Whales with a lot of money to spend have taken a noticeably bearish stance on Citigroup.

Looking at options history for Citigroup C we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 60% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $443,285 and 6, calls, for a total amount of $254,927.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $47.5 to $77.5 for Citigroup during the past quarter.

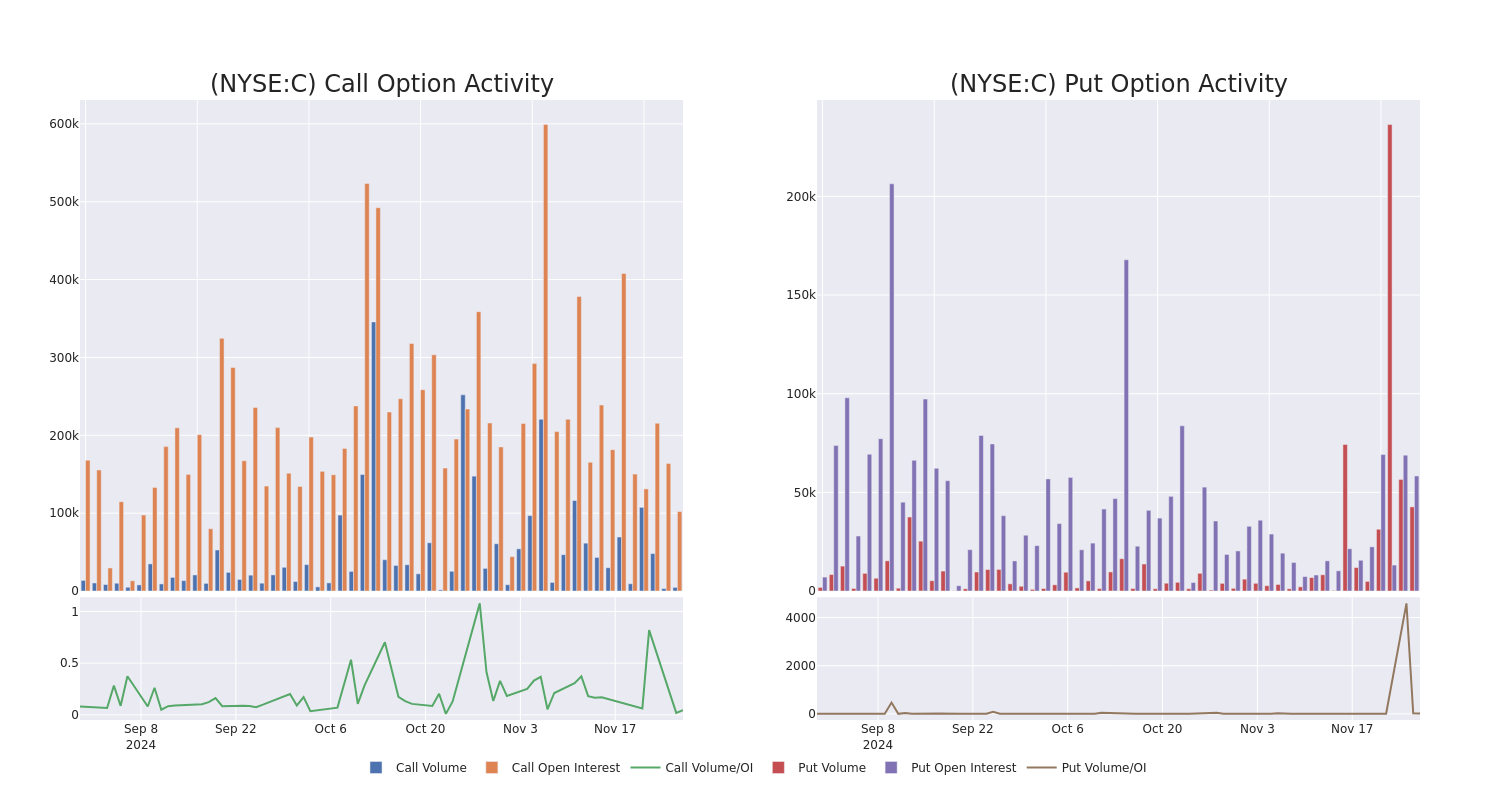

Volume & Open Interest Development

In today's trading context, the average open interest for options of Citigroup stands at 13369.42, with a total volume reaching 47,345.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Citigroup, situated within the strike price corridor from $47.5 to $77.5, throughout the last 30 days.

Citigroup 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | PUT | SWEEP | BEARISH | 01/17/25 | $0.31 | $0.3 | $0.31 | $60.00 | $93.0K | 32.6K | 4.0K |

| C | PUT | SWEEP | BEARISH | 11/29/24 | $0.35 | $0.34 | $0.35 | $70.00 | $85.9K | 2.0K | 4.5K |

| C | CALL | TRADE | BULLISH | 06/20/25 | $5.8 | $5.75 | $5.8 | $70.00 | $58.0K | 24.0K | 104 |

| C | CALL | SWEEP | BEARISH | 11/29/24 | $0.62 | $0.59 | $0.62 | $70.00 | $51.9K | 5.3K | 1.8K |

| C | PUT | TRADE | BEARISH | 01/16/26 | $9.8 | $9.7 | $9.8 | $75.00 | $49.0K | 246 | 50 |

About Citigroup

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

After a thorough review of the options trading surrounding Citigroup, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Citigroup

- Trading volume stands at 5,003,621, with C's price up by 0.05%, positioned at $69.78.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 49 days.

Expert Opinions on Citigroup

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $101.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Oppenheimer has decided to maintain their Outperform rating on Citigroup, which currently sits at a price target of $107. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Citigroup, targeting a price of $95.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Citigroup options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.