Financial giants have made a conspicuous bullish move on Lyft. Our analysis of options history for Lyft LYFT revealed 11 unusual trades.

Delving into the details, we found 63% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $164,232, and 7 were calls, valued at $1,166,313.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $14.0 and $27.0 for Lyft, spanning the last three months.

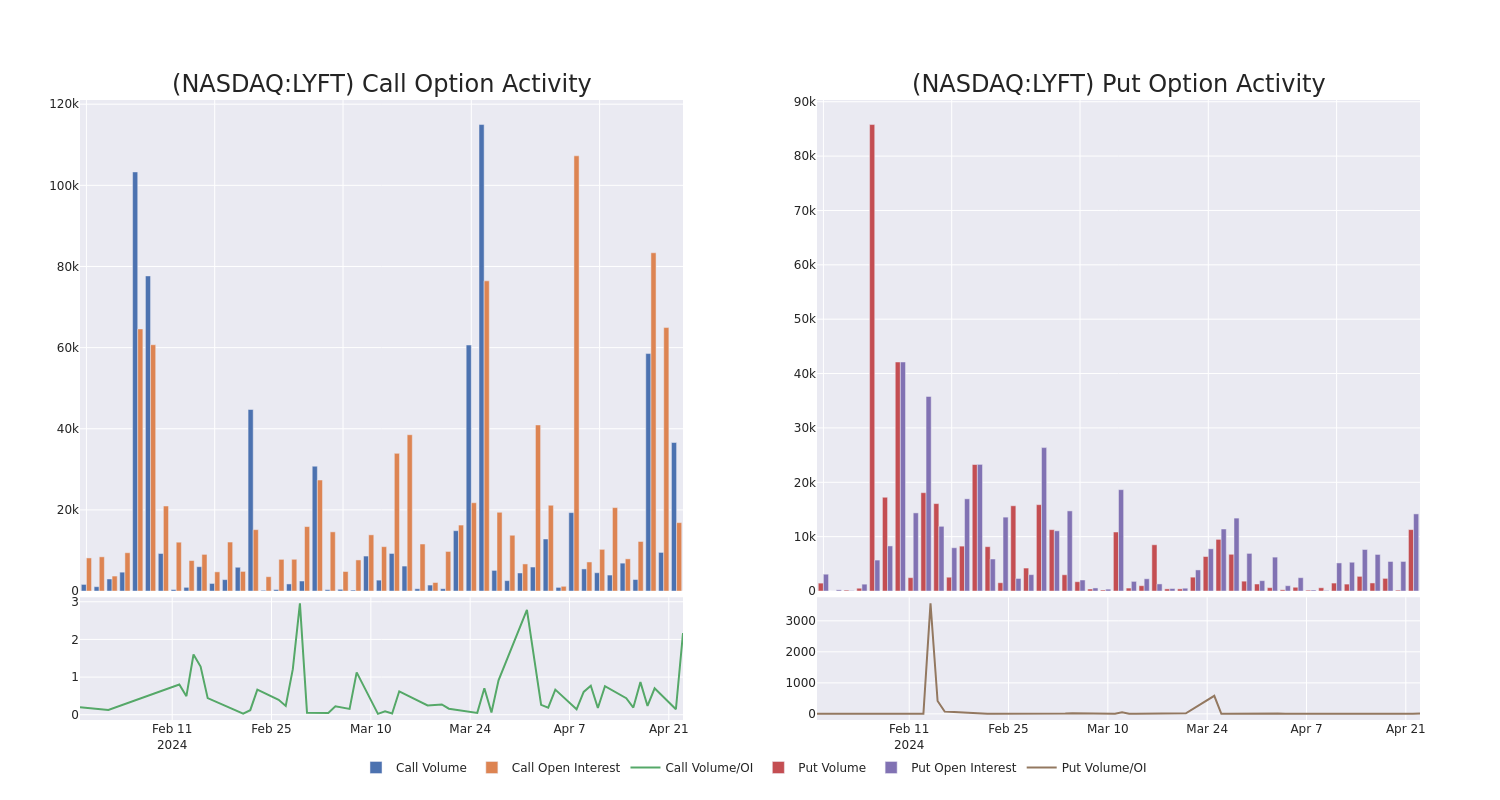

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Lyft stands at 2059.73, with a total volume reaching 1,463.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lyft, situated within the strike price corridor from $14.0 to $27.0, throughout the last 30 days.

Lyft Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LYFT | CALL | TRADE | BULLISH | 07/19/24 | $2.2 | $2.17 | $2.2 | $17.00 | $770.0K | 1.6K | 23 |

| LYFT | CALL | TRADE | BEARISH | 05/17/24 | $2.76 | $2.67 | $2.67 | $14.00 | $114.0K | 286 | 2 |

| LYFT | CALL | SWEEP | BEARISH | 05/03/24 | $0.56 | $0.37 | $0.37 | $17.50 | $108.6K | 4.0K | 0 |

| LYFT | PUT | SWEEP | BULLISH | 05/16/25 | $12.05 | $11.95 | $12.0 | $27.00 | $73.2K | 0 | 3 |

| LYFT | CALL | SWEEP | BULLISH | 05/17/24 | $1.31 | $1.28 | $1.3 | $17.00 | $65.0K | 2.2K | 546 |

About Lyft

Lyft is the second-largest ride-sharing service provider in the us and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

Present Market Standing of Lyft

- With a volume of 12,069,459, the price of LYFT is down -2.48% at $16.5.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 13 days.

What The Experts Say On Lyft

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $21.0.

- An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Lyft, which currently sits at a price target of $18.

- An analyst from Tigress Financial persists with their Buy rating on Lyft, maintaining a target price of $24.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lyft options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.