Whales with a lot of money to spend have taken a noticeably bearish stance on Cloudflare.

Looking at options history for Cloudflare NET we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 15% of the investors opened trades with bullish expectations and 84% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $597,534 and 5, calls, for a total amount of $381,708.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $55.0 and $120.0 for Cloudflare, spanning the last three months.

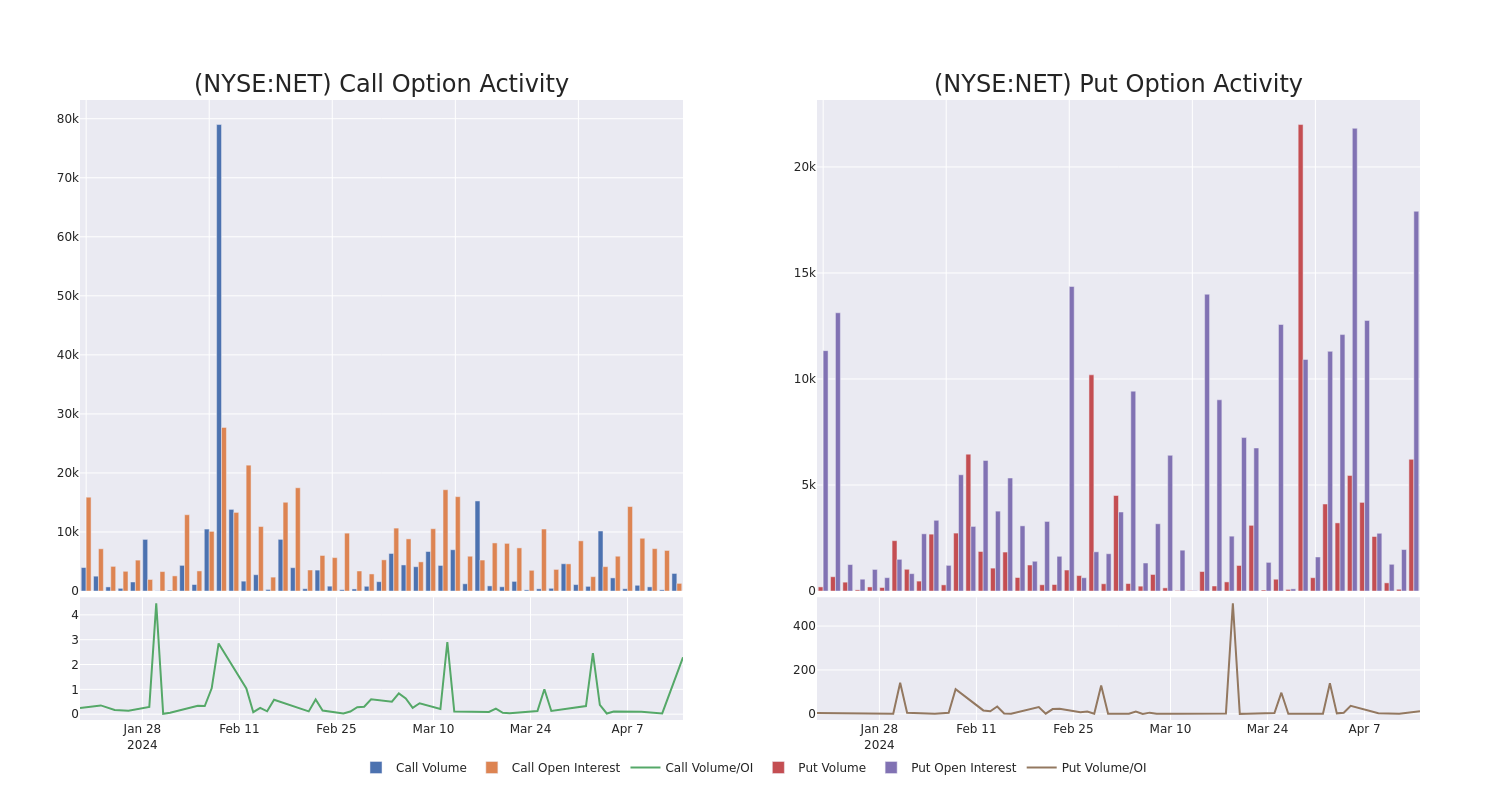

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cloudflare's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cloudflare's substantial trades, within a strike price spectrum from $55.0 to $120.0 over the preceding 30 days.

Cloudflare Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NET | PUT | SWEEP | NEUTRAL | 01/17/25 | $8.9 | $8.7 | $8.85 | $75.00 | $162.2K | 612 | 184 |

| NET | CALL | SWEEP | BULLISH | 12/20/24 | $22.25 | $22.1 | $22.25 | $80.00 | $149.0K | 333 | 67 |

| NET | PUT | SWEEP | BULLISH | 01/17/25 | $2.98 | $2.66 | $2.82 | $55.00 | $123.0K | 2.7K | 436 |

| NET | CALL | SWEEP | BEARISH | 05/17/24 | $35.45 | $33.65 | $33.6 | $55.00 | $110.8K | 52 | 0 |

| NET | PUT | SWEEP | BEARISH | 01/17/25 | $8.95 | $8.65 | $8.8 | $75.00 | $110.1K | 612 | 311 |

About Cloudflare

Cloudflare is a software company based in San Francisco, California, that offers security and web performance offerings by utilizing a distributed, serverless content delivery network, or CDN. The firm's edge computing platform, Workers, leverages this network by providing clients the ability to deploy, and execute code without maintaining servers.

In light of the recent options history for Cloudflare, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Cloudflare's Current Market Status

- Trading volume stands at 848,197, with NET's price down by -2.91%, positioned at $88.39.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 15 days.

What The Experts Say On Cloudflare

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $97.5.

- An analyst from Mizuho persists with their Neutral rating on Cloudflare, maintaining a target price of $95.

- An analyst from Cantor Fitzgerald has revised its rating downward to Neutral, adjusting the price target to $100.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cloudflare options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.