High-rolling investors have positioned themselves bullish on Intuitive Machines LUNR, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LUNR often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Intuitive Machines. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 25% bearish. Among all the options we identified, there was one put, amounting to $52,500, and 7 calls, totaling $299,041.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $2.5 to $20.0 for Intuitive Machines over the last 3 months.

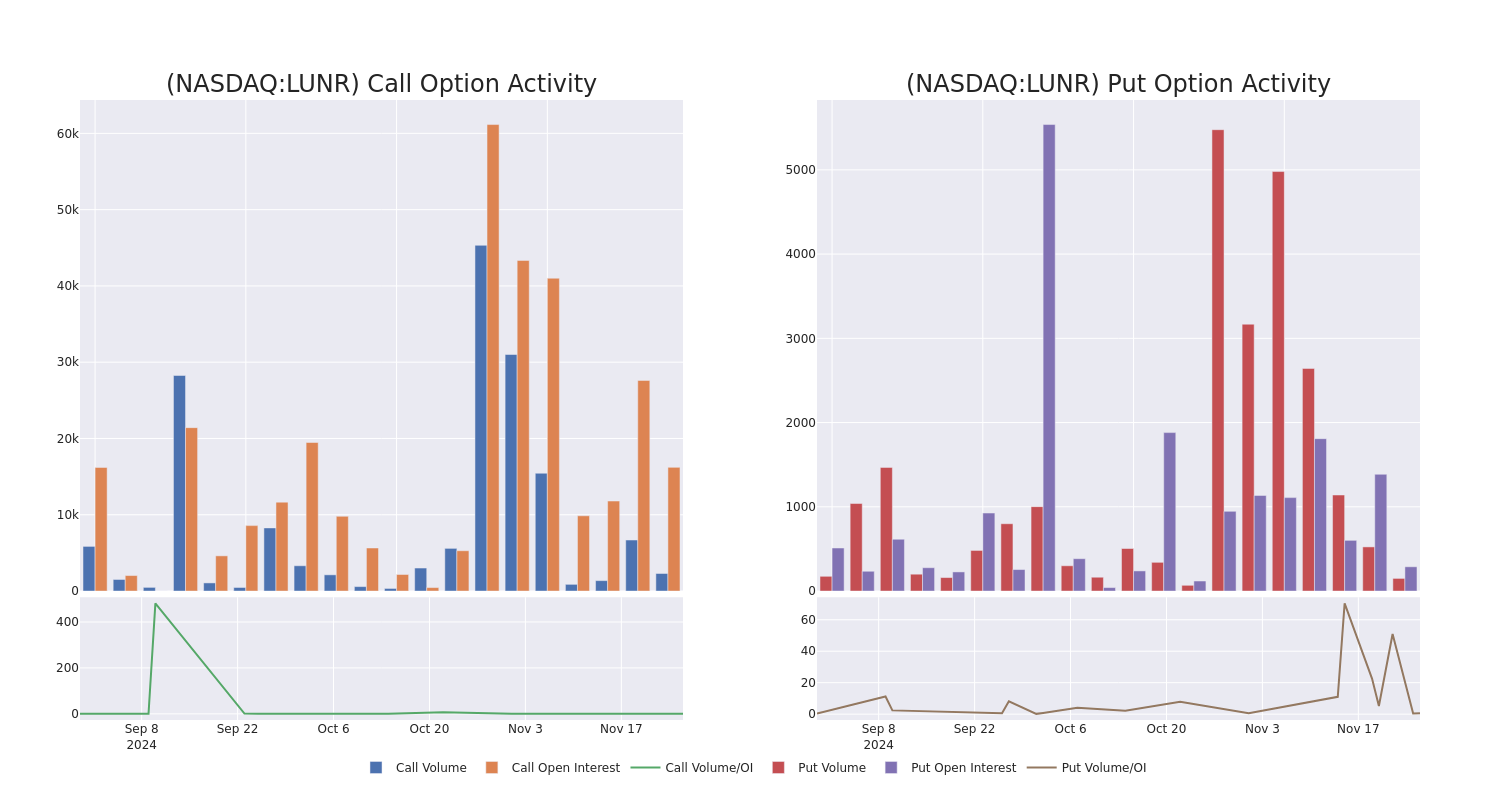

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Intuitive Machines options trades today is 2062.62 with a total volume of 2,451.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Intuitive Machines's big money trades within a strike price range of $2.5 to $20.0 over the last 30 days.

Intuitive Machines 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LUNR | CALL | TRADE | BULLISH | 01/16/26 | $8.2 | $7.6 | $8.0 | $10.00 | $80.0K | 3.6K | 100 |

| LUNR | CALL | TRADE | BEARISH | 01/17/25 | $10.4 | $10.2 | $10.2 | $5.00 | $61.2K | 2.1K | 70 |

| LUNR | PUT | TRADE | NEUTRAL | 03/21/25 | $3.6 | $3.4 | $3.5 | $14.00 | $52.5K | 288 | 150 |

| LUNR | CALL | SWEEP | BULLISH | 01/17/25 | $2.4 | $2.35 | $2.4 | $15.00 | $48.0K | 4.8K | 596 |

| LUNR | CALL | TRADE | NEUTRAL | 01/17/25 | $12.6 | $12.4 | $12.51 | $2.50 | $31.2K | 382 | 25 |

About Intuitive Machines

Intuitive Machines Inc is a space exploration, infrastructure, and services company. It is a diversified space company focused on space exploration. It supplies space products and services to support sustained robotic and human exploration to the Moon, Mars, and beyond. Its products and services are offered through its four business units: Lunar Access Services, Orbital Services, Lunar Data Services, and Space Products and Infrastructure.

In light of the recent options history for Intuitive Machines, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Intuitive Machines Standing Right Now?

- Currently trading with a volume of 10,700,192, the LUNR's price is down by -2.59%, now at $14.3.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 114 days.

What Analysts Are Saying About Intuitive Machines

In the last month, 3 experts released ratings on this stock with an average target price of $14.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Cantor Fitzgerald persists with their Overweight rating on Intuitive Machines, maintaining a target price of $15. * An analyst from Benchmark persists with their Buy rating on Intuitive Machines, maintaining a target price of $16. * Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Intuitive Machines, targeting a price of $12.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intuitive Machines, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.