Investors with a lot of money to spend have taken a bearish stance on Morgan Stanley MS.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MS, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 14 uncommon options trades for Morgan Stanley.

This isn't normal.

The overall sentiment of these big-money traders is split between 35% bullish and 50%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $399,371, and 7 are calls, for a total amount of $605,350.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $105.0 for Morgan Stanley during the past quarter.

Insights into Volume & Open Interest

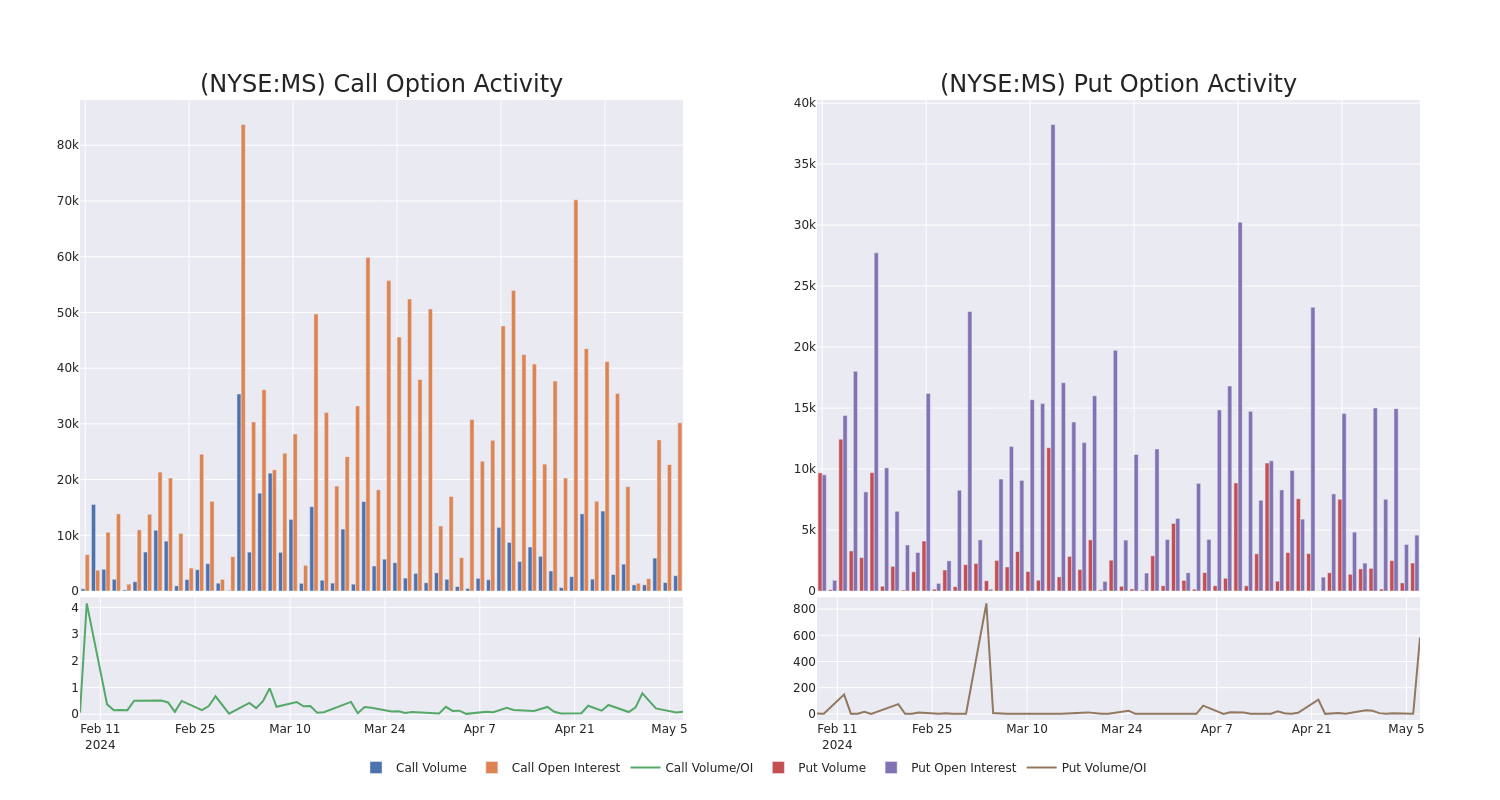

In today's trading context, the average open interest for options of Morgan Stanley stands at 3477.4, with a total volume reaching 5,049.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Morgan Stanley, situated within the strike price corridor from $85.0 to $105.0, throughout the last 30 days.

Morgan Stanley 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | SWEEP | BEARISH | 01/17/25 | $12.5 | $12.25 | $12.26 | $90.00 | $236.2K | 7.7K | 1.0K |

| MS | CALL | SWEEP | BEARISH | 01/17/25 | $12.3 | $12.2 | $12.23 | $90.00 | $209.4K | 7.7K | 796 |

| MS | PUT | SWEEP | BULLISH | 05/31/24 | $1.05 | $1.04 | $1.04 | $94.00 | $110.0K | 2 | 1.0K |

| MS | PUT | SWEEP | BEARISH | 05/17/24 | $1.99 | $1.97 | $1.98 | $97.00 | $84.7K | 13 | 546 |

| MS | PUT | SWEEP | BEARISH | 10/18/24 | $5.25 | $5.2 | $5.25 | $95.00 | $52.5K | 1.1K | 200 |

About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments. The company had over $4 trillion of client assets as well as over 80,000 employees at the end of 2022. Approximately 50% of the company's net revenue is from its institutional securities business, with the remainder coming from wealth and investment management. The company derives about 30% of its total revenue outside the Americas.

Morgan Stanley's Current Market Status

- Currently trading with a volume of 3,083,004, the MS's price is up by 0.91%, now at $95.65.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 70 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Morgan Stanley, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.