Investors with a lot of money to spend have taken a bullish stance on Amgen AMGN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMGN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 20 uncommon options trades for Amgen.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 35%, bearish.

Out of all of the special options we uncovered, 10 are puts, for a total amount of $571,622, and 10 are calls, for a total amount of $492,166.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $320.0 for Amgen during the past quarter.

Analyzing Volume & Open Interest

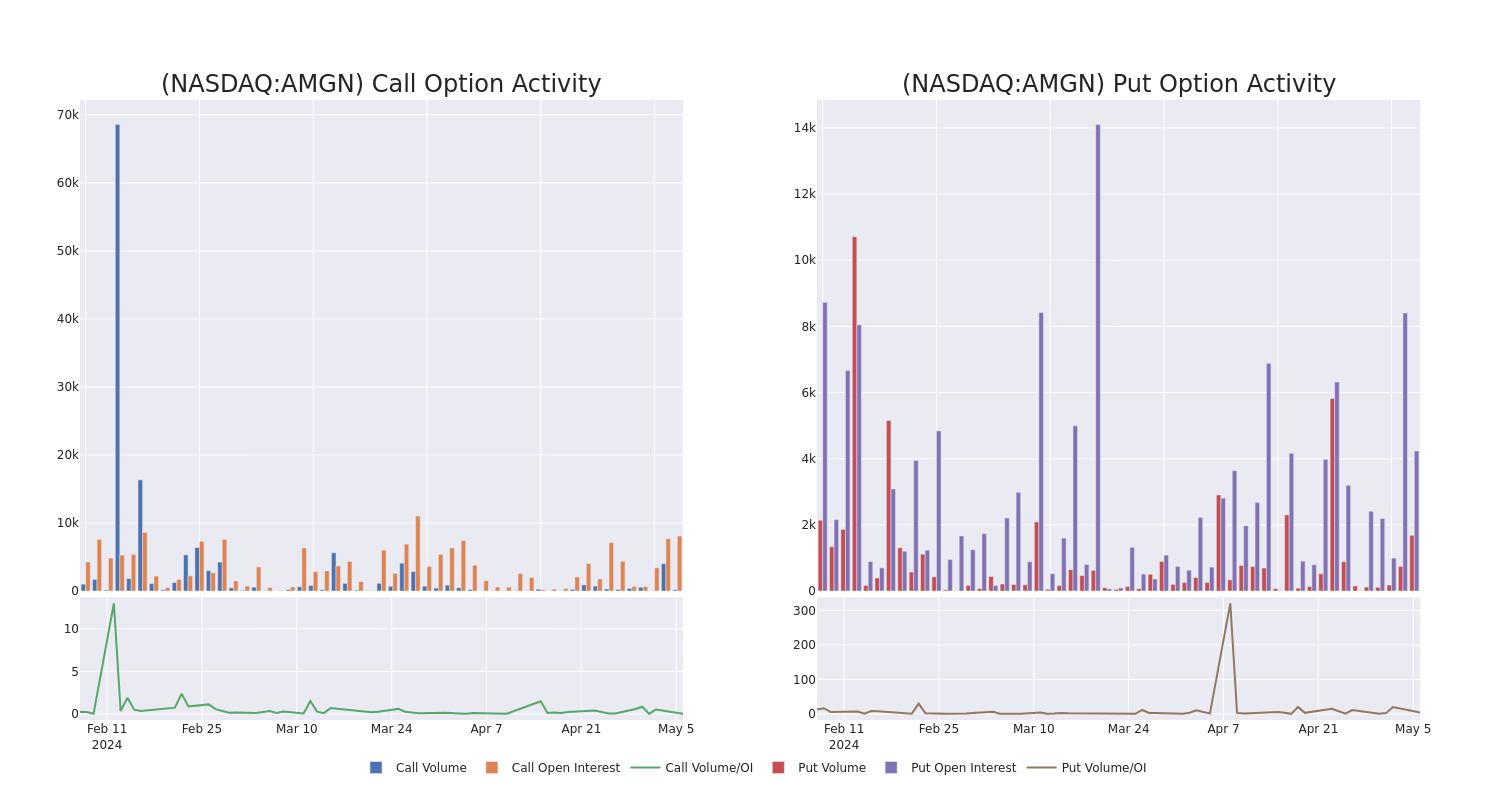

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Amgen's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Amgen's substantial trades, within a strike price spectrum from $140.0 to $320.0 over the preceding 30 days.

Amgen Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | SWEEP | BULLISH | 09/20/24 | $5.5 | $5.45 | $5.45 | $270.00 | $111.1K | 568 | 2 |

| AMGN | PUT | SWEEP | BULLISH | 05/17/24 | $4.45 | $4.4 | $4.4 | $300.00 | $104.7K | 341 | 130 |

| AMGN | PUT | TRADE | BULLISH | 06/21/24 | $9.25 | $8.2 | $8.39 | $300.00 | $83.9K | 1.8K | 184 |

| AMGN | CALL | SWEEP | BULLISH | 06/21/24 | $4.1 | $3.4 | $4.1 | $315.00 | $82.0K | 207 | 10 |

| AMGN | CALL | TRADE | NEUTRAL | 06/20/25 | $164.5 | $160.0 | $162.25 | $140.00 | $81.1K | 5 | 0 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company's own performance.

Present Market Standing of Amgen

- With a volume of 794,285, the price of AMGN is down -0.42% at $309.98.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 87 days.

What Analysts Are Saying About Amgen

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $330.6.

- An analyst from Barclays has elevated its stance to Equal-Weight, setting a new price target at $300.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Amgen, which currently sits at a price target of $310.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Amgen with a target price of $360.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Amgen, targeting a price of $355.

- An analyst from RBC Capital has decided to maintain their Outperform rating on Amgen, which currently sits at a price target of $328.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amgen options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.