Financial giants have made a conspicuous bearish move on Taiwan Semiconductor. Our analysis of options history for Taiwan Semiconductor TSM revealed 41 unusual trades.

Delving into the details, we found 39% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $485,502, and 31 were calls, valued at $3,296,628.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $105.0 and $210.0 for Taiwan Semiconductor, spanning the last three months.

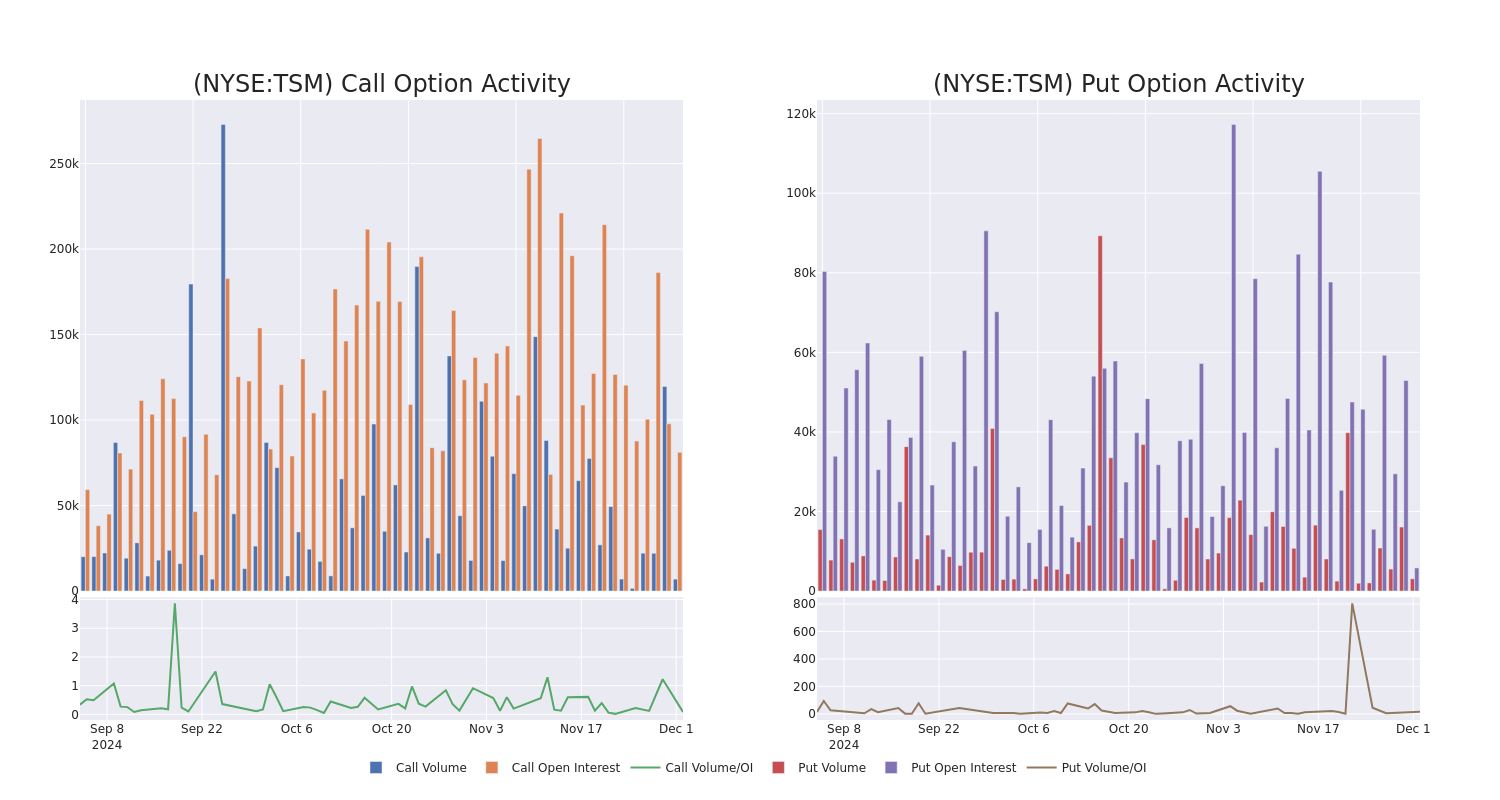

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Taiwan Semiconductor's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Taiwan Semiconductor's whale trades within a strike price range from $105.0 to $210.0 in the last 30 days.

Taiwan Semiconductor 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSM | CALL | SWEEP | BEARISH | 01/17/25 | $14.55 | $14.5 | $14.46 | $185.00 | $1.0M | 15.7K | 1.4K |

| TSM | CALL | SWEEP | BULLISH | 01/17/25 | $14.5 | $14.4 | $14.48 | $185.00 | $256.2K | 15.7K | 734 |

| TSM | CALL | SWEEP | BULLISH | 01/17/25 | $29.6 | $28.95 | $29.6 | $165.00 | $207.2K | 2.4K | 270 |

| TSM | CALL | TRADE | BULLISH | 08/15/25 | $36.15 | $35.8 | $36.15 | $175.00 | $180.7K | 662 | 125 |

| TSM | CALL | TRADE | BEARISH | 08/15/25 | $35.25 | $35.0 | $35.0 | $175.00 | $175.0K | 662 | 75 |

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the us in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Following our analysis of the options activities associated with Taiwan Semiconductor, we pivot to a closer look at the company's own performance.

Where Is Taiwan Semiconductor Standing Right Now?

- With a trading volume of 5,767,619, the price of TSM is up by 4.72%, reaching $193.38.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 45 days from now.

Professional Analyst Ratings for Taiwan Semiconductor

1 market experts have recently issued ratings for this stock, with a consensus target price of $240.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Barclays has decided to maintain their Overweight rating on Taiwan Semiconductor, which currently sits at a price target of $240.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Taiwan Semiconductor options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.