High-rolling investors have positioned themselves bearish on Unity Software U, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in U often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 9 options trades for Unity Software. This is not a typical pattern.

The sentiment among these major traders is split, with 44% bullish and 55% bearish. Among all the options we identified, there was one put, amounting to $27,302, and 8 calls, totaling $394,713.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $33.0 for Unity Software during the past quarter.

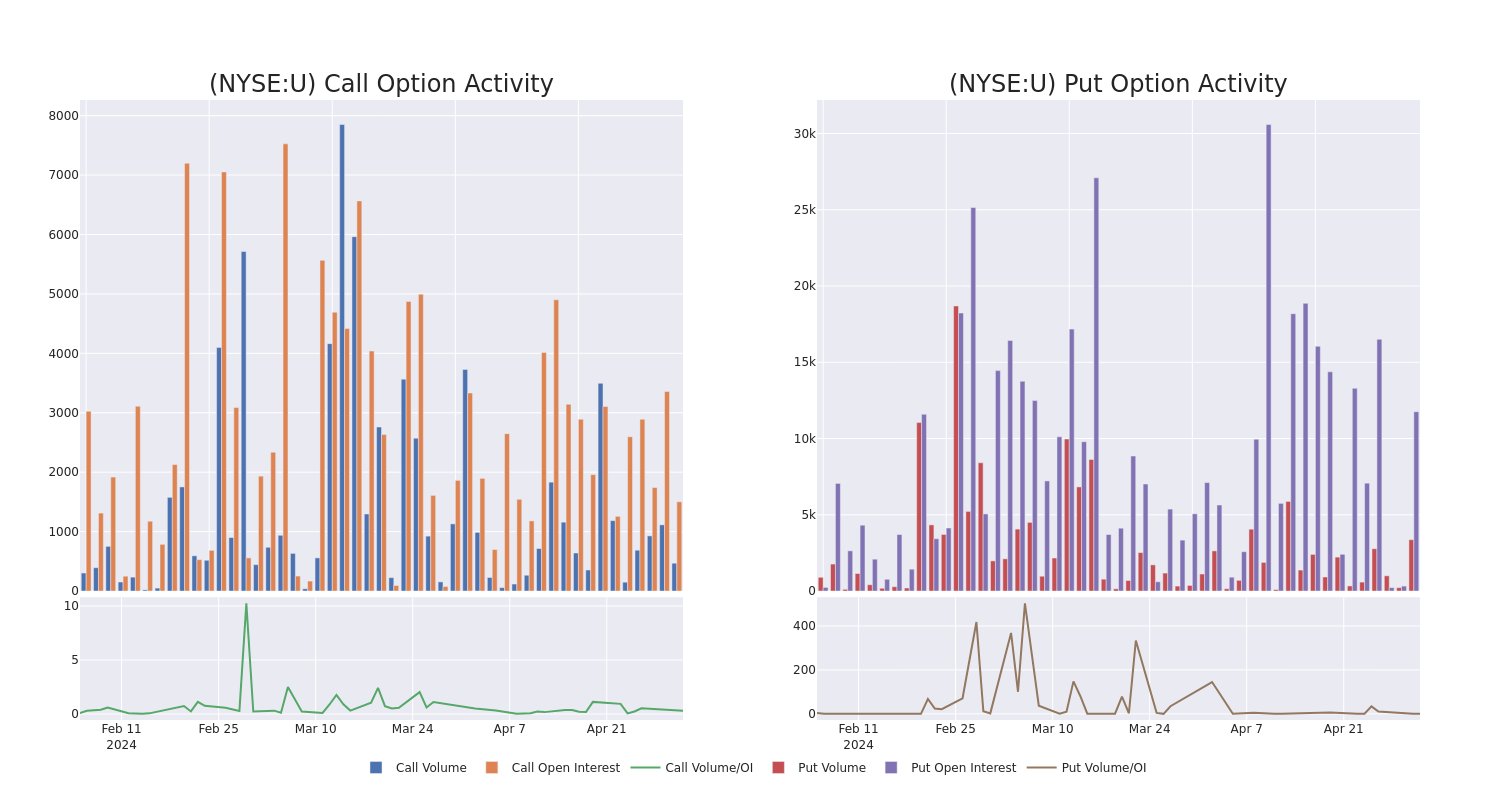

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Unity Software's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Unity Software's significant trades, within a strike price range of $20.0 to $33.0, over the past month.

Unity Software Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | CALL | SWEEP | BULLISH | 05/10/24 | $2.65 | $2.61 | $2.65 | $23.00 | $80.0K | 162 | 305 |

| U | CALL | SWEEP | BEARISH | 05/10/24 | $2.59 | $2.42 | $2.59 | $23.00 | $77.7K | 162 | 380 |

| U | CALL | SWEEP | BEARISH | 07/19/24 | $1.27 | $1.15 | $1.25 | $30.00 | $50.0K | 883 | 435 |

| U | CALL | SWEEP | BULLISH | 09/20/24 | $5.8 | $5.65 | $5.8 | $22.00 | $44.0K | 87 | 0 |

| U | CALL | TRADE | BEARISH | 12/19/25 | $11.2 | $10.2 | $10.2 | $20.00 | $40.8K | 79 | 41 |

About Unity Software

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Where Is Unity Software Standing Right Now?

- Trading volume stands at 4,101,204, with U's price up by 1.41%, positioned at $24.5.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 6 days.

Professional Analyst Ratings for Unity Software

1 market experts have recently issued ratings for this stock, with a consensus target price of $33.5.

- An analyst from Wedbush downgraded its action to Outperform with a price target of $33.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Unity Software options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.