Whales with a lot of money to spend have taken a noticeably bearish stance on Carnival.

Looking at options history for Carnival CCL we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 23% of the investors opened trades with bullish expectations and 70% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $112,041 and 14, calls, for a total amount of $468,479.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $13.0 to $20.0 for Carnival over the last 3 months.

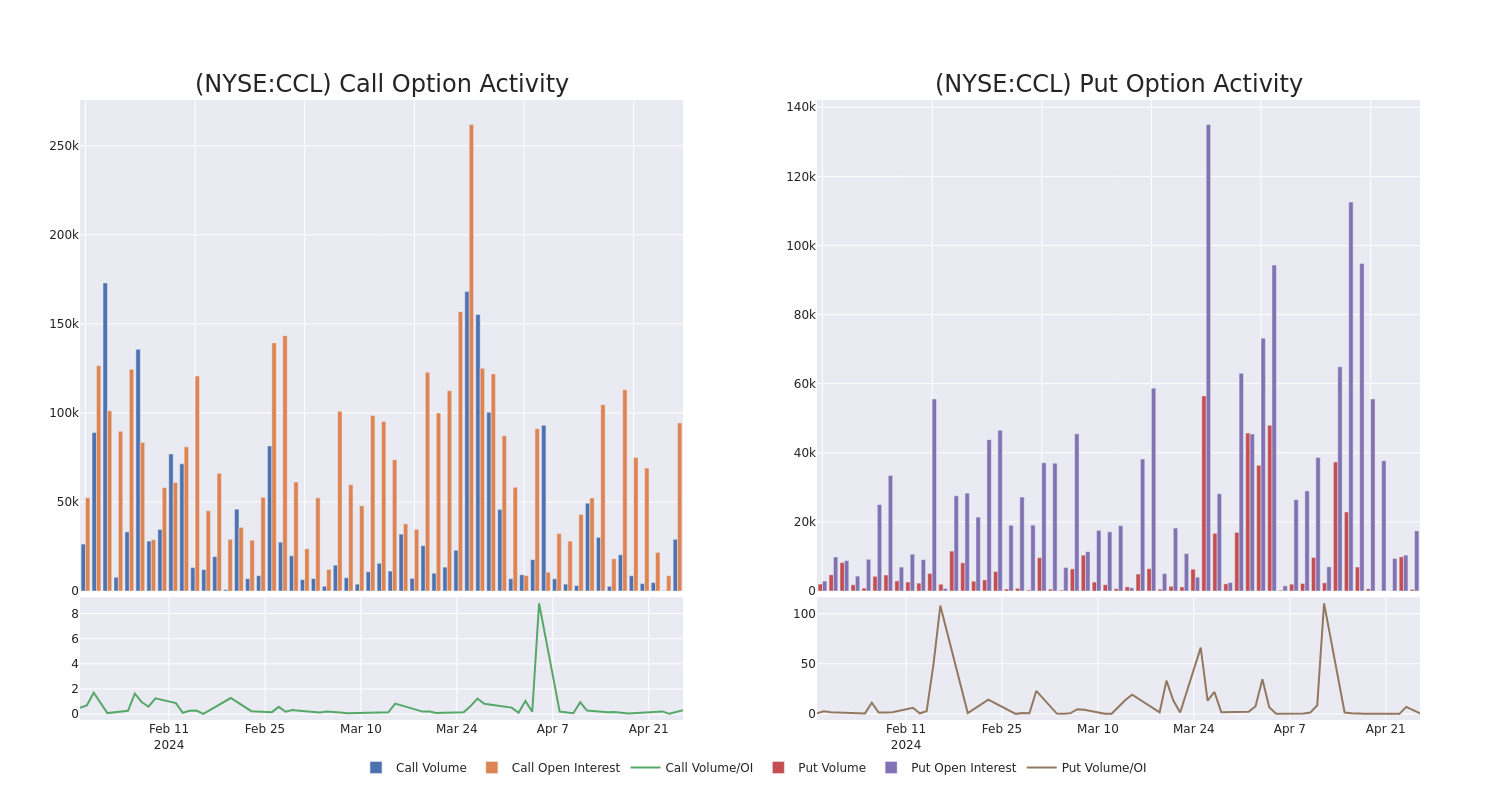

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Carnival options trades today is 13970.25 with a total volume of 29,536.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carnival's big money trades within a strike price range of $13.0 to $20.0 over the last 30 days.

Carnival Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | PUT | SWEEP | BEARISH | 06/20/25 | $3.6 | $3.55 | $3.6 | $17.00 | $57.9K | 1.1K | 286 |

| CCL | CALL | SWEEP | BULLISH | 07/19/24 | $1.31 | $1.29 | $1.31 | $15.00 | $51.3K | 4.8K | 465 |

| CCL | CALL | SWEEP | BEARISH | 01/17/25 | $0.94 | $0.92 | $0.92 | $20.00 | $46.0K | 29.7K | 721 |

| CCL | CALL | SWEEP | BEARISH | 06/21/24 | $1.05 | $1.03 | $1.03 | $15.00 | $41.2K | 26.6K | 767 |

| CCL | CALL | SWEEP | BULLISH | 06/20/25 | $2.47 | $2.37 | $2.47 | $17.00 | $37.5K | 3.9K | 16 |

About Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe; and P&O Cruises in Australia. Carnival also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

In light of the recent options history for Carnival, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Carnival's Current Market Status

- With a volume of 14,396,886, the price of CCL is down -0.95% at $15.04.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 59 days.

Expert Opinions on Carnival

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $24.4.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Carnival, targeting a price of $25.

- Maintaining their stance, an analyst from Tigress Financial continues to hold a Buy rating for Carnival, targeting a price of $25.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Carnival, targeting a price of $23.

- An analyst from Macquarie persists with their Outperform rating on Carnival, maintaining a target price of $24.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Carnival with a target price of $25.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.