Deep-pocketed investors have adopted a bearish approach towards PDD Holdings PDD, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PDD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for PDD Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 50% bearish. Among these notable options, 8 are puts, totaling $404,240, and 2 are calls, amounting to $115,700.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $150.0 for PDD Holdings over the recent three months.

Insights into Volume & Open Interest

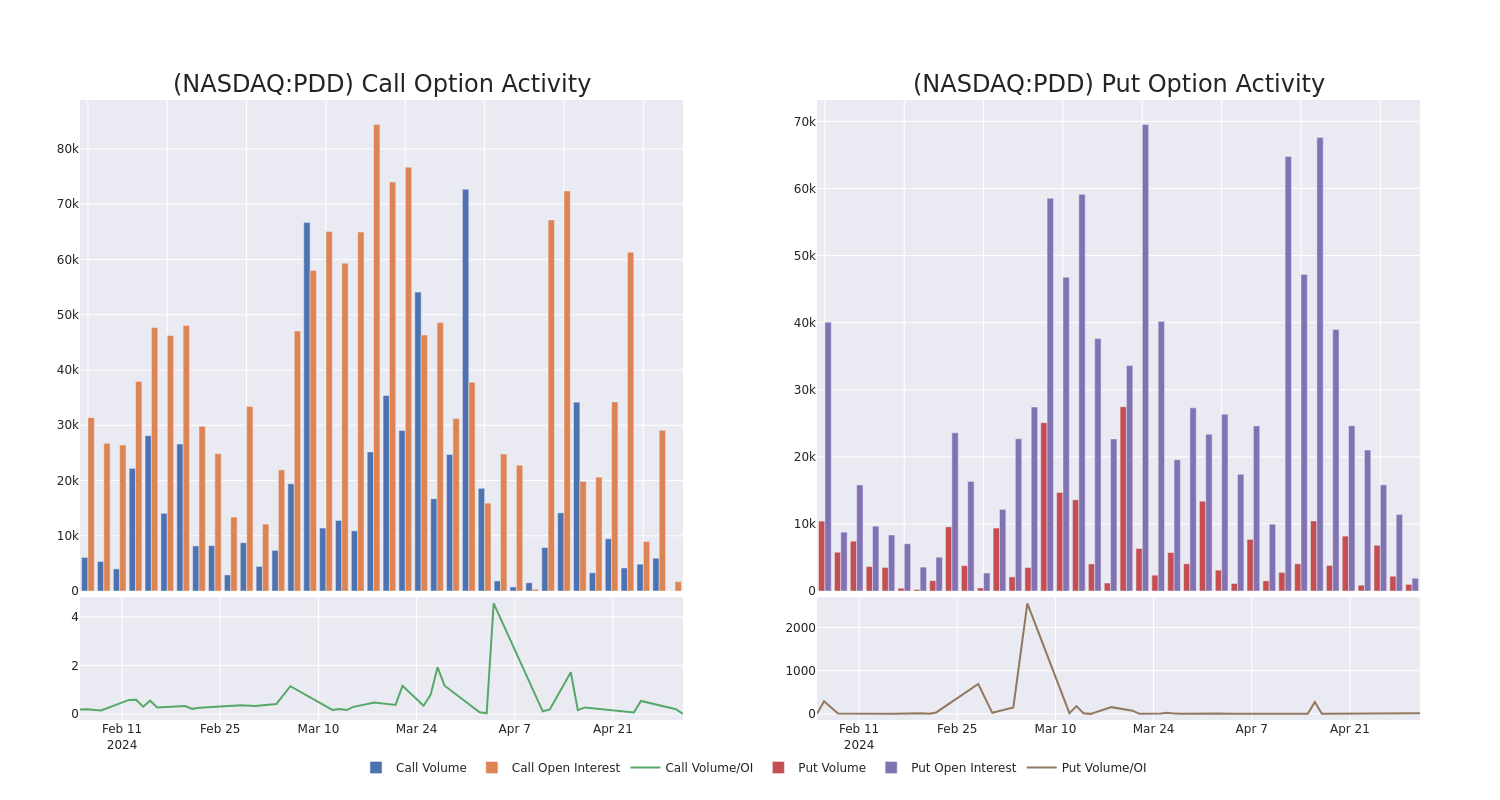

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for PDD Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PDD Holdings's whale trades within a strike price range from $100.0 to $150.0 in the last 30 days.

PDD Holdings 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | PUT | SWEEP | BULLISH | 03/21/25 | $10.65 | $9.5 | $9.5 | $100.00 | $137.7K | 72 | 400 |

| PDD | CALL | SWEEP | BULLISH | 01/17/25 | $28.95 | $28.6 | $28.95 | $110.00 | $57.9K | 1.7K | 20 |

| PDD | CALL | SWEEP | NEUTRAL | 01/17/25 | $28.9 | $28.9 | $28.9 | $110.00 | $57.8K | 1.7K | 20 |

| PDD | PUT | SWEEP | BEARISH | 03/21/25 | $9.9 | $9.65 | $9.75 | $100.00 | $48.7K | 72 | 50 |

| PDD | PUT | SWEEP | BEARISH | 03/21/25 | $9.5 | $9.5 | $9.5 | $100.00 | $47.5K | 72 | 200 |

About PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

In light of the recent options history for PDD Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is PDD Holdings Standing Right Now?

- With a volume of 1,030,050, the price of PDD is down -1.69% at $123.06.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 23 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PDD Holdings options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.