Financial giants have made a conspicuous bullish move on Starbucks. Our analysis of options history for Starbucks SBUX revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $252,963, and 3 were calls, valued at $204,162.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $85.0 for Starbucks over the recent three months.

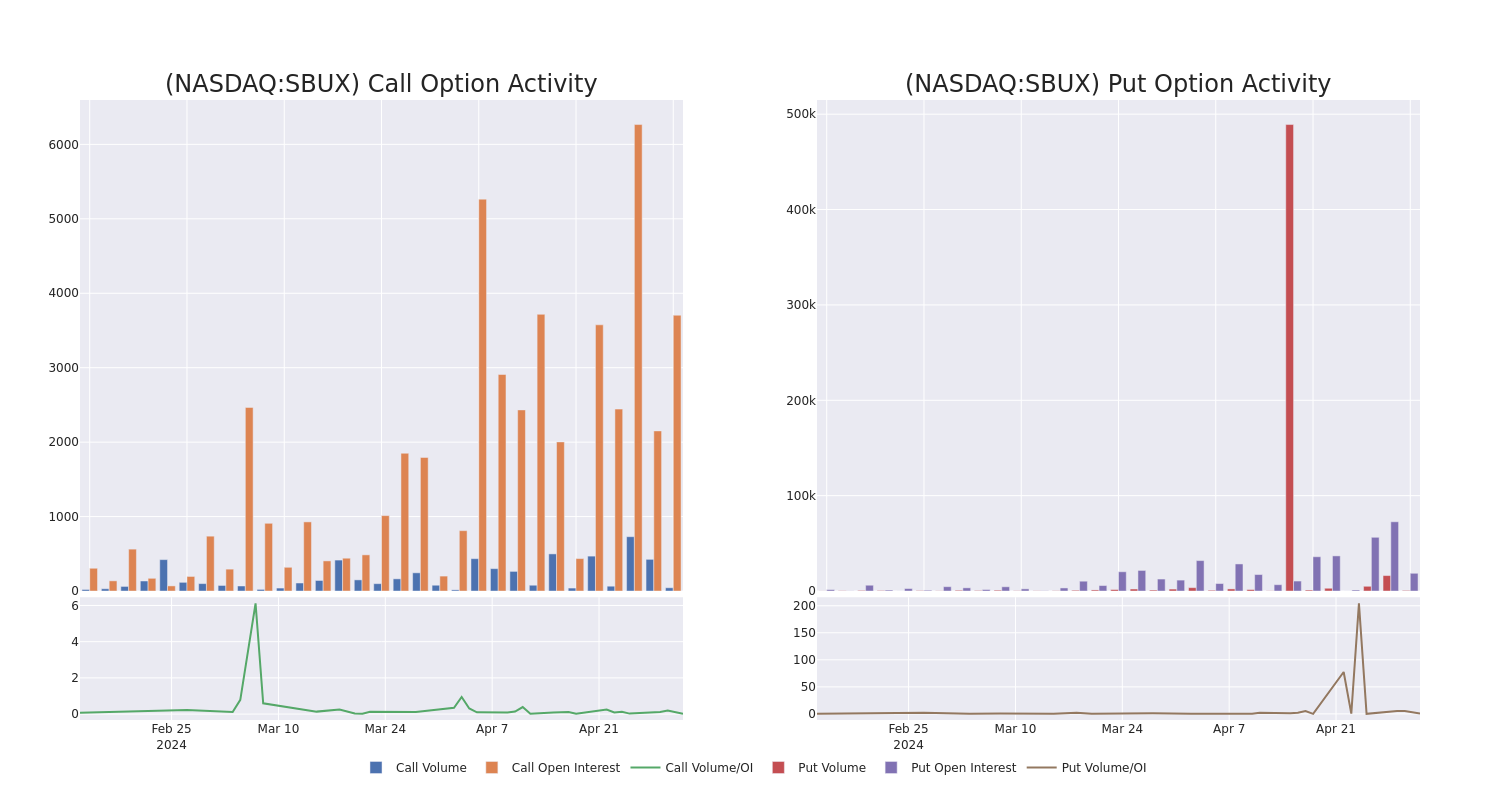

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Starbucks's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Starbucks's whale activity within a strike price range from $70.0 to $85.0 in the last 30 days.

Starbucks Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SBUX | CALL | SWEEP | BULLISH | 03/21/25 | $5.5 | $5.35 | $5.45 | $80.00 | $135.7K | 63 | 2 |

| SBUX | PUT | TRADE | BULLISH | 05/17/24 | $6.85 | $6.65 | $6.7 | $80.00 | $67.0K | 10.5K | 160 |

| SBUX | PUT | TRADE | BULLISH | 01/17/25 | $4.35 | $4.3 | $4.3 | $70.00 | $55.9K | 3.5K | 153 |

| SBUX | PUT | SWEEP | BEARISH | 05/03/24 | $11.15 | $10.3 | $11.15 | $85.00 | $50.1K | 199 | 36 |

| SBUX | PUT | TRADE | NEUTRAL | 05/03/24 | $10.3 | $9.9 | $10.08 | $84.00 | $48.3K | 146 | 44 |

About Starbucks

Starbucks is one of the most widely recognized restaurant brands in the world, operating more than 38,000 stores across more than 80 countries as of the end of fiscal 2023. The firm operates in three segments: North America, international markets, and channel development (grocery and ready-to-drink beverage). The coffee chain generates revenue from company-operated stores, royalties, sales of equipment and products to license partners, ready-to-drink beverages, packaged coffee sales, and single-serve products.

Following our analysis of the options activities associated with Starbucks, we pivot to a closer look at the company's own performance.

Starbucks's Current Market Status

- Trading volume stands at 5,668,339, with SBUX's price down by -0.98%, positioned at $73.71.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 89 days.

Expert Opinions on Starbucks

5 market experts have recently issued ratings for this stock, with a consensus target price of $92.2.

- Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Starbucks with a target price of $85.

- Reflecting concerns, an analyst from TD Cowen lowers its rating to Hold with a new price target of $100.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Starbucks with a target price of $90.

- An analyst from Guggenheim has decided to maintain their Buy rating on Starbucks, which currently sits at a price target of $91.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Starbucks, targeting a price of $95.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Starbucks with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.