Deep-pocketed investors have adopted a bearish approach towards PayPal Holdings PYPL, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PYPL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 30 extraordinary options activities for PayPal Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 23% leaning bullish and 76% bearish. Among these notable options, 13 are puts, totaling $1,016,091, and 17 are calls, amounting to $1,537,611.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $85.0 for PayPal Holdings over the recent three months.

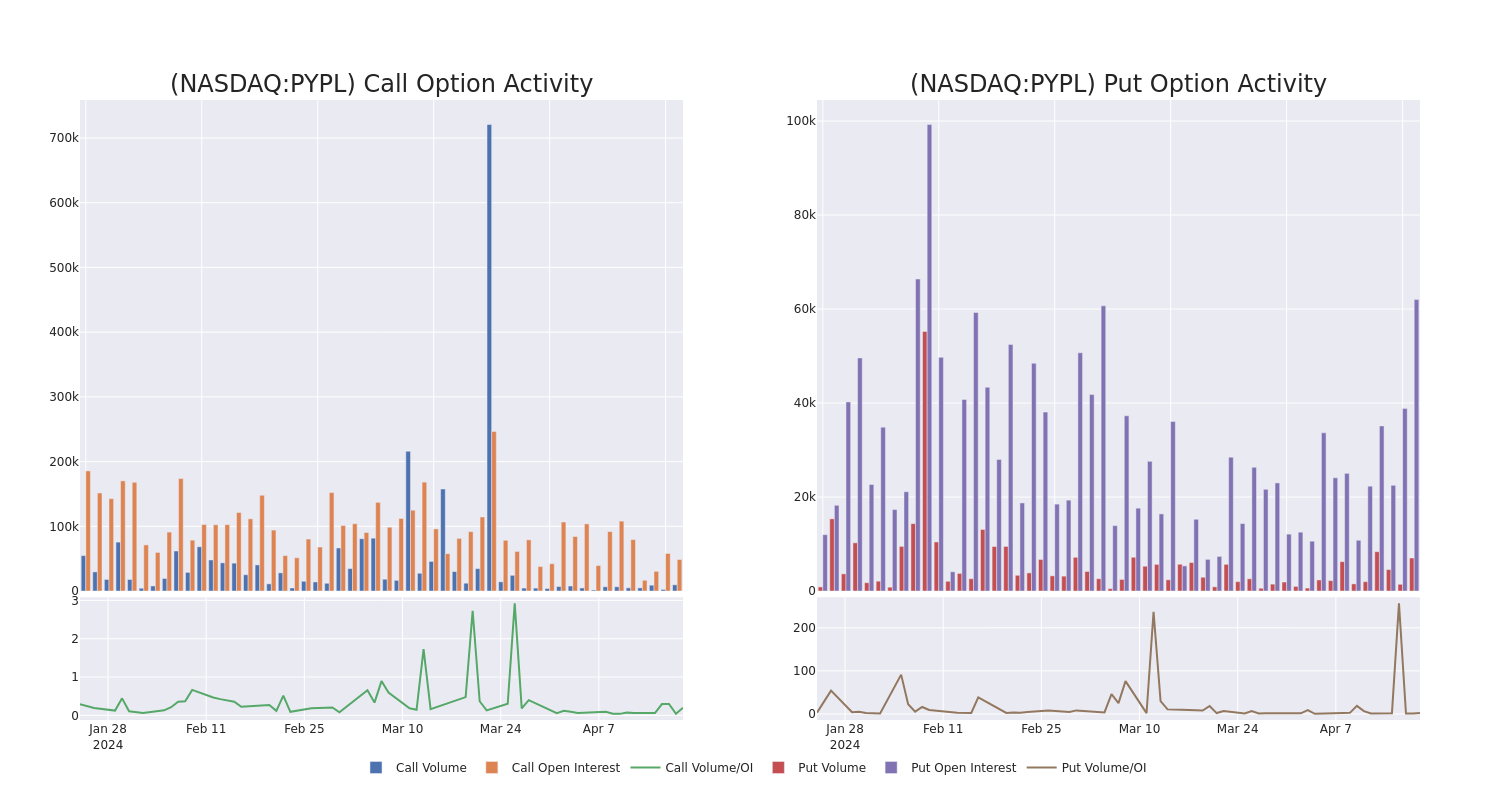

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for PayPal Holdings options trades today is 4257.54 with a total volume of 14,273.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for PayPal Holdings's big money trades within a strike price range of $40.0 to $85.0 over the last 30 days.

PayPal Holdings 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | SWEEP | BEARISH | 05/17/24 | $1.7 | $1.69 | $1.7 | $67.50 | $342.0K | 4.1K | 2.0K |

| PYPL | PUT | SWEEP | BEARISH | 07/19/24 | $4.8 | $4.7 | $4.75 | $62.50 | $332.5K | 4.2K | 58 |

| PYPL | PUT | TRADE | BULLISH | 05/17/24 | $3.75 | $3.7 | $3.7 | $62.50 | $237.5K | 6.3K | 802 |

| PYPL | CALL | TRADE | BULLISH | 05/17/24 | $2.45 | $2.43 | $2.45 | $65.00 | $196.0K | 11.4K | 845 |

| PYPL | CALL | TRADE | BULLISH | 04/19/24 | $9.85 | $9.5 | $9.75 | $52.50 | $185.2K | 870 | 0 |

About PayPal Holdings

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

Following our analysis of the options activities associated with PayPal Holdings, we pivot to a closer look at the company's own performance.

Where Is PayPal Holdings Standing Right Now?

- Trading volume stands at 8,245,581, with PYPL's price down by -0.55%, positioned at $61.76.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 11 days.

Expert Opinions on PayPal Holdings

4 market experts have recently issued ratings for this stock, with a consensus target price of $68.0.

- Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for PayPal Holdings, targeting a price of $70.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on PayPal Holdings with a target price of $60.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $74.

- An analyst from Bernstein has decided to maintain their Market Perform rating on PayPal Holdings, which currently sits at a price target of $68.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for PayPal Holdings, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.