Investors with a lot of money to spend have taken a bullish stance on Lam Research LRCX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with LRCX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 17 uncommon options trades for Lam Research.

This isn't normal.

The overall sentiment of these big-money traders is split between 47% bullish and 29%, bearish.

Out of all of the special options we uncovered, 8 are puts, for a total amount of $426,575, and 9 are calls, for a total amount of $382,585.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $800.0 to $1160.0 for Lam Research over the recent three months.

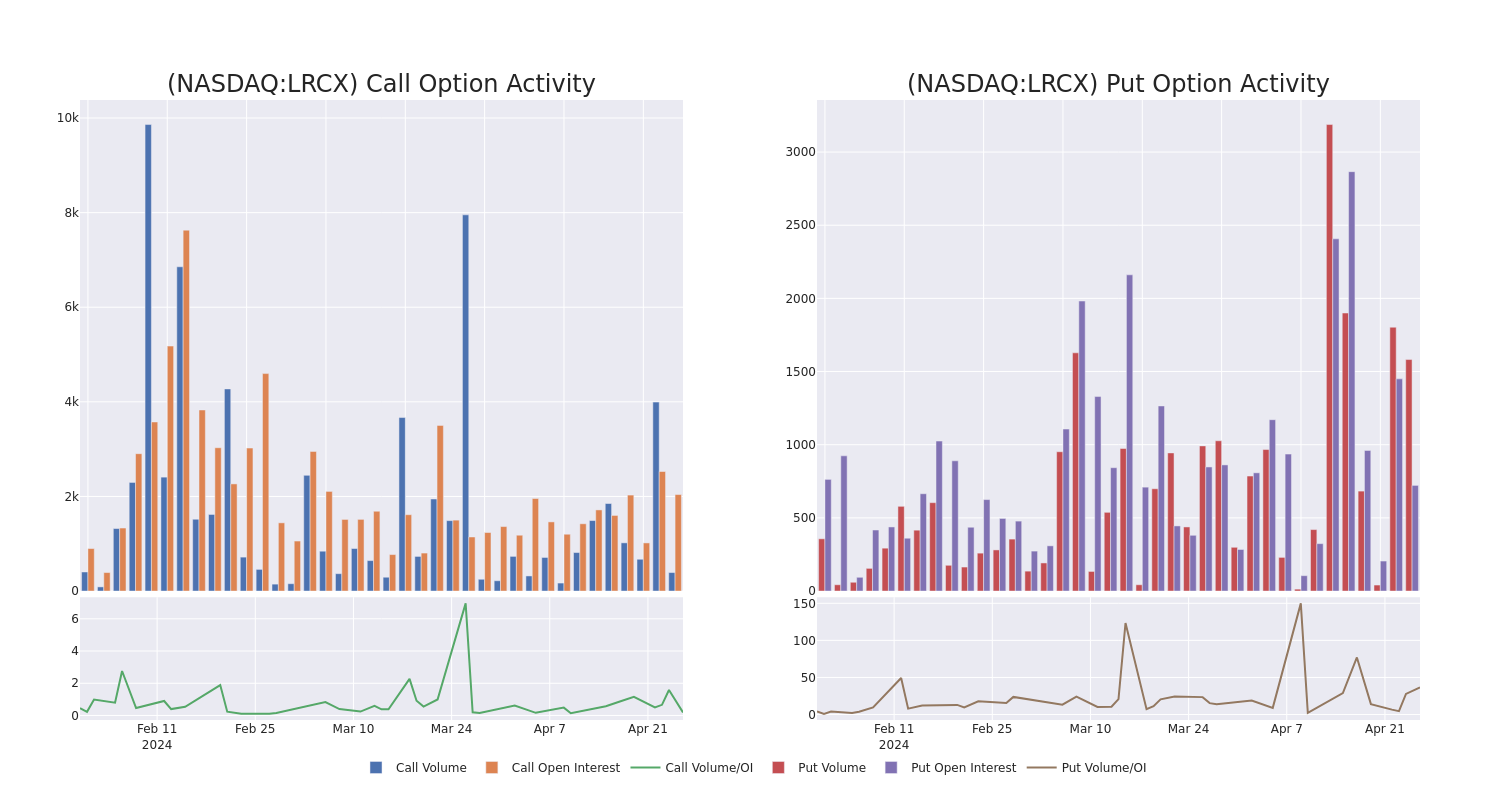

Volume & Open Interest Development

In today's trading context, the average open interest for options of Lam Research stands at 50.0, with a total volume reaching 166.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lam Research, situated within the strike price corridor from $800.0 to $1160.0, throughout the last 30 days.

Lam Research Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | PUT | TRADE | BULLISH | 01/17/25 | $53.75 | $50.5 | $50.5 | $800.00 | $111.1K | 202 | 0 |

| LRCX | CALL | SWEEP | BEARISH | 12/20/24 | $41.95 | $40.35 | $40.75 | $1160.00 | $85.5K | 55 | 21 |

| LRCX | PUT | TRADE | BEARISH | 06/21/24 | $47.8 | $47.5 | $47.8 | $930.00 | $66.9K | 52 | 14 |

| LRCX | PUT | SWEEP | BULLISH | 03/21/25 | $119.7 | $117.1 | $117.1 | $940.00 | $58.5K | 0 | 5 |

| LRCX | PUT | TRADE | BEARISH | 09/20/24 | $83.5 | $83.0 | $83.5 | $940.00 | $58.4K | 12 | 11 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

In light of the recent options history for Lam Research, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Lam Research

- With a volume of 306,805, the price of LRCX is up 0.44% at $929.41.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 86 days.

What The Experts Say On Lam Research

5 market experts have recently issued ratings for this stock, with a consensus target price of $1005.0.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on Lam Research, which currently sits at a price target of $865.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $1100.

- An analyst from Needham downgraded its action to Buy with a price target of $1030.

- An analyst from Stifel persists with their Buy rating on Lam Research, maintaining a target price of $1050.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Lam Research with a target price of $980.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lam Research options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.