Financial giants have made a conspicuous bearish move on Costco Wholesale. Our analysis of options history for Costco Wholesale COST revealed 10 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 80% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $349,866, and 3 were calls, valued at $156,750.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $575.0 to $785.0 for Costco Wholesale during the past quarter.

Insights into Volume & Open Interest

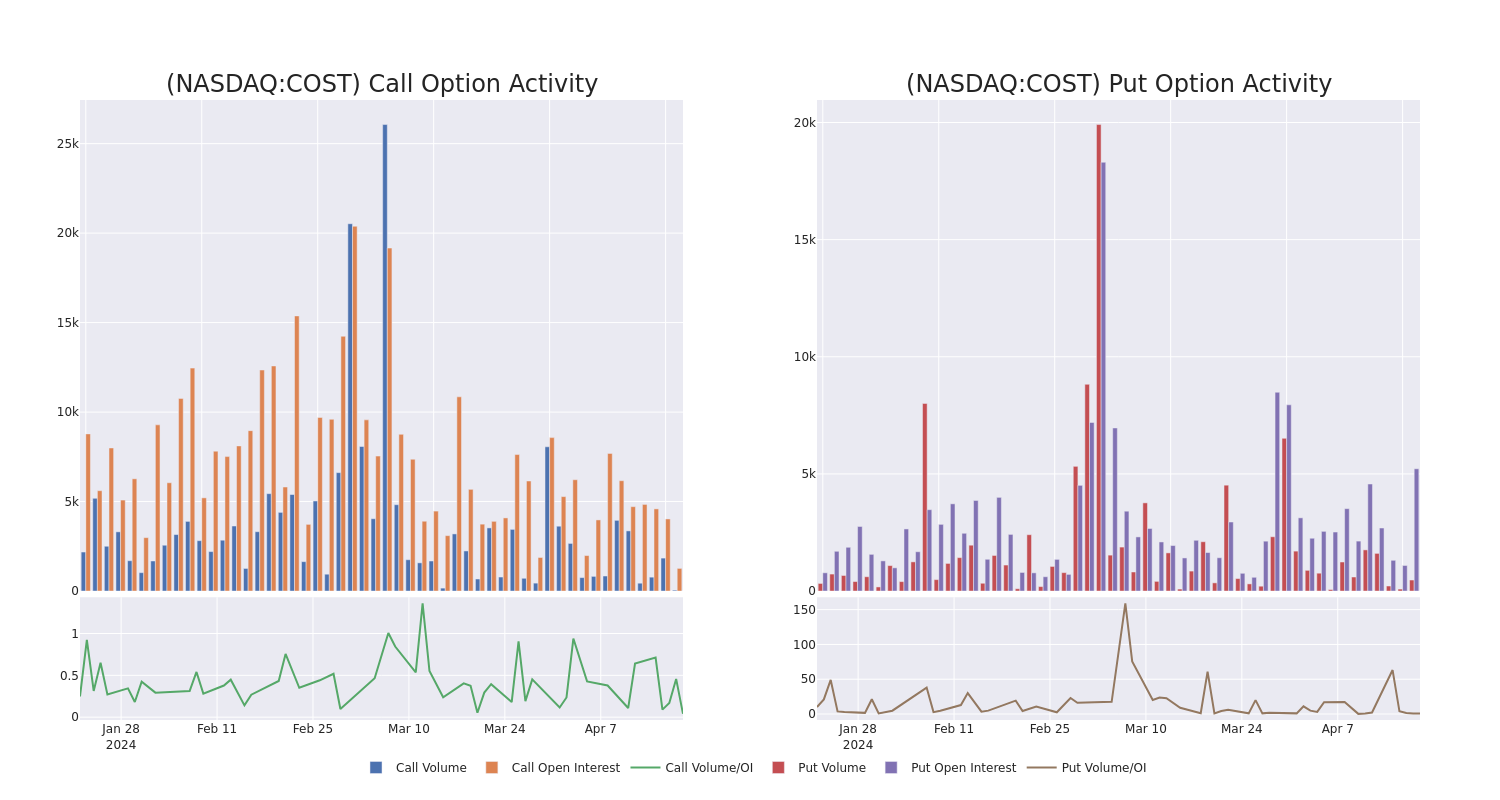

In today's trading context, the average open interest for options of Costco Wholesale stands at 720.44, with a total volume reaching 520.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Costco Wholesale, situated within the strike price corridor from $575.0 to $785.0, throughout the last 30 days.

Costco Wholesale Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COST | CALL | TRADE | BEARISH | 01/16/26 | $122.95 | $120.15 | $121.15 | $700.00 | $96.9K | 54 | 0 |

| COST | PUT | SWEEP | BEARISH | 04/26/24 | $9.35 | $9.1 | $9.35 | $715.00 | $92.5K | 470 | 9 |

| COST | PUT | SWEEP | NEUTRAL | 05/17/24 | $20.9 | $20.3 | $20.57 | $720.00 | $51.2K | 1.6K | 75 |

| COST | PUT | TRADE | NEUTRAL | 01/17/25 | $48.35 | $47.4 | $47.79 | $715.00 | $47.7K | 102 | 10 |

| COST | PUT | SWEEP | NEUTRAL | 05/17/24 | $17.9 | $17.5 | $17.74 | $715.00 | $44.1K | 1.4K | 56 |

About Costco Wholesale

Costco operates a membership-based, no-frills retail model, predicated on offering a select product assortment in bulk quantities at bargain prices. The firm avoids maintaining costly product displays by keeping inventory on pallets and limits distribution expenses by storing its inventory at point of sale in the warehouse. Given Costco's frugal cost structure, the firm is able to price its merchandise below competing retailers, driving high sales volume per warehouse and allowing the retailer to generate strong profits on thin margins. Costco operates over 600 warehouses in the United States and boasts over 60% market share in the domestic warehouse club industry. Internationally, Costco operates another 270 warehouses, primarily in markets such as Canada, Mexico, Japan, and the UK.

After a thorough review of the options trading surrounding Costco Wholesale, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Costco Wholesale

- Trading volume stands at 492,014, with COST's price down by -0.69%, positioned at $706.36.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 34 days.

Expert Opinions on Costco Wholesale

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $744.0.

- Maintaining their stance, an analyst from Roth MKM continues to hold a Neutral rating for Costco Wholesale, targeting a price of $650.

- An analyst from DA Davidson persists with their Neutral rating on Costco Wholesale, maintaining a target price of $680.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Costco Wholesale, which currently sits at a price target of $790.

- An analyst from Telsey Advisory Group persists with their Outperform rating on Costco Wholesale, maintaining a target price of $800.

- An analyst from Telsey Advisory Group has decided to maintain their Outperform rating on Costco Wholesale, which currently sits at a price target of $800.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Costco Wholesale with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.