Whales with a lot of money to spend have taken a noticeably bearish stance on PDD Holdings.

Looking at options history for PDD Holdings PDD we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $413,419 and 4, calls, for a total amount of $408,925.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $150.0 for PDD Holdings over the recent three months.

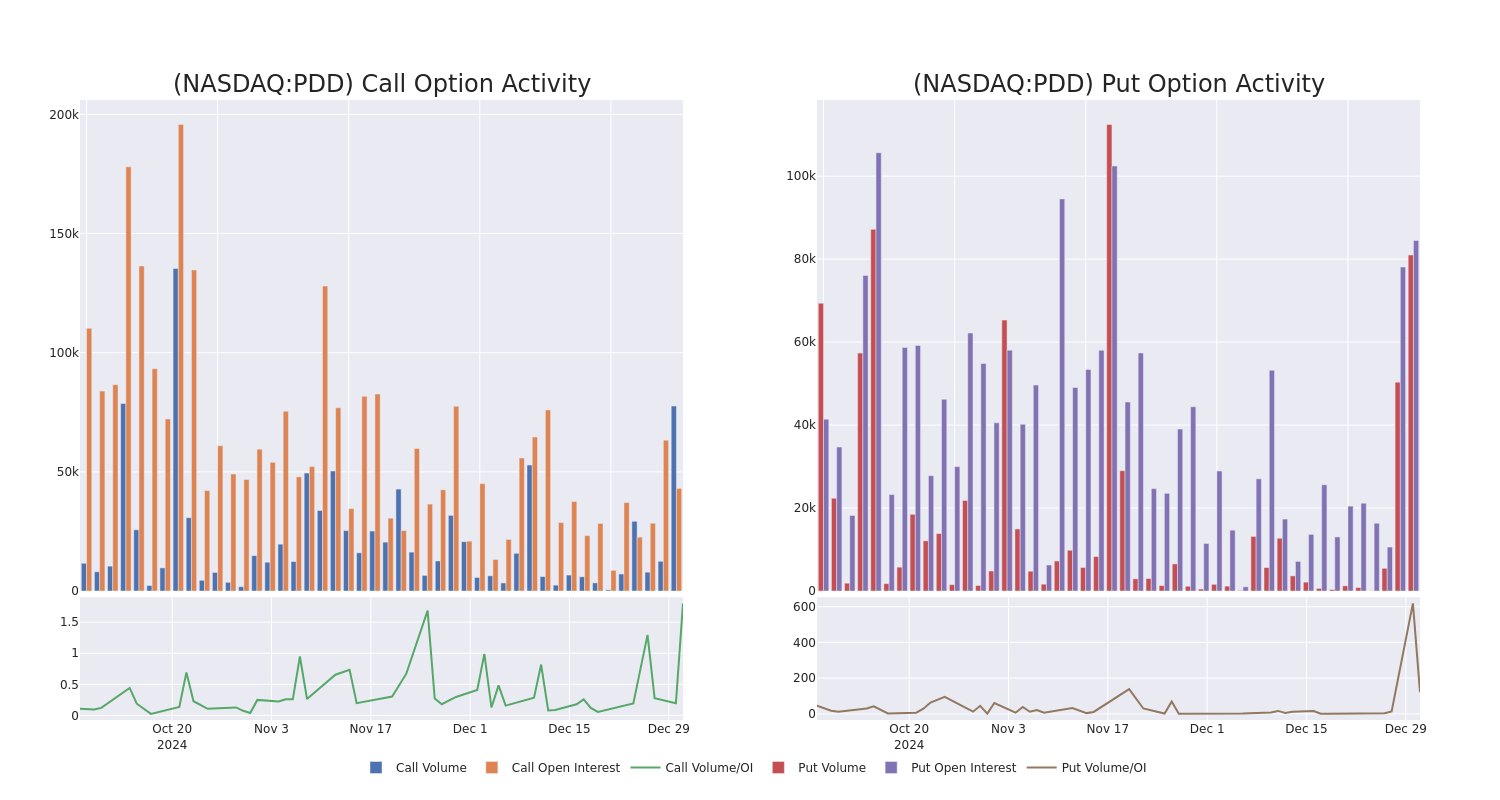

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PDD Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PDD Holdings's substantial trades, within a strike price spectrum from $95.0 to $150.0 over the preceding 30 days.

PDD Holdings Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BULLISH | 01/17/25 | $1.63 | $1.45 | $1.58 | $100.00 | $158.0K | 12.9K | 443 |

| PDD | CALL | TRADE | BEARISH | 01/16/26 | $20.9 | $20.8 | $20.8 | $95.00 | $137.2K | 15.9K | 220 |

| PDD | PUT | TRADE | BULLISH | 06/18/26 | $58.5 | $56.4 | $57.01 | $150.00 | $114.0K | 500 | 20 |

| PDD | PUT | TRADE | BEARISH | 01/16/26 | $56.7 | $53.85 | $55.86 | $150.00 | $111.7K | 1.4K | 20 |

| PDD | PUT | TRADE | NEUTRAL | 06/18/26 | $49.1 | $48.3 | $48.77 | $140.00 | $97.5K | 0 | 0 |

About PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

After a thorough review of the options trading surrounding PDD Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of PDD Holdings

- Trading volume stands at 1,209,318, with PDD's price down by -0.56%, positioned at $96.34.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 75 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.