Whales with a lot of money to spend have taken a noticeably bullish stance on Occidental Petroleum.

Looking at options history for Occidental Petroleum OXY we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $99,595 and 12, calls, for a total amount of $513,920.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $70.0 for Occidental Petroleum during the past quarter.

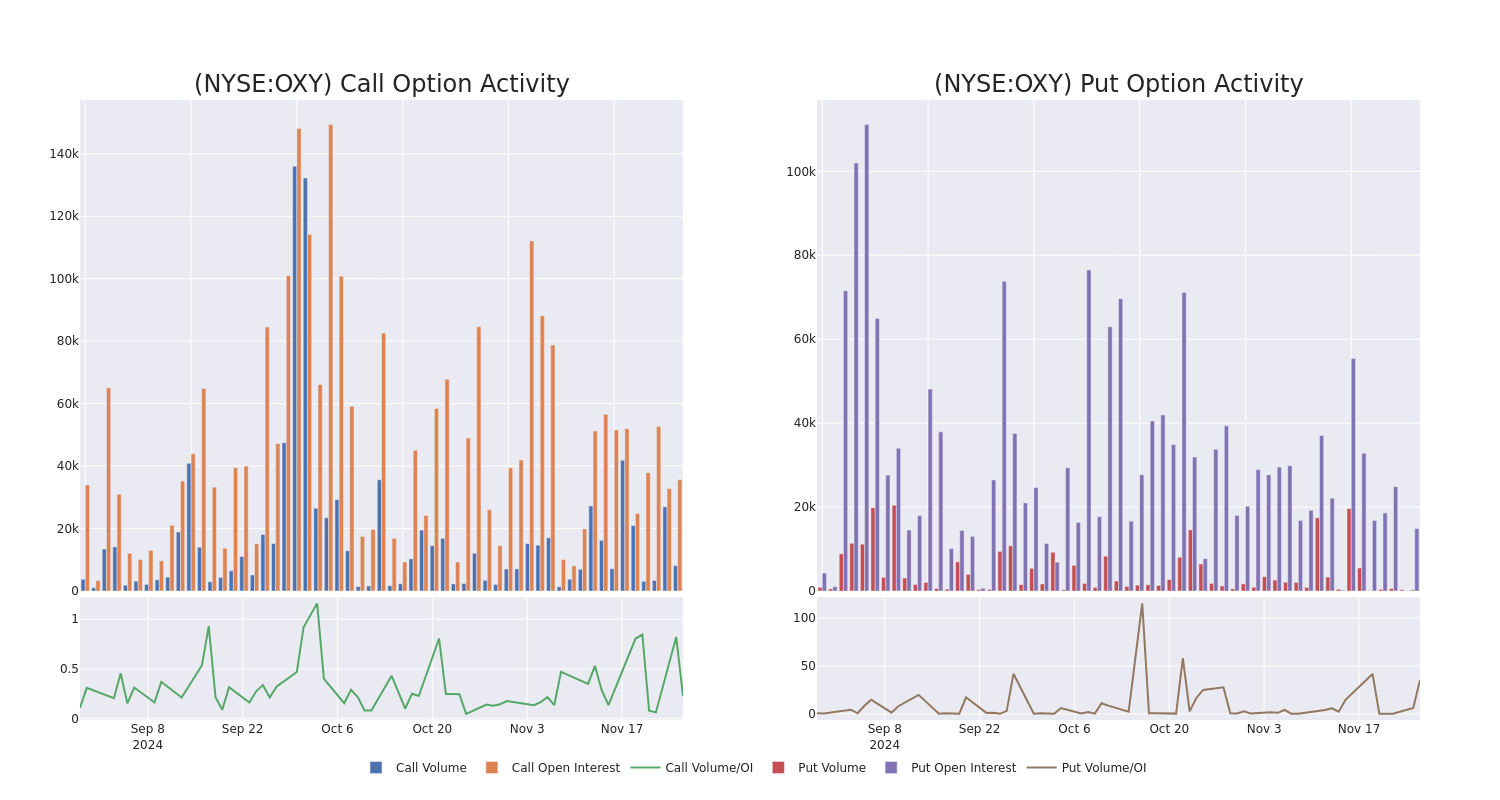

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Occidental Petroleum's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Occidental Petroleum's whale trades within a strike price range from $45.0 to $70.0 in the last 30 days.

Occidental Petroleum Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | CALL | SWEEP | BULLISH | 05/16/25 | $3.05 | $3.0 | $3.05 | $52.50 | $61.0K | 1.0K | 226 |

| OXY | CALL | SWEEP | BULLISH | 03/21/25 | $2.41 | $2.31 | $2.41 | $52.50 | $48.2K | 13.1K | 603 |

| OXY | CALL | TRADE | BULLISH | 03/21/25 | $2.4 | $2.3 | $2.38 | $52.50 | $47.6K | 13.1K | 202 |

| OXY | CALL | TRADE | BULLISH | 03/21/25 | $2.35 | $2.3 | $2.34 | $52.50 | $46.8K | 13.1K | 803 |

| OXY | CALL | SWEEP | BULLISH | 03/21/25 | $2.31 | $2.3 | $2.31 | $52.50 | $46.2K | 13.1K | 403 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

Following our analysis of the options activities associated with Occidental Petroleum, we pivot to a closer look at the company's own performance.

Present Market Standing of Occidental Petroleum

- Trading volume stands at 5,253,956, with OXY's price down by -1.55%, positioned at $49.66.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 78 days.

Professional Analyst Ratings for Occidental Petroleum

5 market experts have recently issued ratings for this stock, with a consensus target price of $62.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Susquehanna persists with their Positive rating on Occidental Petroleum, maintaining a target price of $65. * An analyst from Citigroup persists with their Neutral rating on Occidental Petroleum, maintaining a target price of $56. * Reflecting concerns, an analyst from JP Morgan lowers its rating to Neutral with a new price target of $56. * An analyst from UBS has decided to maintain their Neutral rating on Occidental Petroleum, which currently sits at a price target of $58. * An analyst from Raymond James persists with their Strong Buy rating on Occidental Petroleum, maintaining a target price of $78.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Occidental Petroleum options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.