Investors with a lot of money to spend have taken a bullish stance on Coca-Cola KO.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KO, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Coca-Cola.

This isn't normal.

The overall sentiment of these big-money traders is split between 66% bullish and 33%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $36,120, and 8, calls, for a total amount of $580,077.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $60.0 for Coca-Cola during the past quarter.

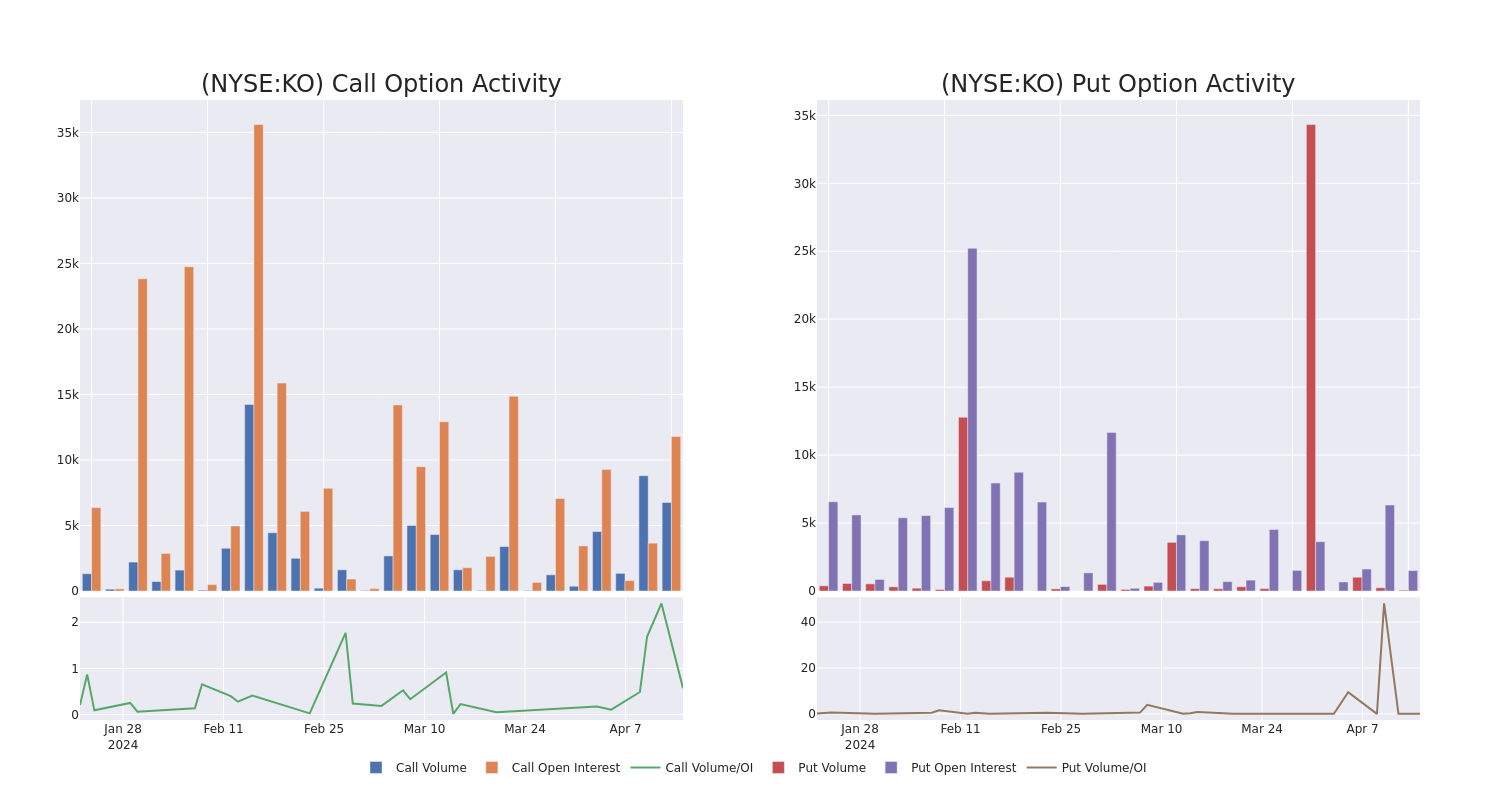

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Coca-Cola's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Coca-Cola's significant trades, within a strike price range of $50.0 to $60.0, over the past month.

Coca-Cola Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | SWEEP | BEARISH | 04/19/24 | $1.43 | $1.4 | $1.39 | $57.00 | $139.1K | 5.0K | 1.0K |

| KO | CALL | SWEEP | BULLISH | 04/19/24 | $1.36 | $1.32 | $1.32 | $57.00 | $132.0K | 5.0K | 2.0K |

| KO | CALL | TRADE | BEARISH | 04/19/24 | $1.35 | $1.29 | $1.3 | $57.00 | $130.0K | 5.0K | 3.0K |

| KO | CALL | SWEEP | BULLISH | 05/17/24 | $2.08 | $1.92 | $2.03 | $57.50 | $40.5K | 3.3K | 1 |

| KO | CALL | TRADE | BULLISH | 05/17/24 | $2.0 | $1.98 | $2.0 | $57.50 | $40.0K | 3.3K | 402 |

About Coca-Cola

Founded in 1886, Atlanta-headquartered Coca-Cola is the world's largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenues overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

Following our analysis of the options activities associated with Coca-Cola, we pivot to a closer look at the company's own performance.

Present Market Standing of Coca-Cola

- Trading volume stands at 6,886,171, with KO's price up by 0.46%, positioned at $58.55.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 15 days.

What The Experts Say On Coca-Cola

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $68.0.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Coca-Cola, targeting a price of $68.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Coca-Cola, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.