Financial giants have made a conspicuous bullish move on Vertex Pharmaceuticals. Our analysis of options history for Vertex Pharmaceuticals VRTX revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 0% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $196,340, and 3 were calls, valued at $160,581.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $380.0 and $450.0 for Vertex Pharmaceuticals, spanning the last three months.

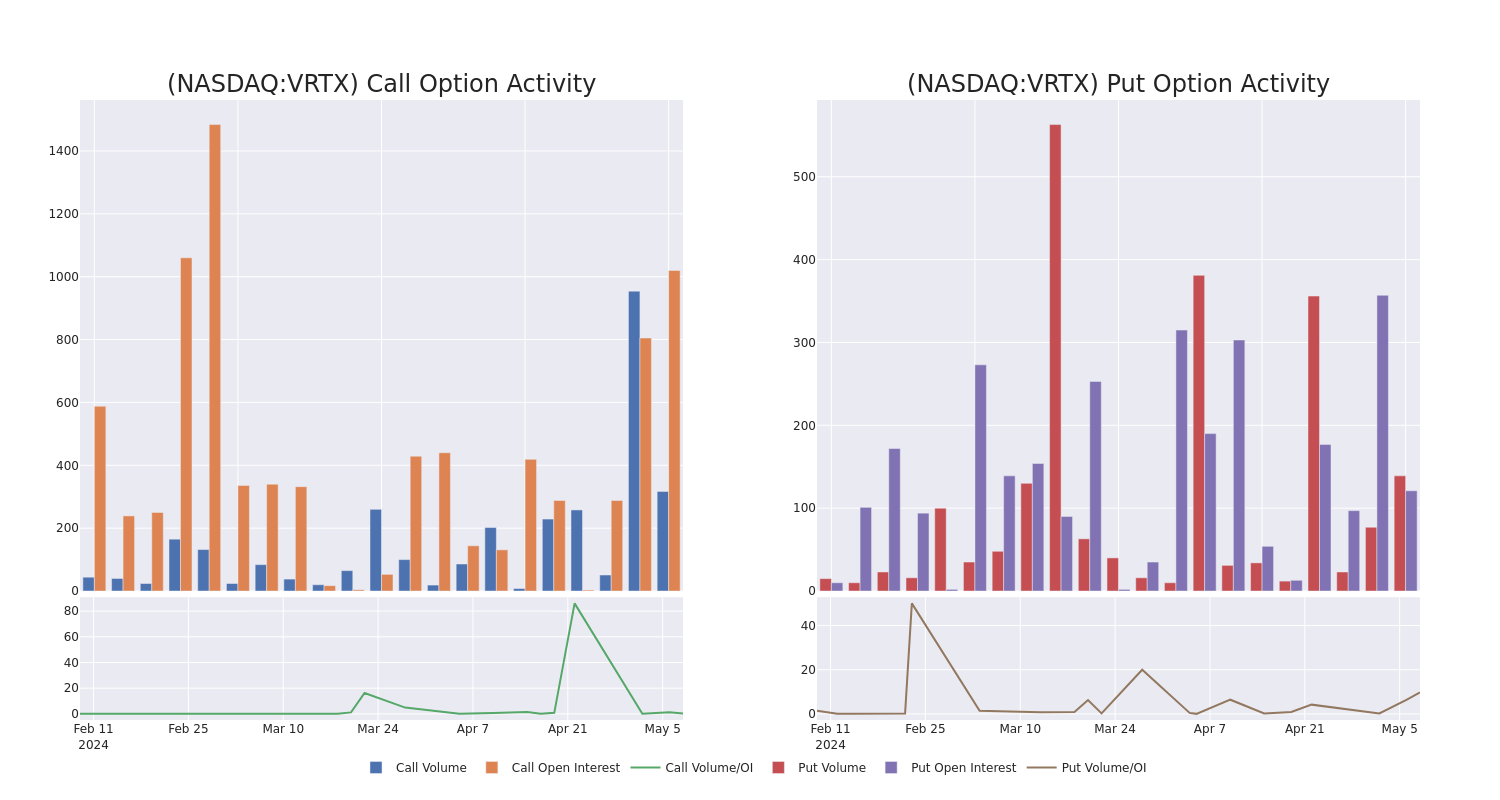

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Vertex Pharmaceuticals's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Vertex Pharmaceuticals's significant trades, within a strike price range of $380.0 to $450.0, over the past month.

Vertex Pharmaceuticals 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRTX | CALL | SWEEP | NEUTRAL | 06/21/24 | $9.1 | $9.0 | $9.0 | $430.00 | $87.5K | 481 | 34 |

| VRTX | PUT | SWEEP | BULLISH | 10/18/24 | $19.9 | $16.7 | $18.0 | $410.00 | $50.4K | 12 | 37 |

| VRTX | CALL | SWEEP | BULLISH | 05/10/24 | $4.9 | $4.9 | $4.9 | $420.00 | $43.6K | 532 | 278 |

| VRTX | PUT | SWEEP | NEUTRAL | 01/17/25 | $44.0 | $41.9 | $44.0 | $450.00 | $39.6K | 98 | 9 |

| VRTX | PUT | SWEEP | BULLISH | 10/18/24 | $22.3 | $20.5 | $22.2 | $420.00 | $37.7K | 11 | 6 |

About Vertex Pharmaceuticals

Vertex Pharmaceuticals is a global biotechnology company that discovers and develops small-molecule drugs for the treatment of serious diseases. Its key drugs are Kalydeco, Orkambi, Symdeko, and Trikafta/Kaftrio for cystic fibrosis, where Vertex therapies remain the standard of care globally. Vertex has diversified its portfolio through Casgevy, a gene-editing therapy for beta thalassemia and sickle-cell disease. Additionally, Vertex is evaluating small-molecule inhibitors targeting acute and chronic pain using nonopioid treatments, and small-molecule inhibitors of APOL1-mediated kidney diseases. Vertex is also investigating cell therapies to deliver a potential functional cure for type 1 diabetes.

Having examined the options trading patterns of Vertex Pharmaceuticals, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Vertex Pharmaceuticals's Current Market Status

- Trading volume stands at 1,063,883, with VRTX's price up by 3.27%, positioned at $423.65.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 83 days.

What Analysts Are Saying About Vertex Pharmaceuticals

5 market experts have recently issued ratings for this stock, with a consensus target price of $447.4.

- Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Sell rating for Vertex Pharmaceuticals, targeting a price of $371.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Vertex Pharmaceuticals, which currently sits at a price target of $500.

- Showing optimism, an analyst from Evercore ISI Group upgrades its rating to Outperform with a revised price target of $438.

- An analyst from UBS persists with their Buy rating on Vertex Pharmaceuticals, maintaining a target price of $466.

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $462.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertex Pharmaceuticals with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.