Whales with a lot of money to spend have taken a noticeably bullish stance on Trade Desk.

Looking at options history for Trade Desk TTD we detected 19 trades.

If we consider the specifics of each trade, it is accurate to state that 47% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $140,955 and 17, calls, for a total amount of $2,622,838.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $190.0 for Trade Desk, spanning the last three months.

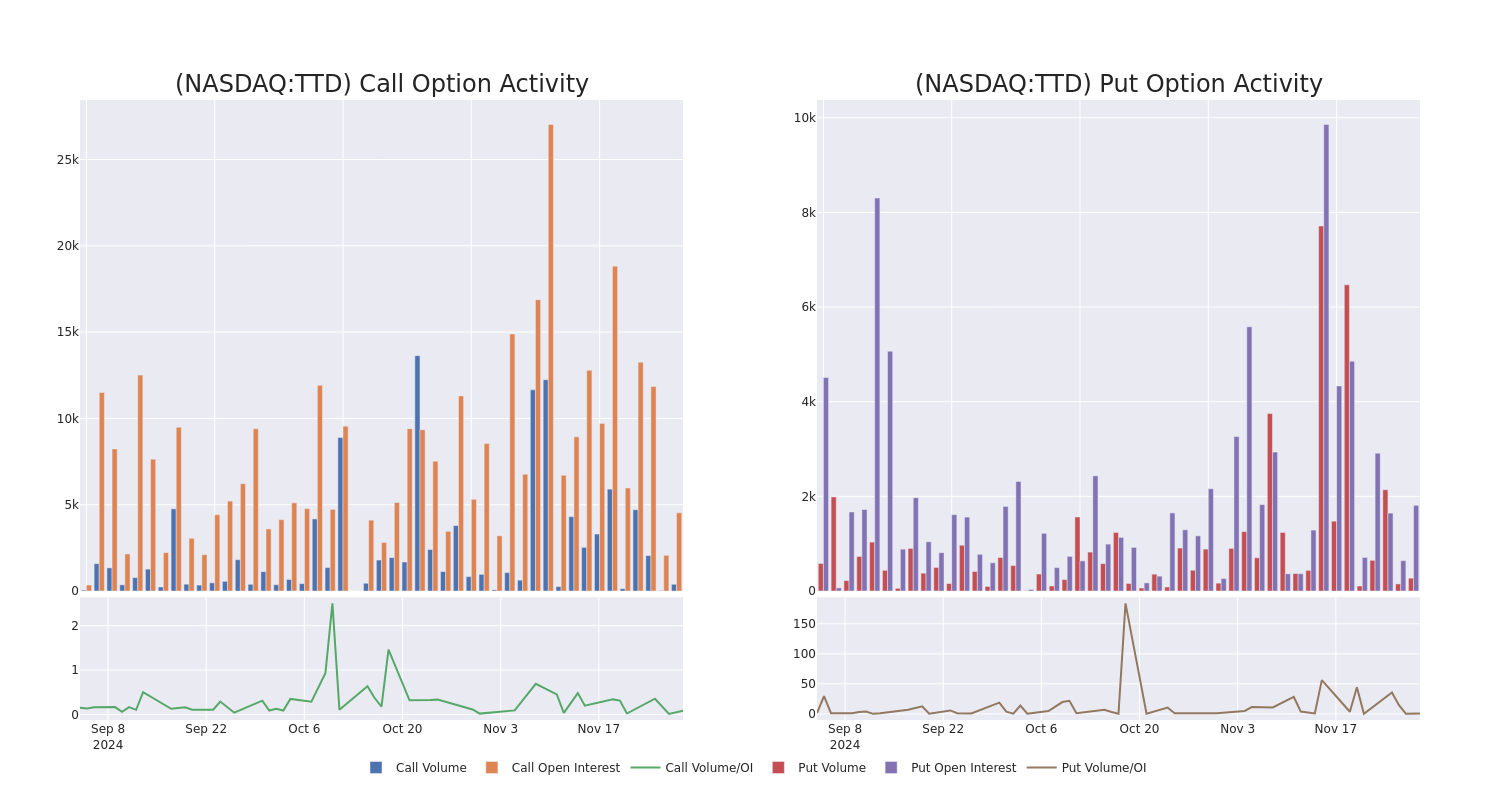

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Trade Desk's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Trade Desk's significant trades, within a strike price range of $30.0 to $190.0, over the past month.

Trade Desk 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | CALL | TRADE | BEARISH | 09/19/25 | $7.75 | $6.7 | $6.75 | $190.00 | $1.3M | 70 | 2.0K |

| TTD | CALL | TRADE | BEARISH | 01/17/25 | $86.95 | $85.0 | $85.0 | $50.00 | $170.0K | 407 | 20 |

| TTD | CALL | SWEEP | BULLISH | 01/16/26 | $10.95 | $10.3 | $10.95 | $190.00 | $136.8K | 49 | 62 |

| TTD | CALL | TRADE | BULLISH | 01/15/27 | $21.75 | $21.75 | $21.75 | $180.00 | $130.5K | 265 | 60 |

| TTD | CALL | SWEEP | BULLISH | 04/17/25 | $4.25 | $3.7 | $3.7 | $170.00 | $115.4K | 169 | 312 |

About Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

Following our analysis of the options activities associated with Trade Desk, we pivot to a closer look at the company's own performance.

Present Market Standing of Trade Desk

- Trading volume stands at 2,218,875, with TTD's price up by 4.98%, positioned at $134.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 73 days.

What Analysts Are Saying About Trade Desk

In the last month, 5 experts released ratings on this stock with an average target price of $141.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Macquarie continues to hold a Outperform rating for Trade Desk, targeting a price of $150. * Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Trade Desk with a target price of $150. * Maintaining their stance, an analyst from DA Davidson continues to hold a Buy rating for Trade Desk, targeting a price of $134. * Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Trade Desk, targeting a price of $135. * An analyst from Baird persists with their Outperform rating on Trade Desk, maintaining a target price of $140.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Trade Desk with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.