Financial giants have made a conspicuous bullish move on Robinhood Markets. Our analysis of options history for Robinhood Markets HOOD revealed 13 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $219,256, and 8 were calls, valued at $428,662.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $25.0 for Robinhood Markets over the recent three months.

Volume & Open Interest Trends

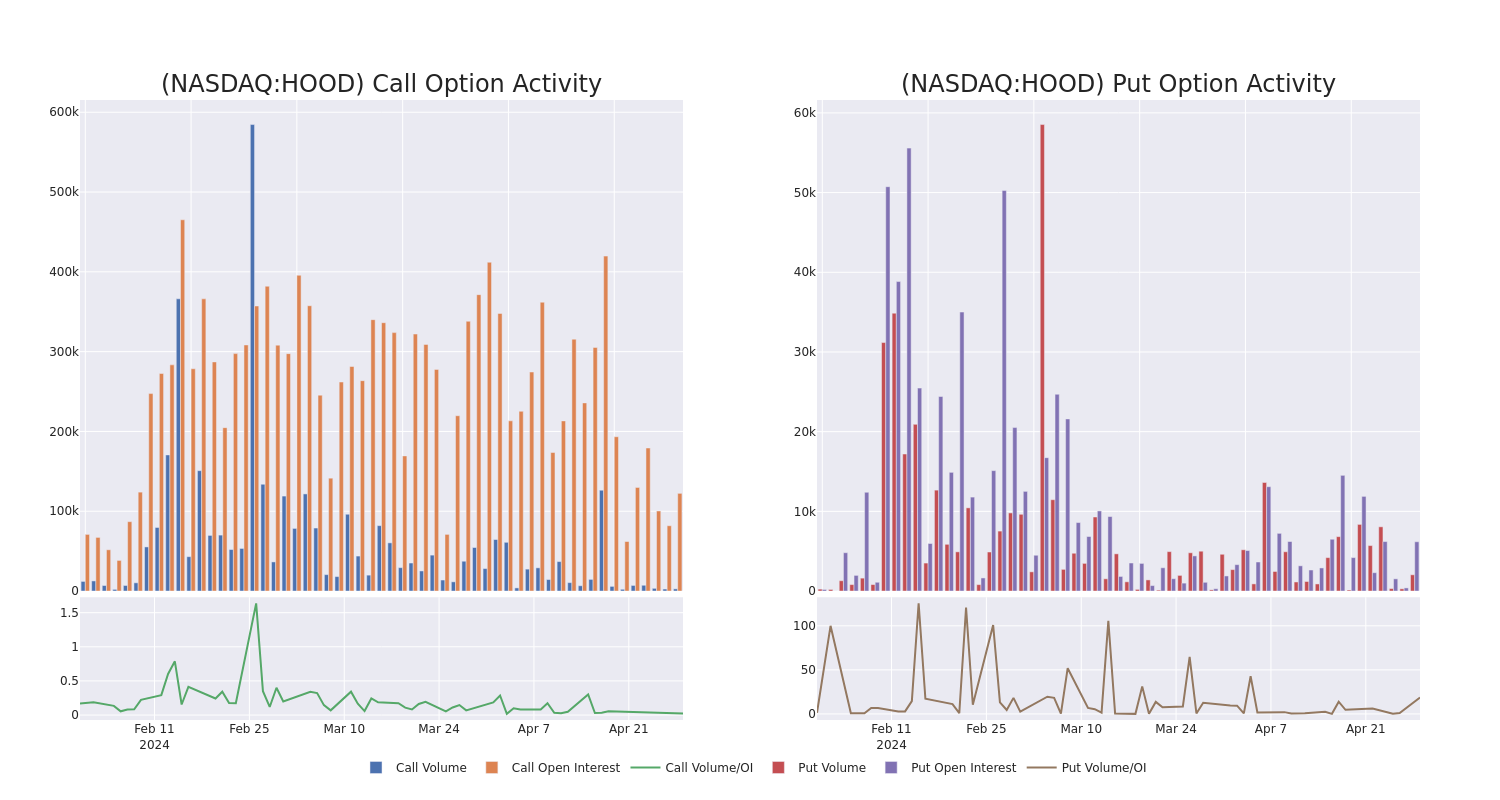

In terms of liquidity and interest, the mean open interest for Robinhood Markets options trades today is 10716.75 with a total volume of 4,769.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Robinhood Markets's big money trades within a strike price range of $10.0 to $25.0 over the last 30 days.

Robinhood Markets Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | SWEEP | BULLISH | 01/16/26 | $5.55 | $5.35 | $5.55 | $20.00 | $166.5K | 31.1K | 613 |

| HOOD | PUT | SWEEP | BEARISH | 05/10/24 | $1.12 | $1.1 | $1.11 | $17.50 | $71.9K | 737 | 231 |

| HOOD | CALL | SWEEP | BULLISH | 05/24/24 | $1.12 | $0.93 | $0.94 | $19.50 | $67.4K | 2.0K | 630 |

| HOOD | PUT | SWEEP | BULLISH | 06/21/24 | $1.38 | $1.36 | $1.36 | $17.00 | $51.0K | 3.2K | 392 |

| HOOD | CALL | SWEEP | BEARISH | 08/16/24 | $1.79 | $1.75 | $1.75 | $20.00 | $42.1K | 12.9K | 492 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

In light of the recent options history for Robinhood Markets, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Robinhood Markets

- With a volume of 5,658,517, the price of HOOD is down -1.51% at $17.61.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 9 days.

Expert Opinions on Robinhood Markets

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $19.8.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Robinhood Markets with a target price of $18.

- An analyst from JMP Securities has decided to maintain their Market Outperform rating on Robinhood Markets, which currently sits at a price target of $28.

- An analyst from Piper Sandler persists with their Neutral rating on Robinhood Markets, maintaining a target price of $17.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Neutral rating for Robinhood Markets, targeting a price of $20.

- Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Robinhood Markets, targeting a price of $16.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Robinhood Markets options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.