High-rolling investors have positioned themselves bearish on Red Cat Hldgs RCAT, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RCAT often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 17 options trades for Red Cat Hldgs. This is not a typical pattern.

The sentiment among these major traders is split, with 41% bullish and 52% bearish. Among all the options we identified, there was one put, amounting to $444,450, and 16 calls, totaling $1,566,550.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $15.0 for Red Cat Hldgs during the past quarter.

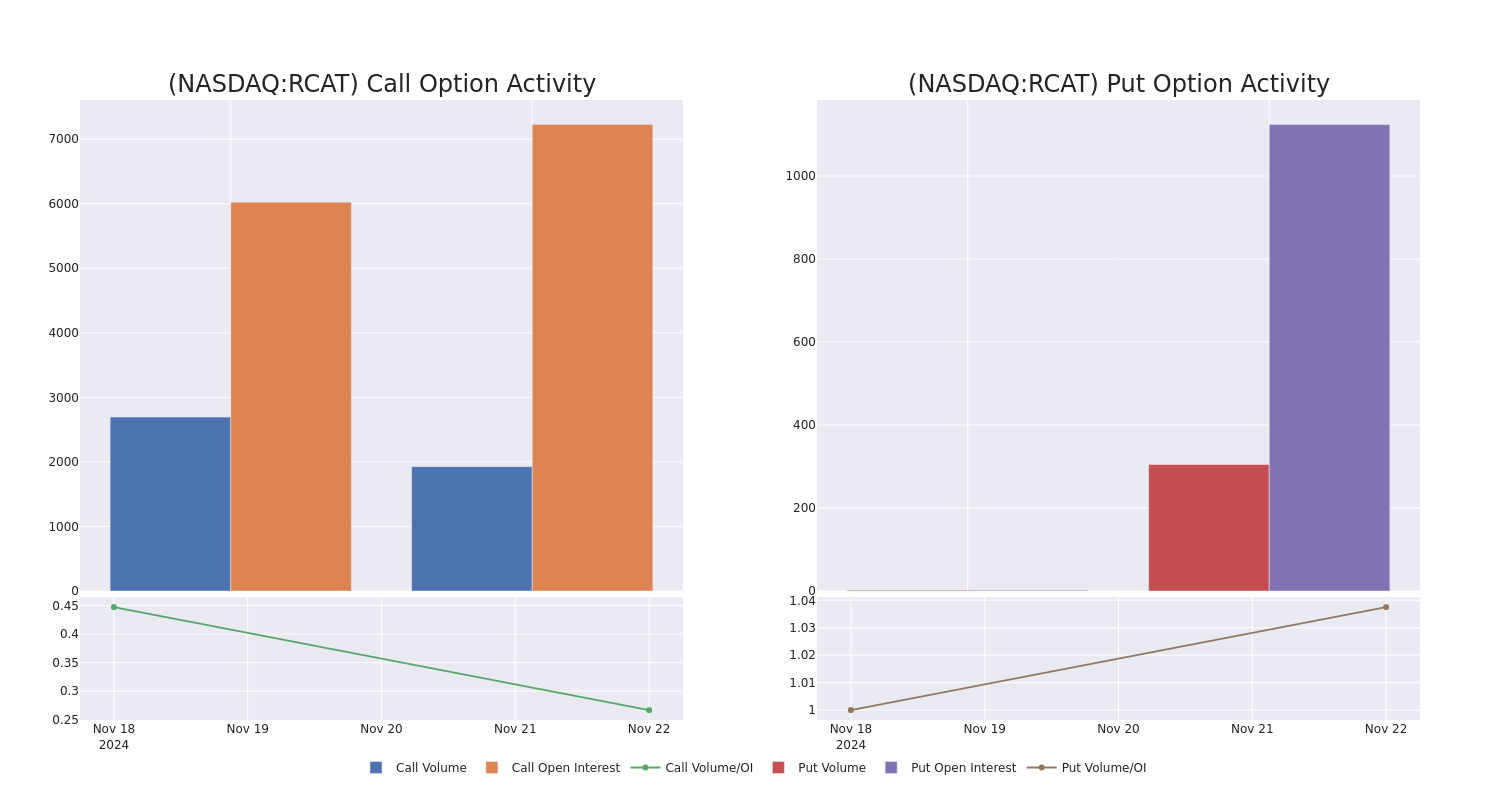

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Red Cat Hldgs's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Red Cat Hldgs's substantial trades, within a strike price spectrum from $5.0 to $15.0 over the preceding 30 days.

Red Cat Hldgs Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RCAT | PUT | SWEEP | BEARISH | 07/18/25 | $9.0 | $8.8 | $8.8 | $15.00 | $444.4K | 0 | 505 |

| RCAT | CALL | SWEEP | BEARISH | 12/20/24 | $3.1 | $2.75 | $2.75 | $7.00 | $398.4K | 4.6K | 114 |

| RCAT | CALL | SWEEP | BULLISH | 12/20/24 | $2.1 | $2.0 | $2.09 | $11.00 | $168.9K | 405 | 1.1K |

| RCAT | CALL | SWEEP | BEARISH | 12/20/24 | $2.25 | $2.2 | $2.2 | $8.00 | $133.1K | 2.8K | 525 |

| RCAT | CALL | TRADE | BULLISH | 12/20/24 | $1.7 | $1.4 | $1.6 | $10.00 | $131.8K | 1.5K | 2.1K |

About Red Cat Hldgs

Red Cat Holdings Inc is a military technology company that integrates robotic hardware and software to provide critical situational awareness and actionable intelligence to on-the-ground warfighters and battlefield commanders. Its mission is to enhance the effectiveness and safety of military operations domestically and globally. Red Cat's suite of solutions includes Teal Drones, developer of the Golden Eagle, a small unmanned system with the highest resolution imaging for night-time operations, and Skypersonic, a provider of unmanned aircraft for interior spaces and other dangerous environments.

In light of the recent options history for Red Cat Hldgs, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Red Cat Hldgs's Current Market Status

- With a volume of 8,908,543, the price of RCAT is up 6.69% at $9.57.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 18 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Red Cat Hldgs with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.