Financial giants have made a conspicuous bullish move on JPMorgan Chase. Our analysis of options history for JPMorgan Chase JPM revealed 10 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $305,662, and 5 were calls, valued at $260,840.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $200.0 for JPMorgan Chase over the recent three months.

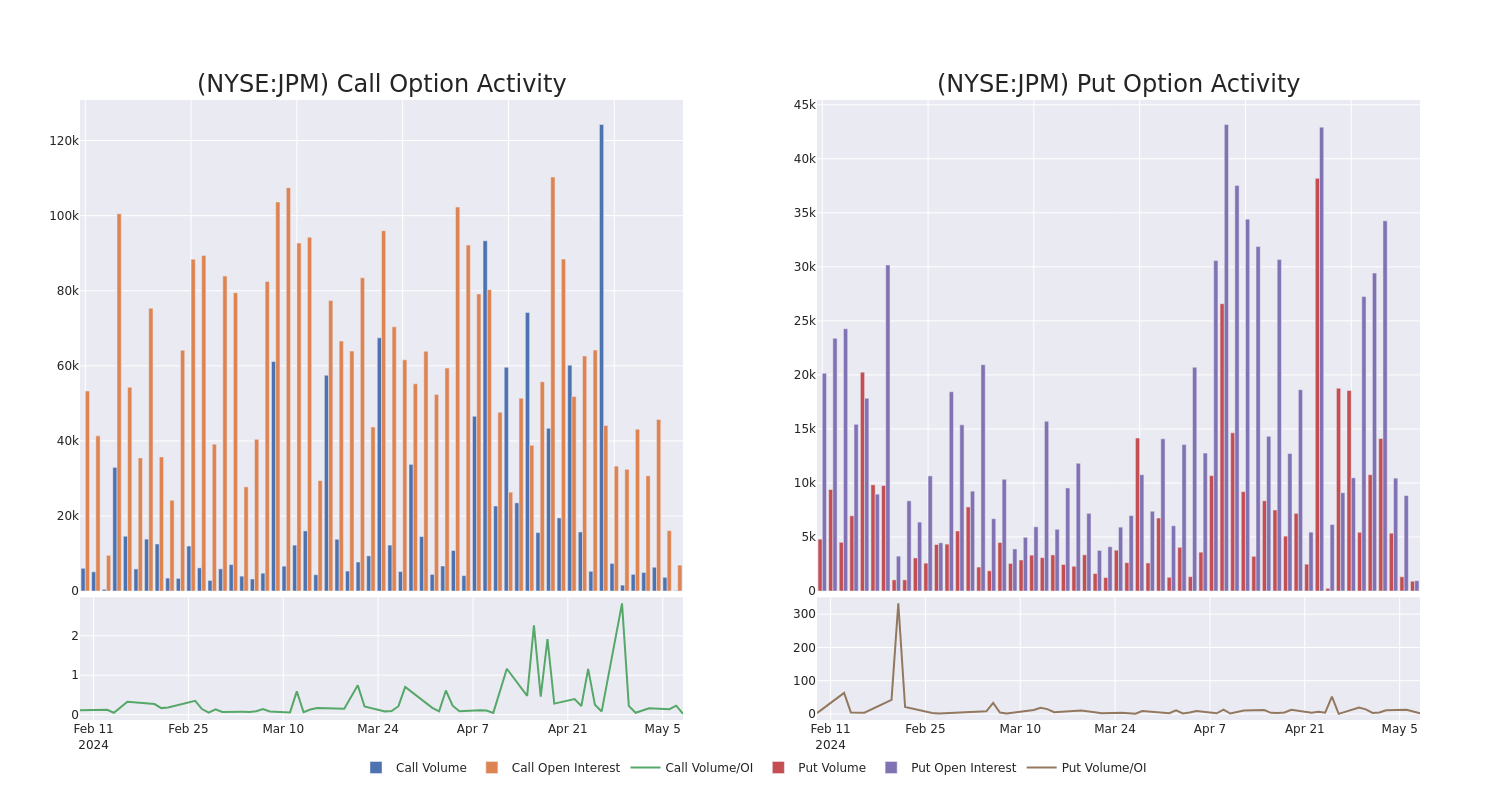

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for JPMorgan Chase's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JPMorgan Chase's whale trades within a strike price range from $160.0 to $200.0 in the last 30 days.

JPMorgan Chase 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | PUT | SWEEP | NEUTRAL | 08/16/24 | $11.4 | $11.25 | $11.31 | $200.00 | $67.8K | 378 | 174 |

| JPM | CALL | TRADE | BEARISH | 09/20/24 | $27.15 | $27.0 | $27.0 | $170.00 | $67.5K | 2.4K | 0 |

| JPM | PUT | SWEEP | BULLISH | 08/16/24 | $11.45 | $11.2 | $11.3 | $200.00 | $66.6K | 378 | 55 |

| JPM | CALL | TRADE | BEARISH | 07/19/24 | $8.65 | $8.6 | $8.6 | $190.00 | $62.7K | 3.1K | 83 |

| JPM | CALL | TRADE | BULLISH | 06/07/24 | $3.05 | $3.0 | $3.05 | $195.00 | $61.0K | 455 | 1 |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $3.9 trillion in assets. It is organized into four major segments--consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

Following our analysis of the options activities associated with JPMorgan Chase, we pivot to a closer look at the company's own performance.

JPMorgan Chase's Current Market Status

- Trading volume stands at 2,448,319, with JPM's price up by 0.49%, positioned at $192.69.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 65 days.

What Analysts Are Saying About JPMorgan Chase

In the last month, 5 experts released ratings on this stock with an average target price of $212.4.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on JPMorgan Chase with a target price of $195.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on JPMorgan Chase, which currently sits at a price target of $216.

- Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on JPMorgan Chase with a target price of $217.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for JPMorgan Chase, targeting a price of $219.

- An analyst from Piper Sandler has decided to maintain their Overweight rating on JPMorgan Chase, which currently sits at a price target of $215.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JPMorgan Chase options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.