MercadoLibre over the last 3 months.

Insights into Volume & Open Interest

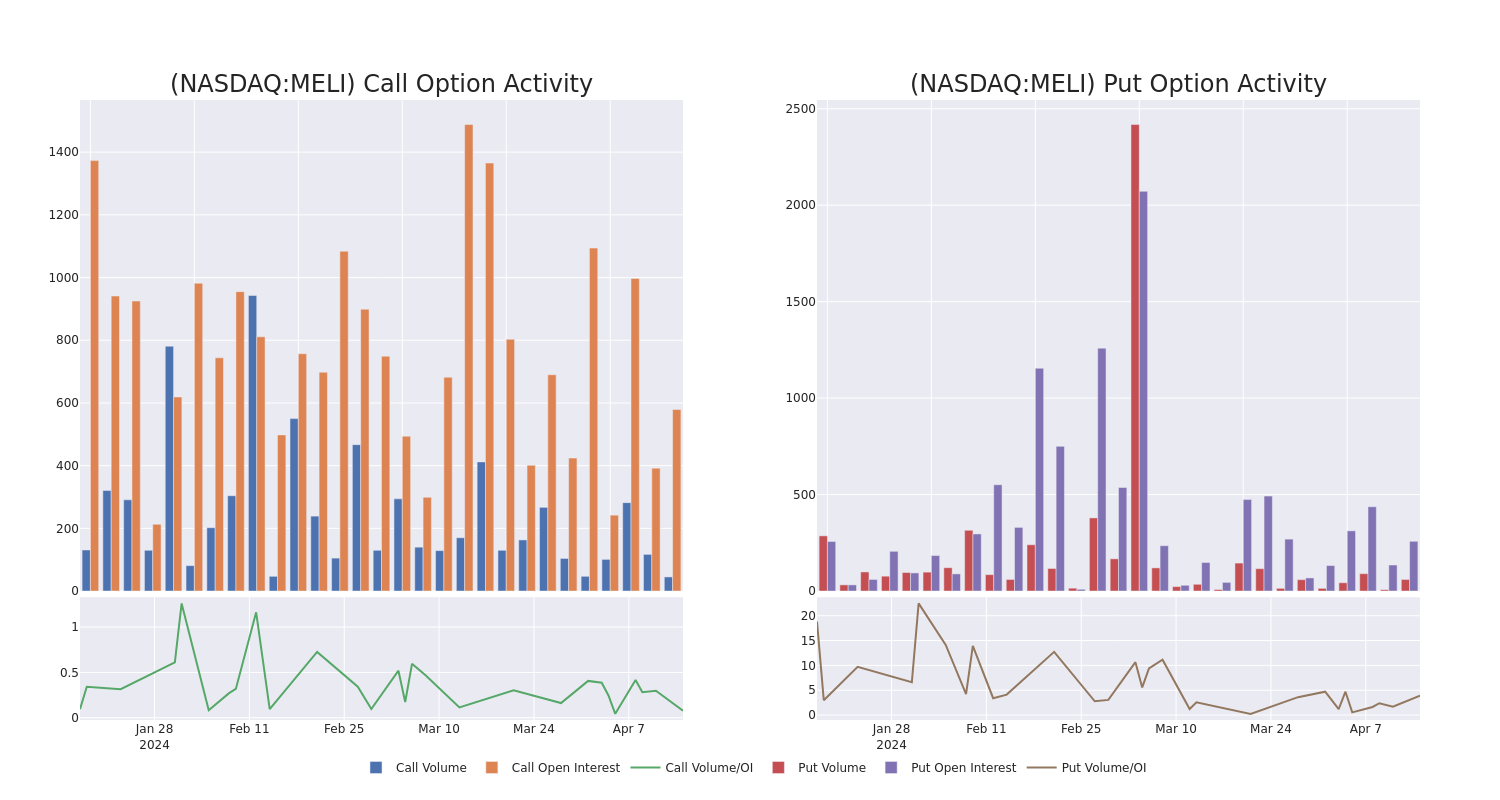

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale activity within a strike price range from $900.0 to $2100.0 in the last 30 days.

MercadoLibre 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | SWEEP | BEARISH | 09/20/24 | $132.8 | $131.0 | $131.0 | $1500.00 | $131.0K | 36 | 10 |

| MELI | PUT | TRADE | NEUTRAL | 07/19/24 | $103.1 | $99.3 | $101.0 | $1450.00 | $101.0K | 58 | 10 |

| MELI | CALL | SWEEP | BEARISH | 09/20/24 | $91.5 | $88.0 | $89.44 | $1600.00 | $88.4K | 37 | 12 |

| MELI | PUT | TRADE | BEARISH | 04/26/24 | $40.1 | $36.0 | $40.1 | $1420.00 | $80.2K | 19 | 40 |

| MELI | CALL | TRADE | BULLISH | 06/21/24 | $100.0 | $90.5 | $100.0 | $1500.00 | $80.0K | 121 | 9 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Present Market Standing of MercadoLibre

- With a trading volume of 419,879, the price of MELI is down by -2.28%, reaching $1411.21.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 16 days from now.

What The Experts Say On MercadoLibre

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $1870.0.

- Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for MercadoLibre, targeting a price of $1940.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on MercadoLibre with a target price of $1800.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for MercadoLibre, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.