Financial giants have made a conspicuous bullish move on Intuit. Our analysis of options history for Intuit INTU revealed 34 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $177,610, and 30 were calls, valued at $1,605,960.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $400.0 to $670.0 for Intuit during the past quarter.

Analyzing Volume & Open Interest

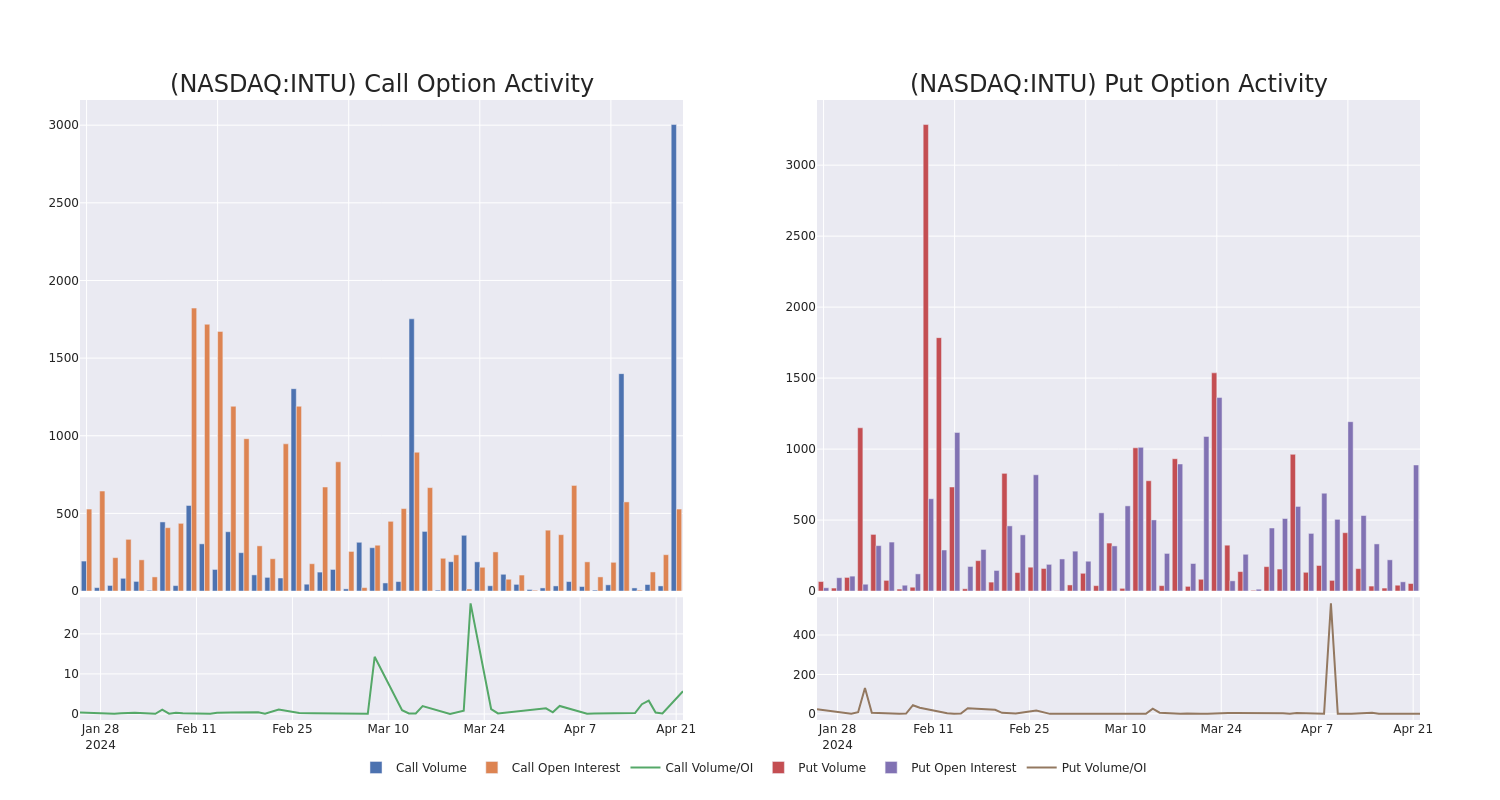

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Intuit's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intuit's whale activity within a strike price range from $400.0 to $670.0 in the last 30 days.

Intuit Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | TRADE | NEUTRAL | 05/17/24 | $16.8 | $16.6 | $16.7 | $615.00 | $140.2K | 0 | 15 |

| INTU | CALL | SWEEP | BULLISH | 05/17/24 | $18.6 | $18.5 | $18.6 | $610.00 | $87.4K | 101 | 47 |

| INTU | PUT | TRADE | BULLISH | 06/21/24 | $36.4 | $35.6 | $35.85 | $620.00 | $71.7K | 252 | 22 |

| INTU | CALL | TRADE | BEARISH | 09/20/24 | $32.1 | $31.6 | $31.6 | $660.00 | $69.5K | 267 | 188 |

| INTU | CALL | TRADE | BEARISH | 09/20/24 | $26.9 | $26.4 | $26.5 | $670.00 | $68.9K | 70 | 112 |

About Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of U.S. market share for small-business accounting and do-it-yourself tax-filing software.

In light of the recent options history for Intuit, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Intuit

- Currently trading with a volume of 1,056,202, the INTU's price is up by 0.76%, now at $609.77.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 29 days.

What Analysts Are Saying About Intuit

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $710.0.

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Intuit with a target price of $720.

- An analyst from BMO Capital persists with their Outperform rating on Intuit, maintaining a target price of $700.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Intuit options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.