Financial giants have made a conspicuous bearish move on Home Depot. Our analysis of options history for Home Depot HD revealed 16 unusual trades.

Delving into the details, we found 12% of traders were bullish, while 87% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $595,315, and 6 were calls, valued at $399,057.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $300.0 to $395.0 for Home Depot during the past quarter.

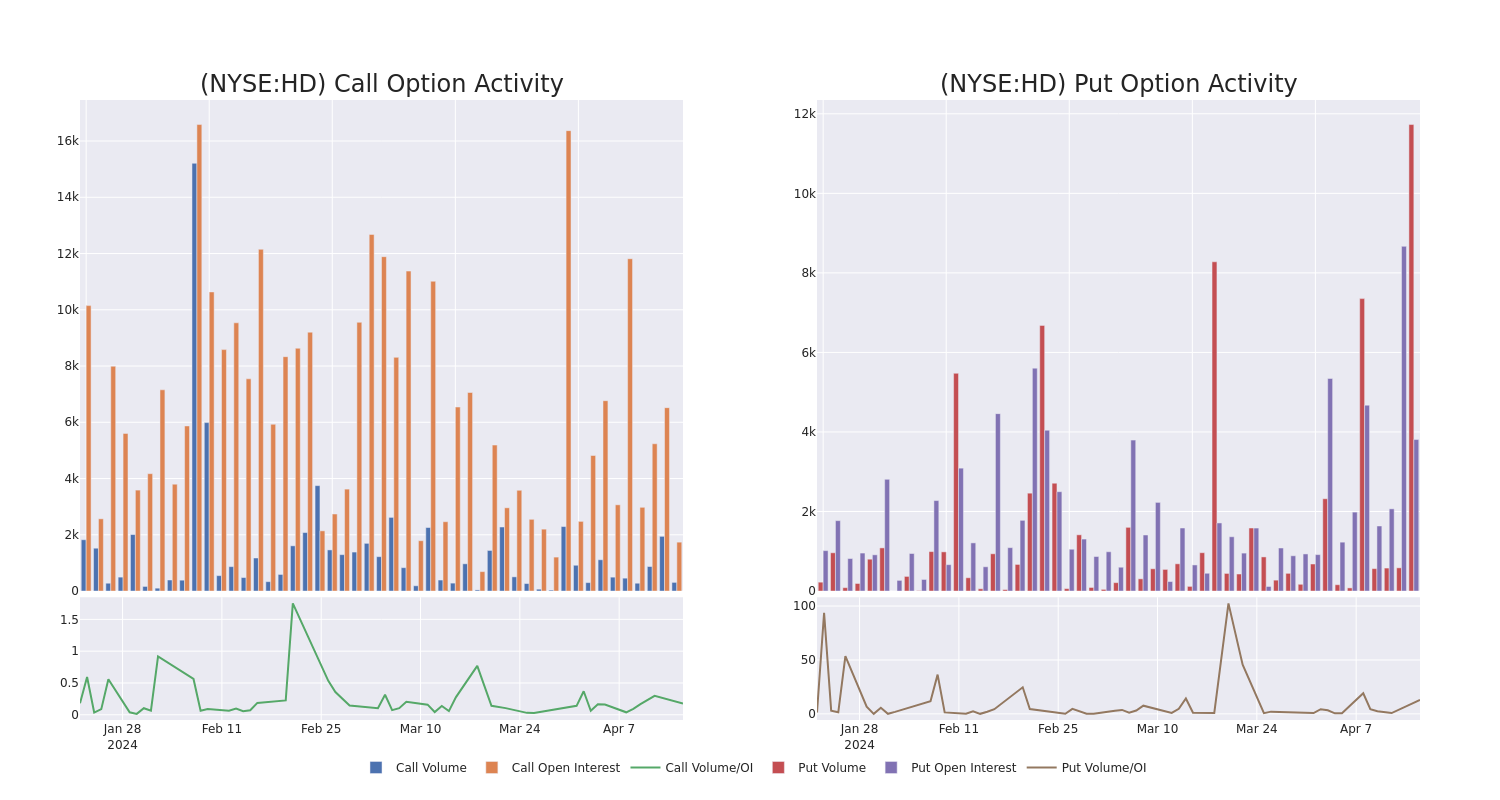

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Home Depot's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Home Depot's whale trades within a strike price range from $300.0 to $395.0 in the last 30 days.

Home Depot Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | CALL | SWEEP | BEARISH | 05/17/24 | $6.1 | $5.95 | $6.1 | $345.00 | $183.0K | 690 | 313 |

| HD | PUT | SWEEP | BEARISH | 06/21/24 | $18.85 | $18.85 | $18.85 | $345.00 | $93.9K | 606 | 152 |

| HD | PUT | TRADE | BULLISH | 06/21/24 | $18.85 | $18.55 | $18.55 | $345.00 | $92.7K | 606 | 100 |

| HD | PUT | TRADE | NEUTRAL | 06/21/24 | $18.85 | $16.5 | $17.55 | $345.00 | $87.7K | 606 | 0 |

| HD | CALL | TRADE | BEARISH | 06/21/24 | $38.95 | $37.75 | $38.0 | $300.00 | $60.8K | 667 | 2 |

About Home Depot

Home Depot is the world's largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the United States, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of distributor Interline Brands in 2015 allowed Home Depot to enter the maintenance, repair, and operations business, which has been expanded through the tie-up with HD Supply (2020). Moreover, the additions of the Company Store brought textile exposure to the lineup, while Redi Carpet added multifamily flooring.

After a thorough review of the options trading surrounding Home Depot, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Home Depot

- With a volume of 1,565,096, the price of HD is up 0.01% at $332.87.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 26 days.

What Analysts Are Saying About Home Depot

In the last month, 5 experts released ratings on this stock with an average target price of $385.0.

- An analyst from Truist Securities has decided to maintain their Buy rating on Home Depot, which currently sits at a price target of $417.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Home Depot with a target price of $415.

- Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Market Perform rating for Home Depot, targeting a price of $360.

- An analyst from Wedbush persists with their Outperform rating on Home Depot, maintaining a target price of $410.

- Reflecting concerns, an analyst from HSBC lowers its rating to Reduce with a new price target of $323.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Home Depot, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.