Whales with a lot of money to spend have taken a noticeably bullish stance on Lumentum Holdings.

Looking at options history for Lumentum Holdings LITE we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 0% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $64,320 and 6, calls, for a total amount of $357,160.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $77.5 to $115.0 for Lumentum Holdings over the last 3 months.

Analyzing Volume & Open Interest

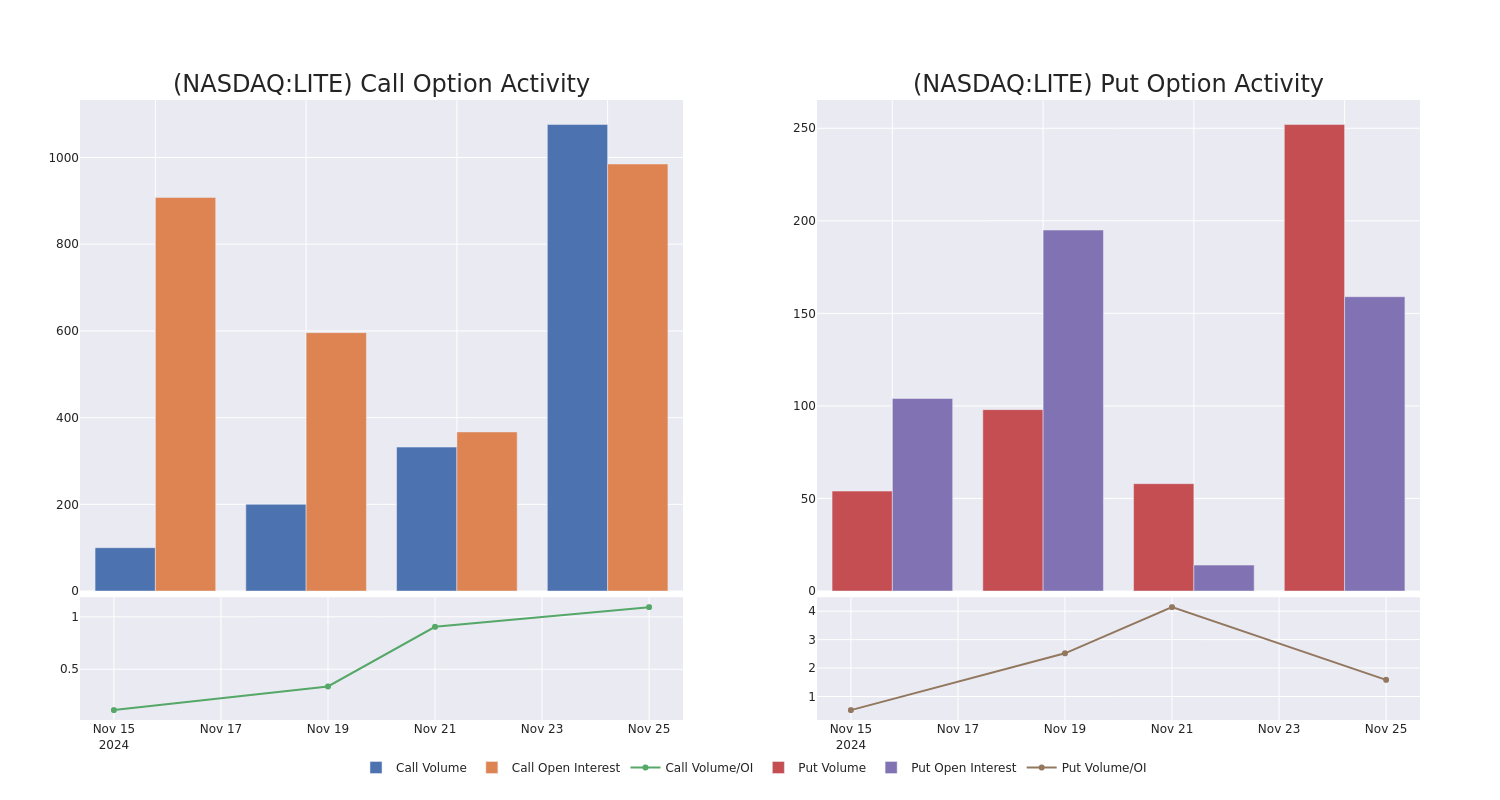

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Lumentum Holdings's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lumentum Holdings's whale activity within a strike price range from $77.5 to $115.0 in the last 30 days.

Lumentum Holdings Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LITE | CALL | SWEEP | BULLISH | 03/21/25 | $14.4 | $14.1 | $14.2 | $85.00 | $142.0K | 666 | 107 |

| LITE | CALL | TRADE | BULLISH | 03/21/25 | $3.2 | $2.4 | $2.9 | $115.00 | $72.5K | 260 | 250 |

| LITE | CALL | SWEEP | NEUTRAL | 03/21/25 | $8.9 | $8.8 | $8.9 | $95.00 | $48.0K | 59 | 241 |

| LITE | CALL | TRADE | BULLISH | 03/21/25 | $9.1 | $8.8 | $9.0 | $95.00 | $34.2K | 59 | 70 |

| LITE | PUT | SWEEP | BULLISH | 03/21/25 | $4.9 | $4.8 | $4.8 | $77.50 | $33.6K | 159 | 70 |

About Lumentum Holdings

Lumentum Holdings Inc is a California-based technology firm. The company provides two types of optical and photonic products: optical components that are used in telecommunications networking equipment, and commercial lasers for manufacturing, inspection, and life-science lab uses. Its segments are Optical Communications and Commercial Lasers. The firm is also expanding into new optical applications, such as 3-D sensing laser diode for consumer electronics. It generates maximum revenue from the OpComms segment. The OpComms segment products include a wide range of components, modules, and subsystems to support customers including carrier networks for access (local), metro (intracity), long-haul, and submarine (undersea) applications.

Current Position of Lumentum Holdings

- Trading volume stands at 1,924,803, with LITE's price up by 0.56%, positioned at $89.59.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 73 days.

Professional Analyst Ratings for Lumentum Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $93.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Northland Capital Markets continues to hold a Market Perform rating for Lumentum Holdings, targeting a price of $60. * An analyst from Raymond James has decided to maintain their Outperform rating on Lumentum Holdings, which currently sits at a price target of $100. * An analyst from Barclays has decided to maintain their Underweight rating on Lumentum Holdings, which currently sits at a price target of $80. * Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Lumentum Holdings with a target price of $110. * An analyst from Susquehanna has decided to maintain their Positive rating on Lumentum Holdings, which currently sits at a price target of $115.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lumentum Holdings options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.