Deep-pocketed investors have adopted a bearish approach towards Booking Holdings BKNG, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BKNG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Booking Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $170,500, and 6 are calls, amounting to $238,135.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $3510.0 to $4350.0 for Booking Holdings over the recent three months.

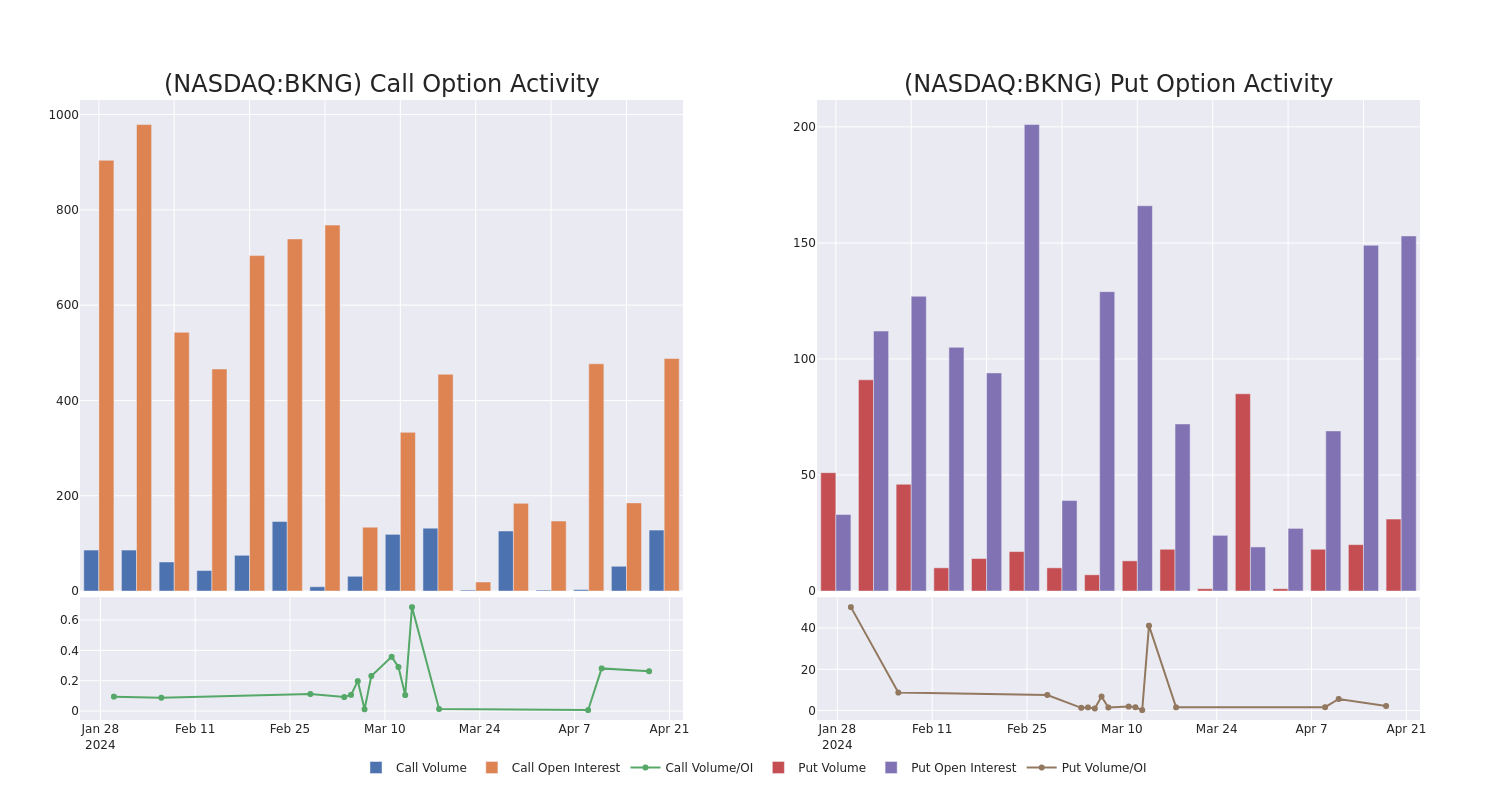

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Booking Holdings options trades today is 32.6 with a total volume of 3.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Booking Holdings's big money trades within a strike price range of $3510.0 to $4350.0 over the last 30 days.

Booking Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | PUT | TRADE | BEARISH | 01/16/26 | $927.5 | $906.3 | $925.0 | $4350.00 | $92.5K | 0 | 1 |

| BKNG | PUT | TRADE | BEARISH | 01/17/25 | $780.0 | $771.2 | $780.0 | $4300.00 | $78.0K | 102 | 1 |

| BKNG | CALL | TRADE | BEARISH | 03/21/25 | $482.5 | $473.0 | $473.0 | $3550.00 | $47.3K | 33 | 1 |

| BKNG | CALL | TRADE | BEARISH | 03/21/25 | $482.5 | $473.0 | $473.0 | $3550.00 | $47.3K | 33 | 0 |

| BKNG | CALL | TRADE | NEUTRAL | 03/21/25 | $482.5 | $457.7 | $471.02 | $3550.00 | $47.1K | 33 | 2 |

About Booking Holdings

Booking is the world's largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

Booking Holdings's Current Market Status

- Trading volume stands at 6,101, with BKNG's price up by 0.09%, positioned at $3537.22.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 8 days.

Professional Analyst Ratings for Booking Holdings

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $4125.0.

- An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $3850.

- In a cautious move, an analyst from B. Riley Securities downgraded its rating to Buy, setting a price target of $4400.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Booking Holdings with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.