High-rolling investors have positioned themselves bearish on Lockheed Martin LMT, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LMT often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 11 options trades for Lockheed Martin. This is not a typical pattern.

The sentiment among these major traders is split, with 27% bullish and 45% bearish. Among all the options we identified, there was one put, amounting to $280,000, and 10 calls, totaling $413,668.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $440.0 to $480.0 for Lockheed Martin over the recent three months.

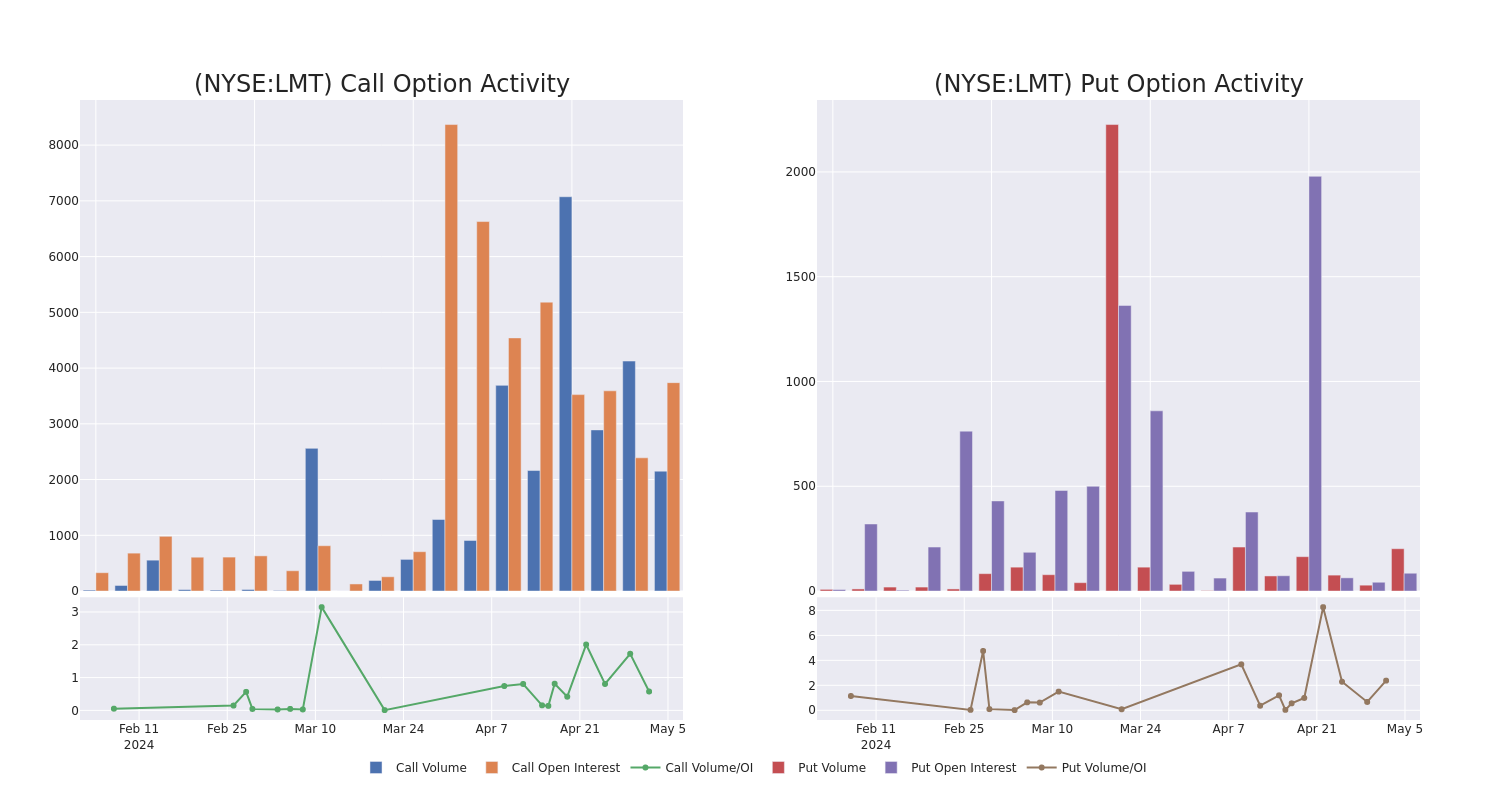

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Lockheed Martin's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lockheed Martin's whale trades within a strike price range from $440.0 to $480.0 in the last 30 days.

Lockheed Martin 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | PUT | TRADE | BEARISH | 07/19/24 | $14.1 | $13.5 | $14.0 | $465.00 | $280.0K | 85 | 202 |

| LMT | CALL | SWEEP | BEARISH | 07/19/24 | $6.0 | $5.6 | $5.6 | $480.00 | $86.2K | 520 | 122 |

| LMT | CALL | SWEEP | BEARISH | 07/19/24 | $5.5 | $5.4 | $5.5 | $480.00 | $64.3K | 520 | 326 |

| LMT | CALL | TRADE | NEUTRAL | 06/21/24 | $5.1 | $4.0 | $4.5 | $475.00 | $37.8K | 2.1K | 222 |

| LMT | CALL | TRADE | BEARISH | 06/21/24 | $5.1 | $4.1 | $4.5 | $475.00 | $36.0K | 2.1K | 370 |

About Lockheed Martin

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

In light of the recent options history for Lockheed Martin, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Lockheed Martin Standing Right Now?

- With a volume of 234,123, the price of LMT is down -0.32% at $460.23.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 75 days.

Professional Analyst Ratings for Lockheed Martin

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $501.8.

- Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Lockheed Martin, targeting a price of $499.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Lockheed Martin, targeting a price of $480.

- Consistent in their evaluation, an analyst from Deutsche Bank keeps a Hold rating on Lockheed Martin with a target price of $487.

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Lockheed Martin with a target price of $525.

- An analyst from JP Morgan upgraded its action to Overweight with a price target of $518.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lockheed Martin with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.