Financial giants have made a conspicuous bearish move on Expedia Group. Our analysis of options history for Expedia Group EXPE revealed 9 unusual trades.

Delving into the details, we found 11% of traders were bullish, while 88% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $94,665, and 6 were calls, valued at $506,743.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $142.0 for Expedia Group, spanning the last three months.

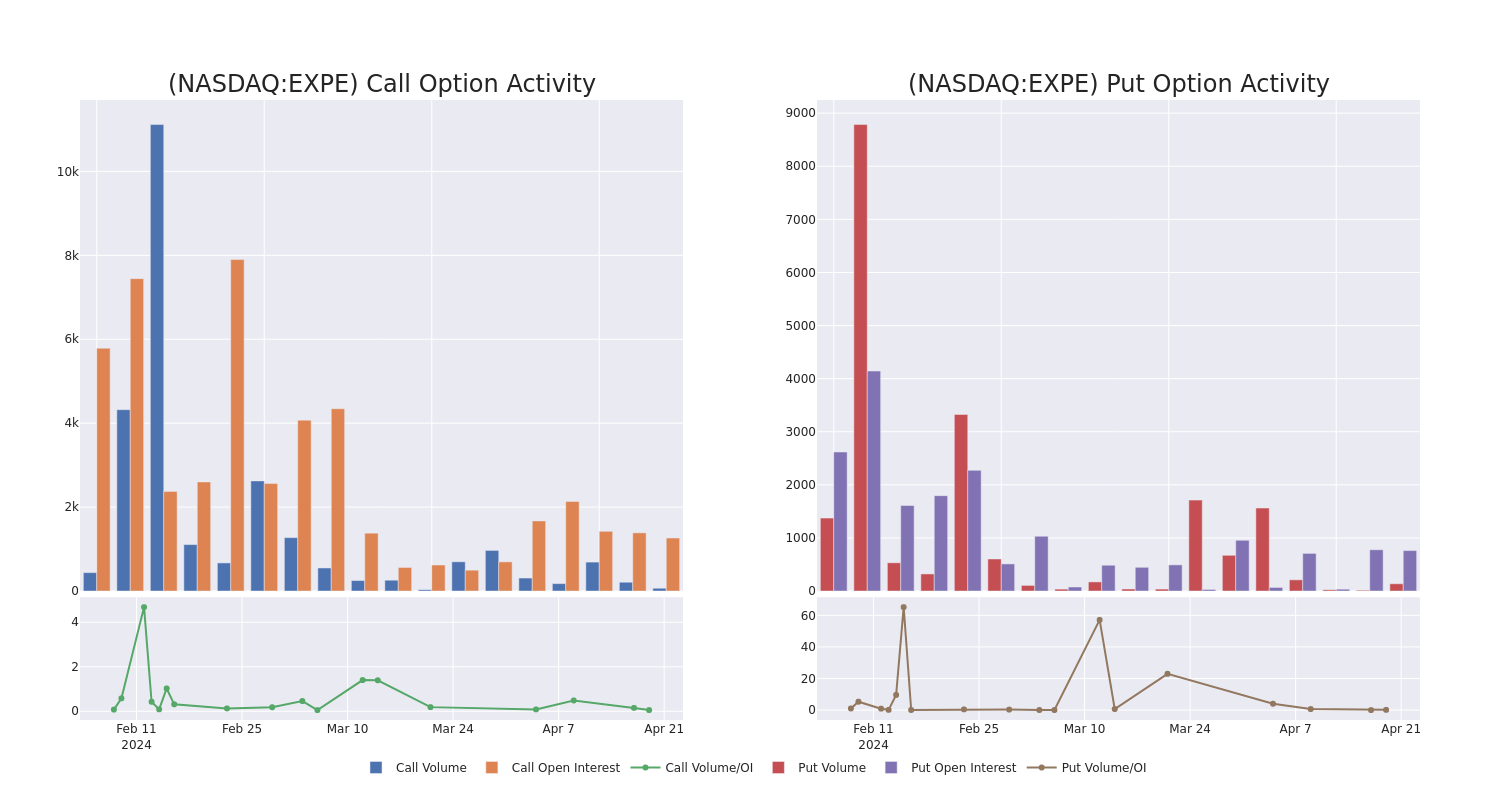

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Expedia Group's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Expedia Group's whale trades within a strike price range from $135.0 to $142.0 in the last 30 days.

Expedia Group Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXPE | CALL | SWEEP | BEARISH | 05/03/24 | $4.45 | $4.25 | $4.2 | $140.00 | $129.0K | 107 | 0 |

| EXPE | CALL | SWEEP | BEARISH | 05/03/24 | $5.3 | $5.1 | $5.12 | $138.00 | $127.6K | 773 | 289 |

| EXPE | CALL | SWEEP | BEARISH | 05/03/24 | $4.25 | $3.3 | $3.3 | $142.00 | $82.5K | 55 | 0 |

| EXPE | CALL | SWEEP | BEARISH | 01/17/25 | $17.75 | $17.15 | $17.5 | $140.00 | $70.0K | 974 | 0 |

| EXPE | CALL | SWEEP | BULLISH | 05/17/24 | $7.25 | $6.85 | $7.25 | $135.00 | $68.8K | 1.2K | 62 |

About Expedia Group

Expedia is the world's second-largest online travel agency by bookings, offering services for lodging (80% of total 2023 sales), air tickets (3%), rental cars, cruises, in-destination, and other (11%), and advertising revenue (6%). Expedia operates a number of branded travel booking sites, but its three core onlint travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

After a thorough review of the options trading surrounding Expedia Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Expedia Group Standing Right Now?

- Trading volume stands at 320,264, with EXPE's price up by 2.53%, positioned at $134.91.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 9 days.

Expert Opinions on Expedia Group

1 market experts have recently issued ratings for this stock, with a consensus target price of $130.0.

- An analyst from Wedbush downgraded its action to Neutral with a price target of $130.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Expedia Group, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.