Financial giants have made a conspicuous bearish move on Super Micro Computer. Our analysis of options history for Super Micro Computer SMCI revealed 26 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 61% showed bearish tendencies. Out of all the trades we spotted, 15 were puts, with a value of $759,657, and 11 were calls, valued at $709,716.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $360.0 to $1000.0 for Super Micro Computer over the recent three months.

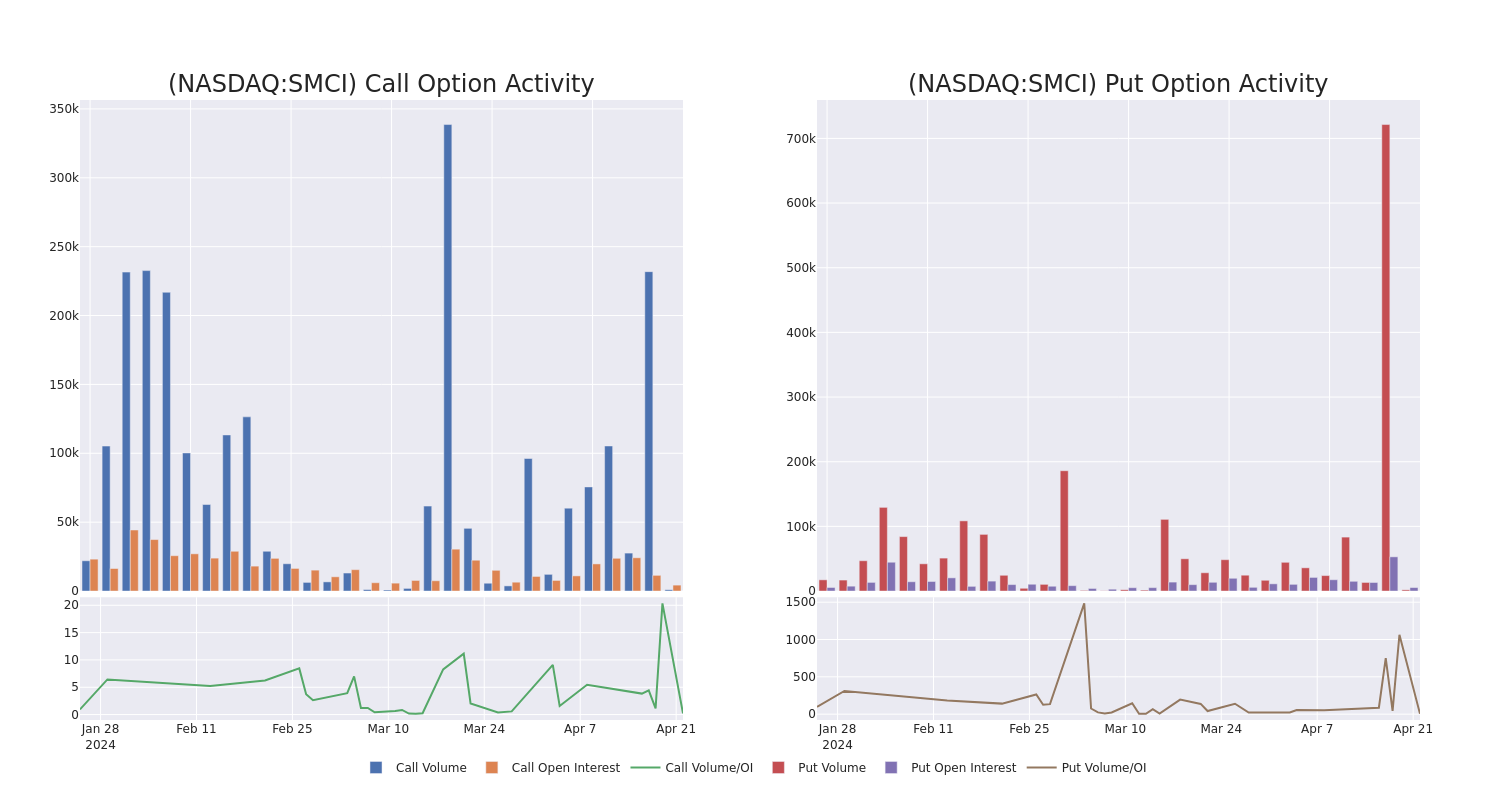

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Super Micro Computer's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Super Micro Computer's substantial trades, within a strike price spectrum from $360.0 to $1000.0 over the preceding 30 days.

Super Micro Computer 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | CALL | SWEEP | BEARISH | 05/17/24 | $127.4 | $118.5 | $118.5 | $650.00 | $225.1K | 75 | 0 |

| SMCI | PUT | TRADE | BEARISH | 05/24/24 | $247.5 | $246.3 | $247.5 | $935.00 | $198.0K | 22 | 2 |

| SMCI | CALL | SWEEP | NEUTRAL | 05/03/24 | $50.9 | $49.6 | $50.32 | $750.00 | $125.5K | 226 | 62 |

| SMCI | PUT | TRADE | BEARISH | 04/26/24 | $35.0 | $33.8 | $34.56 | $710.00 | $103.6K | 274 | 168 |

| SMCI | CALL | SWEEP | BULLISH | 04/26/24 | $55.1 | $53.1 | $55.1 | $700.00 | $66.1K | 122 | 226 |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

Super Micro Computer's Current Market Status

- Currently trading with a volume of 721,675, the SMCI's price is up by 1.34%, now at $723.18.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 8 days.

Expert Opinions on Super Micro Computer

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1316.6666666666667.

- An analyst from Northland Capital Markets has decided to maintain their Outperform rating on Super Micro Computer, which currently sits at a price target of $1300.

- Reflecting concerns, an analyst from JP Morgan lowers its rating to Overweight with a new price target of $1150.

- An analyst from Loop Capital persists with their Buy rating on Super Micro Computer, maintaining a target price of $1500.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Super Micro Computer with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.