Benzinga's options scanner just detected over 14 options trades for Ford Motor F summing a total amount of $2,441,831.

At the same time, our algo caught 7 for a total amount of 495,635.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.17 to $21.82 for Ford Motor over the last 3 months.

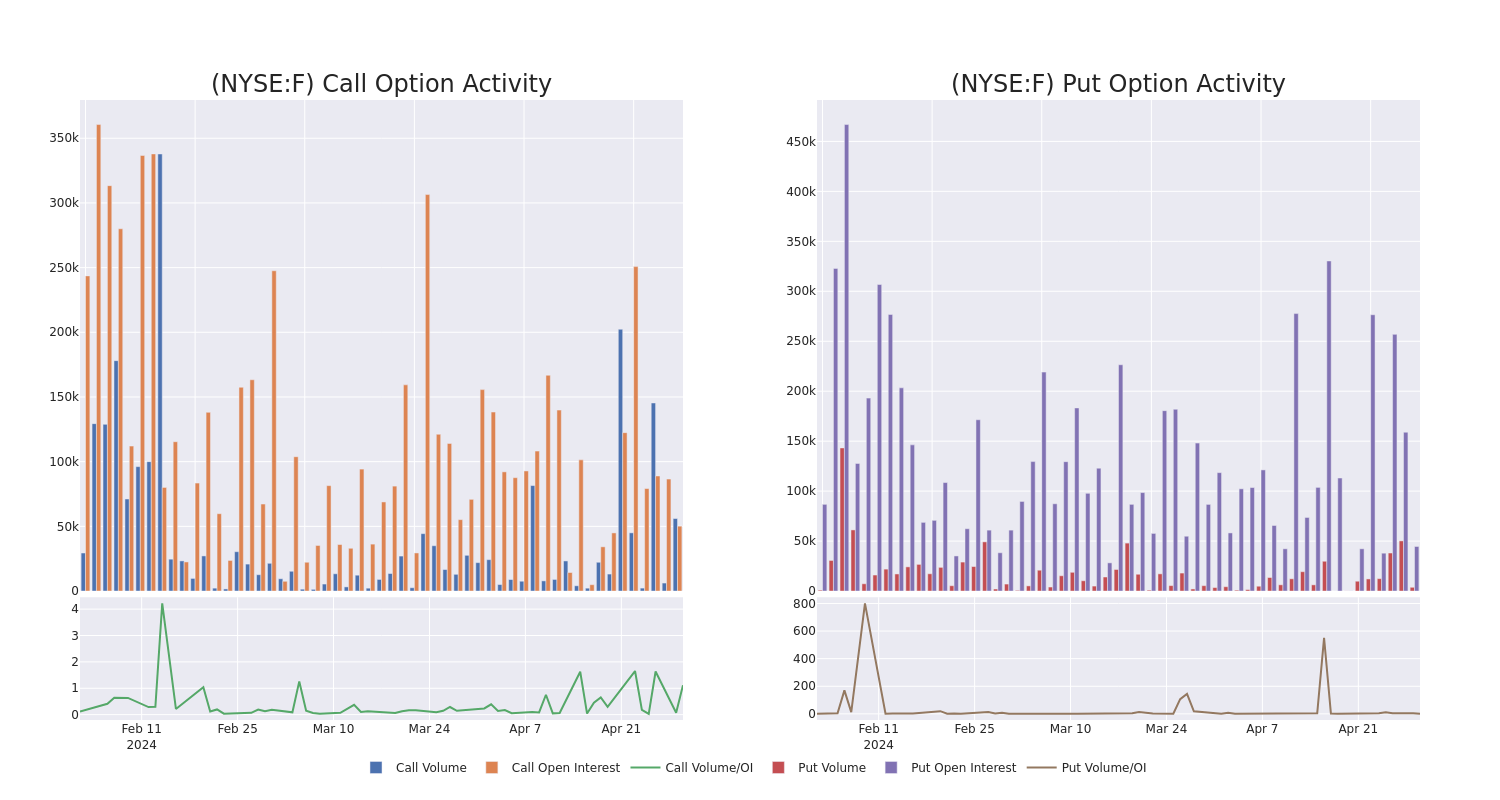

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Ford Motor options trades today is 9475.4 with a total volume of 59,811.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Ford Motor's big money trades within a strike price range of $7.17 to $21.82 over the last 30 days.

Ford Motor Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| F | CALL | TRADE | BULLISH | 12/20/24 | $0.93 | $0.9 | $0.93 | $13.00 | $1.6M | 20.2K | 18.9K |

| F | PUT | SWEEP | BULLISH | 12/19/25 | $5.0 | $4.9 | $4.9 | $16.82 | $144.0K | 231 | 6 |

| F | PUT | SWEEP | BULLISH | 12/20/24 | $5.8 | $5.7 | $5.7 | $18.00 | $141.9K | 1.6K | 1 |

| F | CALL | SWEEP | BULLISH | 07/19/24 | $0.42 | $0.41 | $0.42 | $12.82 | $83.6K | 13.8K | 9.1K |

| F | CALL | SWEEP | BULLISH | 07/19/24 | $0.42 | $0.41 | $0.42 | $12.82 | $75.1K | 13.8K | 8.0K |

About Ford Motor

Ford Motor Co. manufactures automobiles under its Ford and Lincoln brands. In March 2022, the company announced that it will run its combustion engine business, Ford Blue, and its BEV business, Ford Model e, as separate businesses but still all under Ford Motor. The company has nearly 13% market share in the United States, about 11% share in the U.K., and under 2% share in China including unconsolidated affiliates. Sales in the U.S. made up about 66% of 2023 total company revenue. Ford has about 177,000 employees, including about 59,000 UAW employees, and is based in Dearborn, Michigan.

Following our analysis of the options activities associated with Ford Motor, we pivot to a closer look at the company's own performance.

Ford Motor's Current Market Status

- Trading volume stands at 56,687,395, with F's price down by -4.04%, positioned at $12.23.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 86 days.

What The Experts Say On Ford Motor

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $14.333333333333334.

- An analyst from Barclays has decided to maintain their Overweight rating on Ford Motor, which currently sits at a price target of $16.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Sector Perform rating for Ford Motor, targeting a price of $13.

- An analyst from UBS has decided to maintain their Neutral rating on Ford Motor, which currently sits at a price target of $14.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Ford Motor options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.