Investors with a lot of money to spend have taken a bearish stance on Viking Therapeutics VKTX.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VKTX, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 10 options trades for Viking Therapeutics.

This isn't normal.

The overall sentiment of these big-money traders is split between 20% bullish and 80%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $63,900, and 9, calls, for a total amount of $718,259.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $90.0 for Viking Therapeutics during the past quarter.

Volume & Open Interest Development

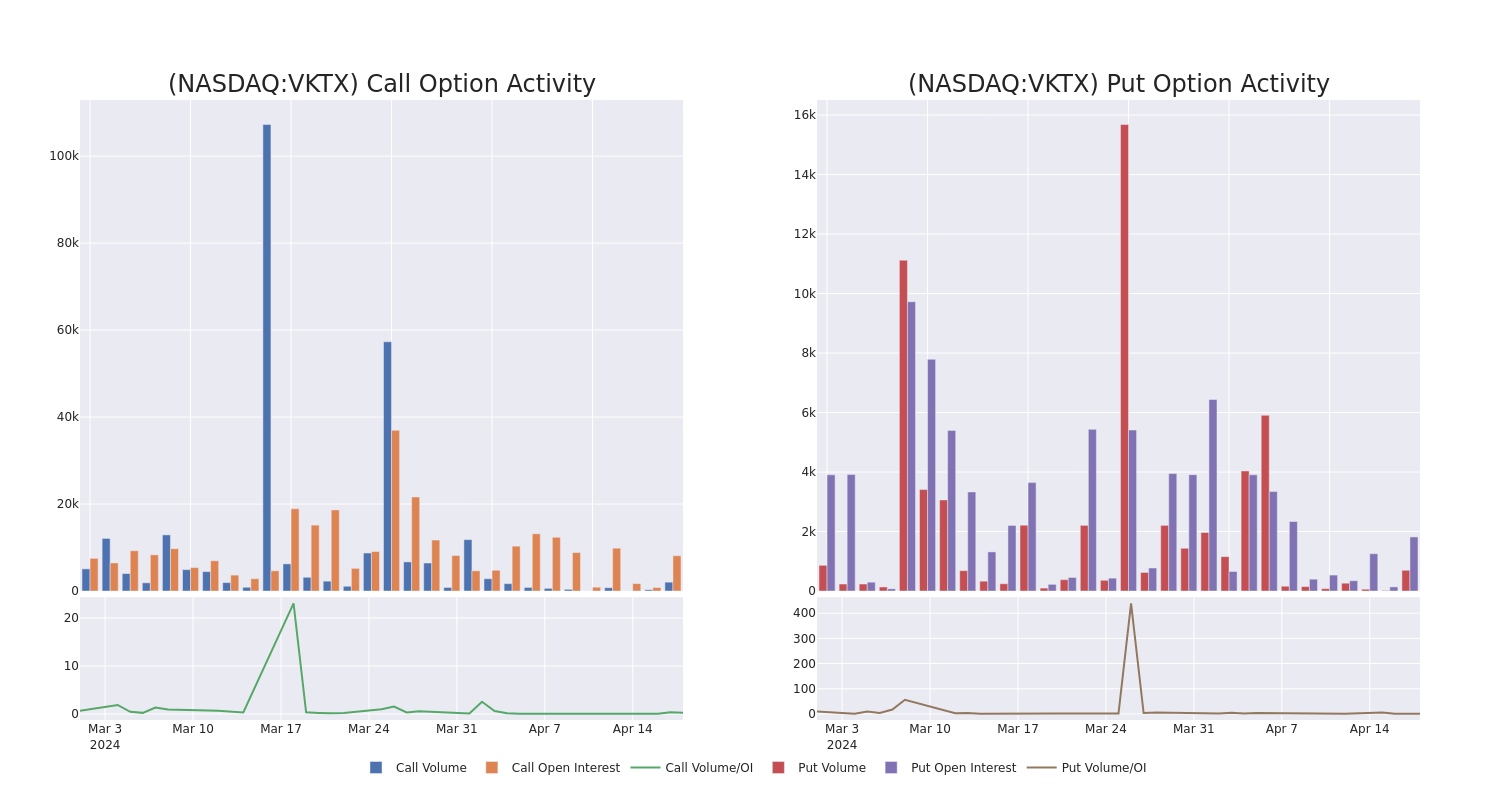

In today's trading context, the average open interest for options of Viking Therapeutics stands at 1655.67, with a total volume reaching 2,742.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Viking Therapeutics, situated within the strike price corridor from $55.0 to $90.0, throughout the last 30 days.

Viking Therapeutics Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | CALL | TRADE | BULLISH | 05/17/24 | $3.1 | $2.9 | $3.1 | $75.00 | $310.0K | 2.2K | 10 |

| VKTX | CALL | SWEEP | BEARISH | 04/19/24 | $10.8 | $10.2 | $10.2 | $55.00 | $106.0K | 4.7K | 242 |

| VKTX | CALL | TRADE | NEUTRAL | 05/17/24 | $3.1 | $2.9 | $3.0 | $75.00 | $75.0K | 2.2K | 1.0K |

| VKTX | CALL | TRADE | BEARISH | 04/19/24 | $11.3 | $10.1 | $10.3 | $55.00 | $69.0K | 4.7K | 112 |

| VKTX | PUT | SWEEP | BEARISH | 04/19/24 | $1.0 | $0.75 | $1.0 | $65.00 | $63.9K | 1.8K | 699 |

About Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company's clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

Where Is Viking Therapeutics Standing Right Now?

- Trading volume stands at 800,529, with VKTX's price down by -1.64%, positioned at $65.38.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 6 days.

What The Experts Say On Viking Therapeutics

In the last month, 4 experts released ratings on this stock with an average target price of $122.75.

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $90.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Viking Therapeutics, which currently sits at a price target of $138.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Viking Therapeutics, which currently sits at a price target of $138.

- Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Viking Therapeutics, targeting a price of $125.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Viking Therapeutics, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.