Whales with a lot of money to spend have taken a noticeably bearish stance on JPMorgan Chase.

Looking at options history for JPMorgan Chase JPM we detected 41 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 14 are puts, for a total amount of $559,531 and 27, calls, for a total amount of $1,038,053.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $215.0 for JPMorgan Chase during the past quarter.

Volume & Open Interest Trends

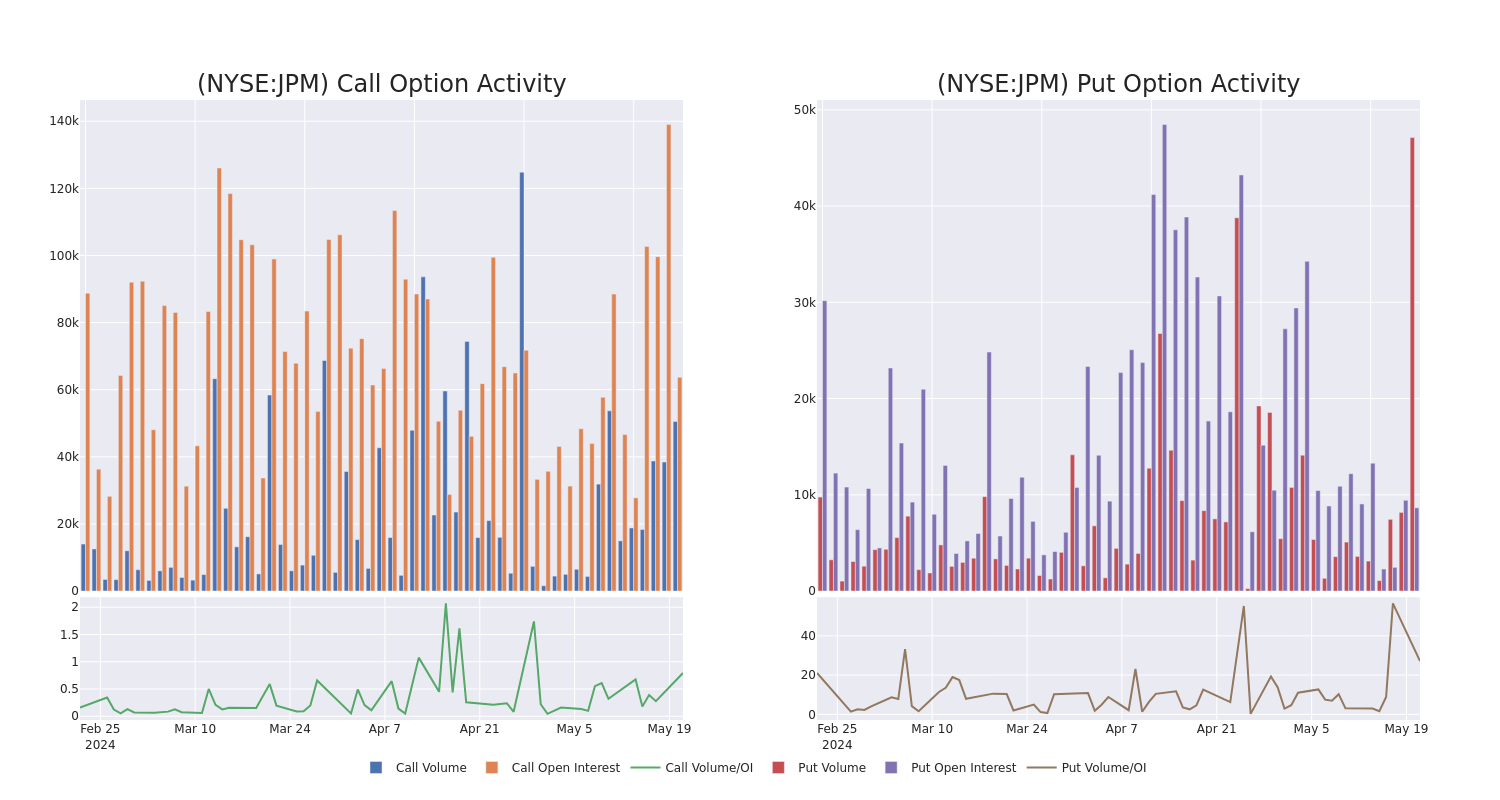

In terms of liquidity and interest, the mean open interest for JPMorgan Chase options trades today is 2877.4 with a total volume of 97,661.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for JPMorgan Chase's big money trades within a strike price range of $65.0 to $215.0 over the last 30 days.

JPMorgan Chase Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | CALL | TRADE | NEUTRAL | 01/16/26 | $26.45 | $26.0 | $26.23 | $200.00 | $62.9K | 3.0K | 35 |

| JPM | CALL | SWEEP | BEARISH | 07/19/24 | $1.23 | $1.22 | $1.22 | $215.00 | $62.3K | 397 | 515 |

| JPM | CALL | SWEEP | BULLISH | 05/24/24 | $0.8 | $0.77 | $0.8 | $200.00 | $58.7K | 8.1K | 13.6K |

| JPM | PUT | TRADE | BEARISH | 08/16/24 | $10.35 | $10.3 | $10.35 | $205.00 | $56.9K | 32 | 157 |

| JPM | CALL | SWEEP | BULLISH | 05/24/24 | $2.46 | $2.45 | $2.46 | $197.50 | $56.6K | 2.6K | 2.2K |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $3.9 trillion in assets. It is organized into four major segments--consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

Present Market Standing of JPMorgan Chase

- Trading volume stands at 13,567,129, with JPM's price up by 2.01%, positioned at $199.52.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 52 days.

Professional Analyst Ratings for JPMorgan Chase

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $210.4.

- An analyst from Keefe, Bruyette & Woods has decided to maintain their Market Perform rating on JPMorgan Chase, which currently sits at a price target of $209.

- An analyst from Morgan Stanley persists with their Overweight rating on JPMorgan Chase, maintaining a target price of $214.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on JPMorgan Chase with a target price of $224.

- An analyst from Piper Sandler persists with their Overweight rating on JPMorgan Chase, maintaining a target price of $220.

- An analyst from Baird has decided to maintain their Neutral rating on JPMorgan Chase, which currently sits at a price target of $185.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for JPMorgan Chase, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.