Investors with a lot of money to spend have taken a bullish stance on American Airlines Gr AAL.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with AAL, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for American Airlines Gr.

This isn't normal.

The overall sentiment of these big-money traders is split between 87% bullish and 12%, bearish.

Out of all of the options we uncovered, 7 are puts, for a total amount of $706,283, and there was 1 call, for a total amount of $27,500.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $25.0 for American Airlines Gr over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for American Airlines Gr's options for a given strike price.

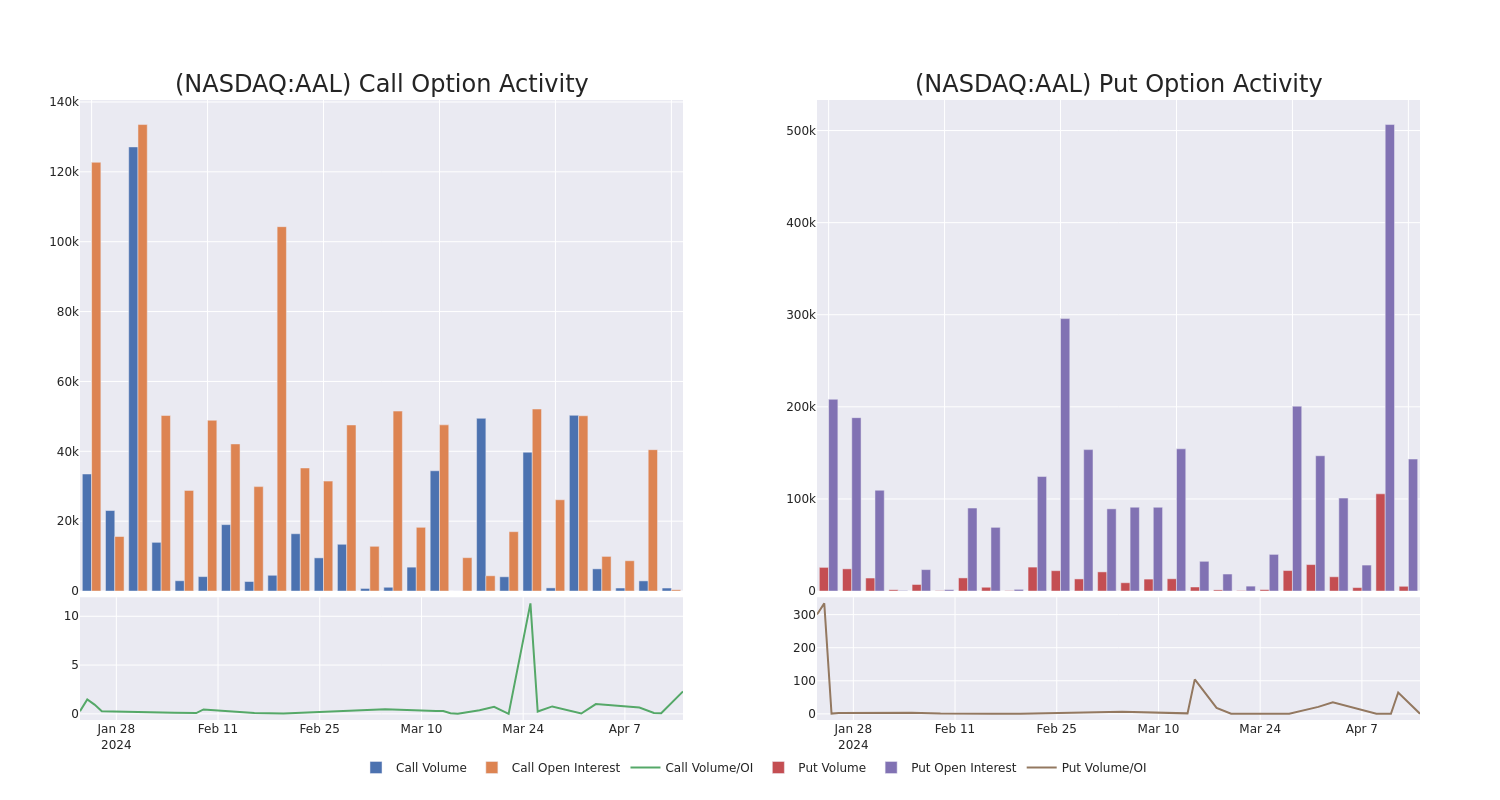

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of American Airlines Gr's whale activity within a strike price range from $10.0 to $25.0 in the last 30 days.

American Airlines Gr Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | PUT | SWEEP | BULLISH | 01/17/25 | $13.0 | $12.1 | $12.1 | $25.00 | $363.0K | 0 | 300 |

| AAL | PUT | TRADE | BEARISH | 06/21/24 | $0.13 | $0.1 | $0.12 | $10.00 | $120.0K | 137.2K | 10 |

| AAL | PUT | TRADE | BULLISH | 11/15/24 | $3.4 | $3.35 | $3.35 | $16.00 | $55.2K | 9 | 135 |

| AAL | PUT | SWEEP | BULLISH | 09/20/24 | $0.53 | $0.52 | $0.52 | $11.00 | $45.6K | 12.4K | 184 |

| AAL | PUT | SWEEP | BULLISH | 11/15/24 | $3.4 | $3.35 | $3.35 | $16.00 | $45.2K | 9 | 135 |

About American Airlines Gr

American Airlines is the world's largest airline by aircraft, capacity, and scheduled revenue passenger miles. Its major U.S. hubs are Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, D.C. It generates over 30% of U.S. airline revenue connecting Latin America with destinations in the United States. After completing a major fleet renewal, the company has the youngest fleet of U.S. legacy carriers.

After a thorough review of the options trading surrounding American Airlines Gr, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is American Airlines Gr Standing Right Now?

- Currently trading with a volume of 9,772,929, the AAL's price is up by 0.5%, now at $13.01.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 13 days.

Professional Analyst Ratings for American Airlines Gr

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $19.0.

- An analyst from UBS has revised its rating downward to Buy, adjusting the price target to $19.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for American Airlines Gr with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.