Whales with a lot of money to spend have taken a noticeably bearish stance on SoFi Techs.

Looking at options history for SoFi Techs SOFI we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 63% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $621,155 and 3, calls, for a total amount of $134,763.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $7.0 to $13.0 for SoFi Techs over the recent three months.

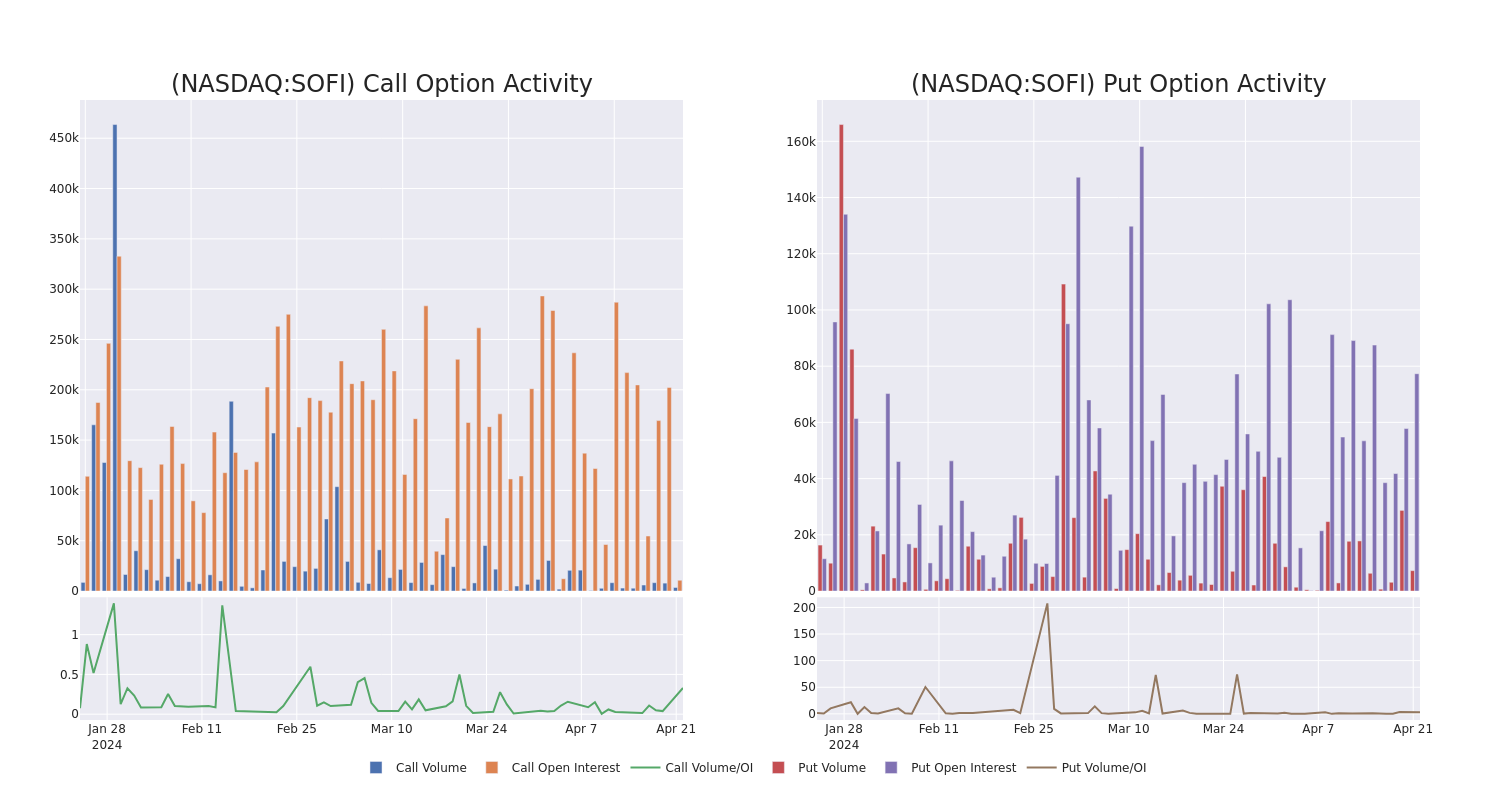

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for SoFi Techs's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across SoFi Techs's significant trades, within a strike price range of $7.0 to $13.0, over the past month.

SoFi Techs Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SOFI | PUT | TRADE | BEARISH | 06/21/24 | $5.85 | $5.8 | $5.85 | $13.00 | $234.0K | 90 | 200 |

| SOFI | PUT | TRADE | BULLISH | 06/21/24 | $6.55 | $5.8 | $5.85 | $13.00 | $117.0K | 90 | 200 |

| SOFI | PUT | SWEEP | BULLISH | 11/15/24 | $4.2 | $4.1 | $4.1 | $11.00 | $81.9K | 1.6K | 200 |

| SOFI | CALL | SWEEP | BEARISH | 05/17/24 | $0.48 | $0.47 | $0.47 | $7.50 | $74.9K | 0 | 1.9K |

| SOFI | PUT | SWEEP | BULLISH | 05/17/24 | $0.51 | $0.5 | $0.5 | $7.00 | $50.0K | 27.2K | 1.8K |

About SoFi Techs

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

SoFi Techs's Current Market Status

- Trading volume stands at 16,702,264, with SOFI's price up by 1.48%, positioned at $7.21.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 7 days.

What Analysts Are Saying About SoFi Techs

4 market experts have recently issued ratings for this stock, with a consensus target price of $10.125.

- An analyst from Needham downgraded its action to Buy with a price target of $10.

- An analyst from Citigroup downgraded its action to Buy with a price target of $11.

- An analyst from Jefferies persists with their Buy rating on SoFi Techs, maintaining a target price of $12.

- An analyst from Keefe, Bruyette & Woods has elevated its stance to Market Perform, setting a new price target at $7.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for SoFi Techs with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.