Investors with a lot of money to spend have taken a bearish stance on Accenture ACN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with ACN, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Accenture.

This isn't normal.

The overall sentiment of these big-money traders is split between 11% bullish and 77%, bearish.

Out of all of the options we uncovered, 8 are puts, for a total amount of $577,090, and there was 1 call, for a total amount of $169,260.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $300.0 to $370.0 for Accenture over the last 3 months.

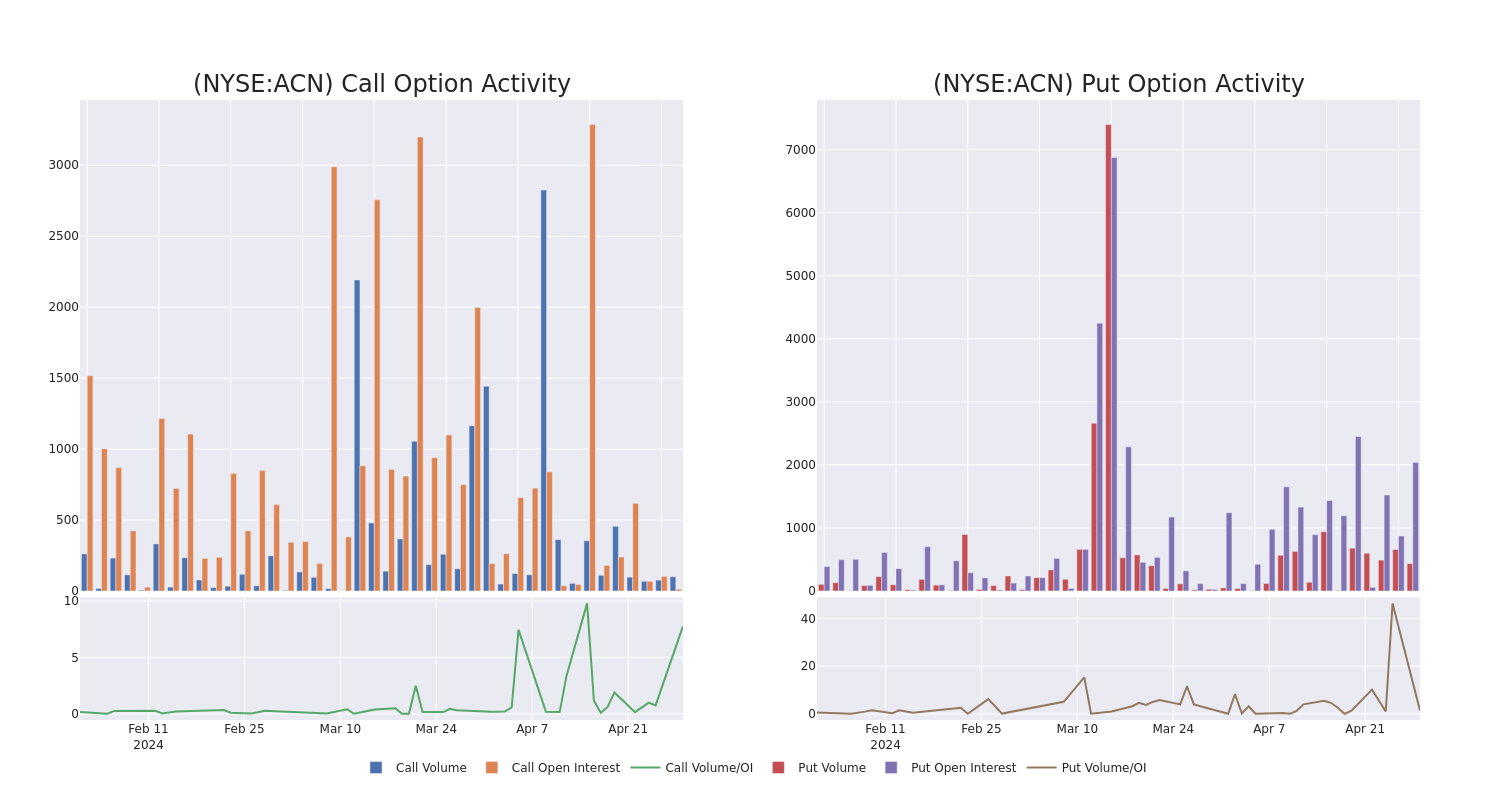

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Accenture options trades today is 293.14 with a total volume of 536.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Accenture's big money trades within a strike price range of $300.0 to $370.0 over the last 30 days.

Accenture Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACN | PUT | TRADE | BEARISH | 05/17/24 | $25.5 | $24.2 | $25.5 | $330.00 | $191.2K | 442 | 80 |

| ACN | CALL | SWEEP | BEARISH | 09/20/24 | $18.4 | $18.2 | $18.2 | $310.00 | $169.2K | 13 | 101 |

| ACN | PUT | TRADE | BEARISH | 06/21/24 | $26.5 | $26.3 | $26.5 | $330.00 | $79.5K | 492 | 111 |

| ACN | PUT | TRADE | BEARISH | 06/21/24 | $26.5 | $26.3 | $26.5 | $330.00 | $79.5K | 492 | 81 |

| ACN | PUT | TRADE | BEARISH | 05/03/24 | $21.3 | $20.4 | $21.3 | $325.00 | $76.6K | 77 | 40 |

About Accenture

Accenture is a leading global IT-services firm that provides consulting, strategy, and technology and operational services. These services run the gamut from aiding enterprises with digital transformation to procurement services to software system integration. The company provides its IT offerings to a variety of sectors, including communications, media and technology, financial services, health and public services, consumer products, and resources. Accenture employs just under 500,000 people throughout 200 cities in 51 countries.

Having examined the options trading patterns of Accenture, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Accenture

- Trading volume stands at 1,808,677, with ACN's price down by -1.19%, positioned at $304.36.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 52 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Accenture, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.