Financial giants have made a conspicuous bullish move on C3.ai. Our analysis of options history for C3.ai AI revealed 22 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $307,758, and 16 were calls, valued at $873,710.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $55.0 for C3.ai over the recent three months.

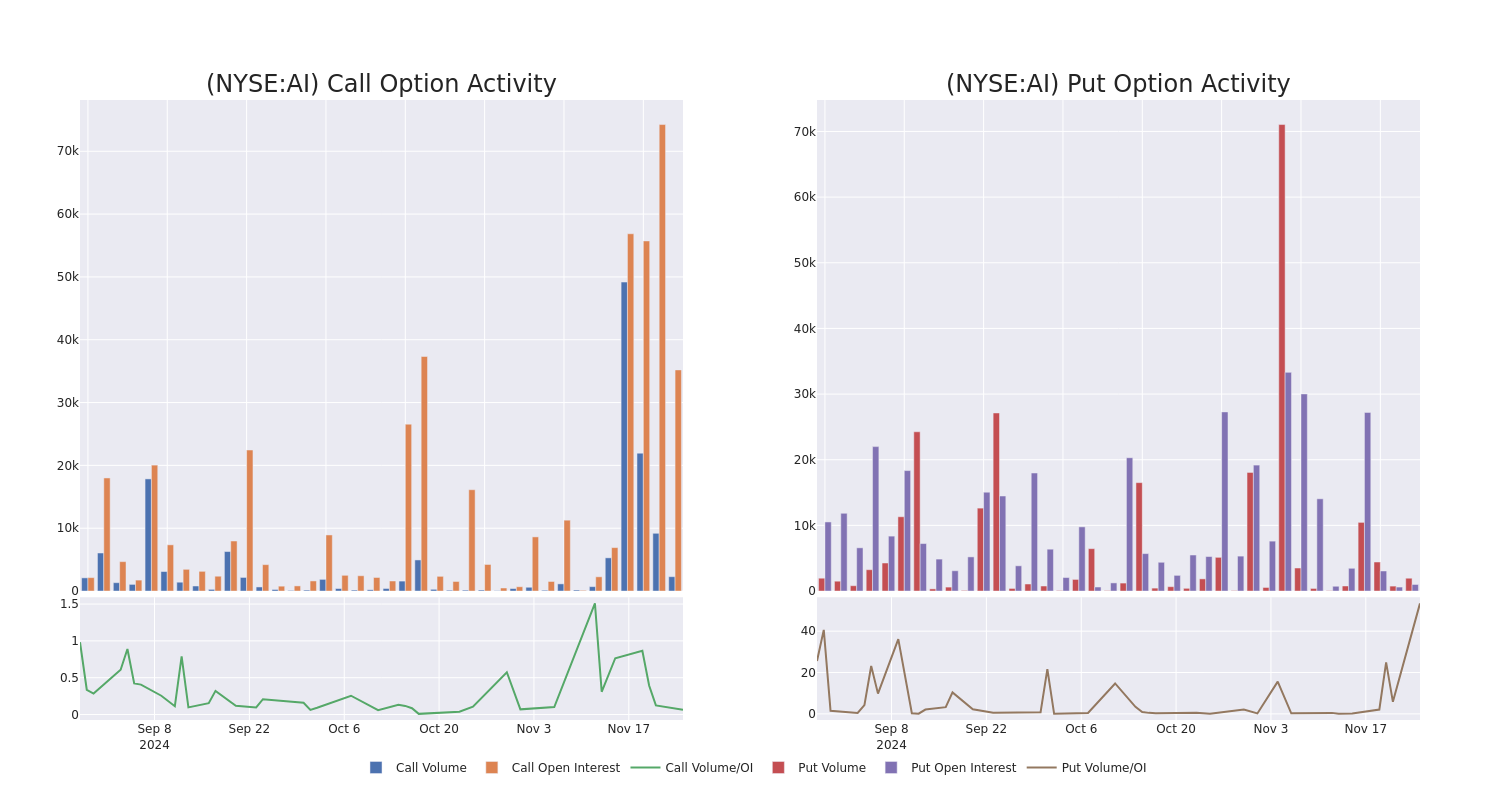

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for C3.ai's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across C3.ai's significant trades, within a strike price range of $10.0 to $55.0, over the past month.

C3.ai Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AI | CALL | TRADE | BEARISH | 01/17/25 | $2.14 | $1.87 | $1.9 | $50.00 | $152.0K | 6.6K | 856 |

| AI | PUT | SWEEP | BEARISH | 04/17/25 | $4.3 | $4.25 | $4.3 | $35.00 | $126.4K | 367 | 332 |

| AI | CALL | TRADE | BULLISH | 01/17/25 | $29.05 | $28.35 | $28.88 | $10.00 | $115.5K | 436 | 40 |

| AI | CALL | SWEEP | BEARISH | 01/16/26 | $21.95 | $21.4 | $21.4 | $20.00 | $85.6K | 1.3K | 145 |

| AI | CALL | SWEEP | BEARISH | 01/16/26 | $21.55 | $21.2 | $21.2 | $20.00 | $80.5K | 1.3K | 65 |

About C3.ai

C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Platform, which is an end-to-end application development and runtime environment for designing, developing, and deploying AI applications: C3 AI Applications, which is a portfolio of pre-built, extensible, industry-specific, and application-specific Enterprise AI applications: and C3 Generative AI, which combines the utility of large language models. Geographically the company derives revenue from North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.

After a thorough review of the options trading surrounding C3.ai, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

C3.ai's Current Market Status

- Trading volume stands at 5,276,663, with AI's price up by 5.29%, positioned at $39.4.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 14 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for C3.ai with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.