Financial giants have made a conspicuous bearish move on Stryker. Our analysis of options history for Stryker SYK revealed 8 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 75% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $424,828, and 3 were calls, valued at $144,240.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $320.0 to $340.0 for Stryker during the past quarter.

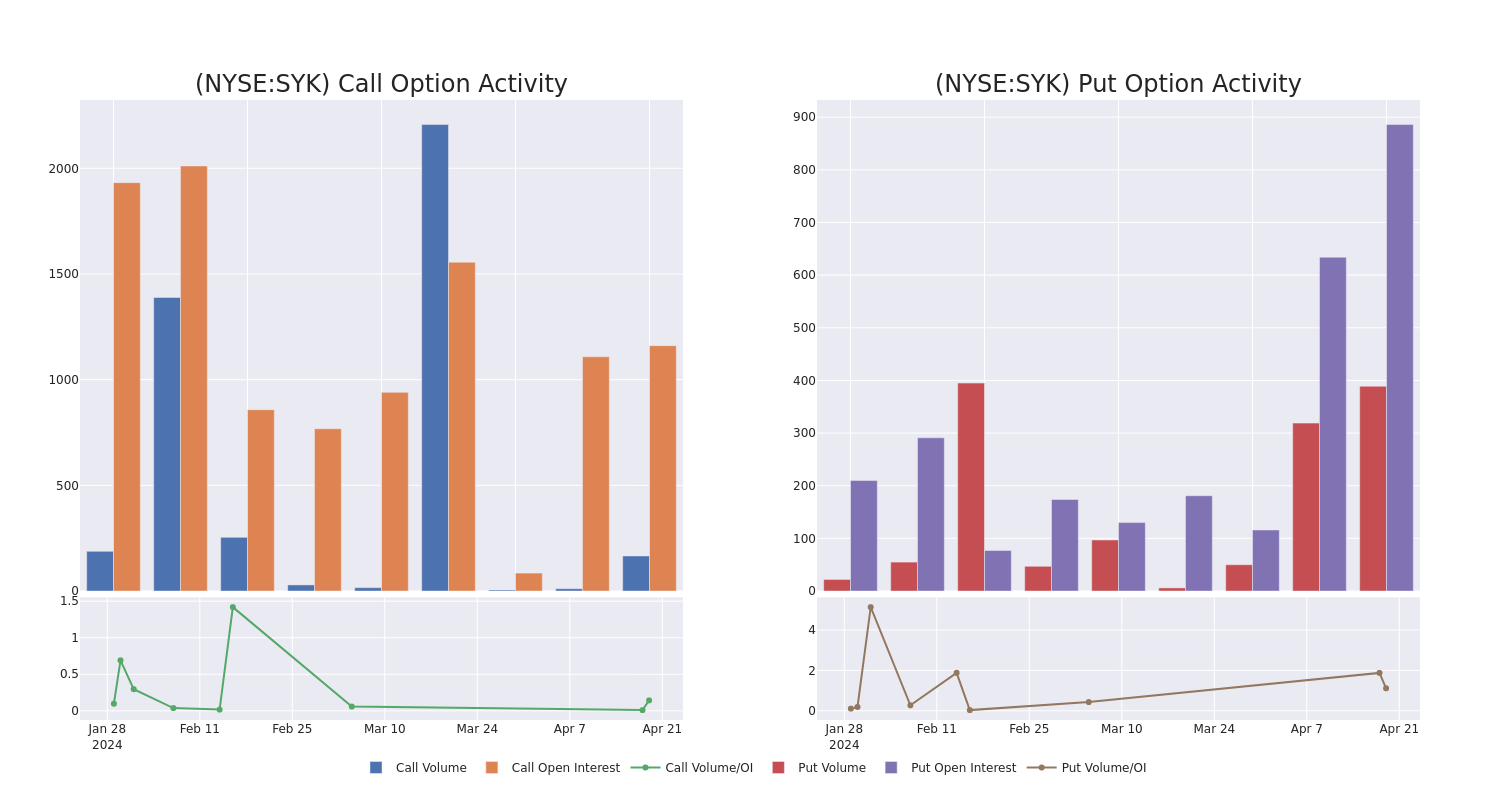

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Stryker's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Stryker's significant trades, within a strike price range of $320.0 to $340.0, over the past month.

Stryker Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SYK | PUT | SWEEP | BULLISH | 01/17/25 | $20.6 | $19.7 | $19.7 | $320.00 | $220.6K | 406 | 143 |

| SYK | CALL | SWEEP | BEARISH | 01/17/25 | $26.2 | $24.9 | $24.9 | $340.00 | $74.7K | 1.0K | 45 |

| SYK | PUT | SWEEP | BEARISH | 01/17/25 | $25.1 | $24.1 | $25.1 | $330.00 | $65.2K | 226 | 46 |

| SYK | PUT | SWEEP | BEARISH | 01/17/25 | $29.6 | $28.6 | $29.6 | $340.00 | $50.3K | 254 | 17 |

| SYK | PUT | SWEEP | BEARISH | 01/17/25 | $24.2 | $23.4 | $24.2 | $330.00 | $48.4K | 226 | 20 |

About Stryker

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and spinal devices. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Just over one fourth of Stryker's total revenue currently comes from outside the United States.

Following our analysis of the options activities associated with Stryker, we pivot to a closer look at the company's own performance.

Stryker's Current Market Status

- With a volume of 951,577, the price of SYK is down -0.57% at $325.58.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 11 days.

What The Experts Say On Stryker

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $390.5.

- An analyst from Citigroup has decided to maintain their Buy rating on Stryker, which currently sits at a price target of $406.

- An analyst from TD Cowen has decided to maintain their Buy rating on Stryker, which currently sits at a price target of $400.

- An analyst from RBC Capital persists with their Outperform rating on Stryker, maintaining a target price of $386.

- An analyst from Evercore ISI Group persists with their Outperform rating on Stryker, maintaining a target price of $370.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Stryker options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.