High-rolling investors have positioned themselves bearish on Caterpillar CAT, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CAT often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 11 options trades for Caterpillar. This is not a typical pattern.

The sentiment among these major traders is split, with 18% bullish and 45% bearish. Among all the options we identified, there was one put, amounting to $31,370, and 10 calls, totaling $539,287.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $240.0 and $372.5 for Caterpillar, spanning the last three months.

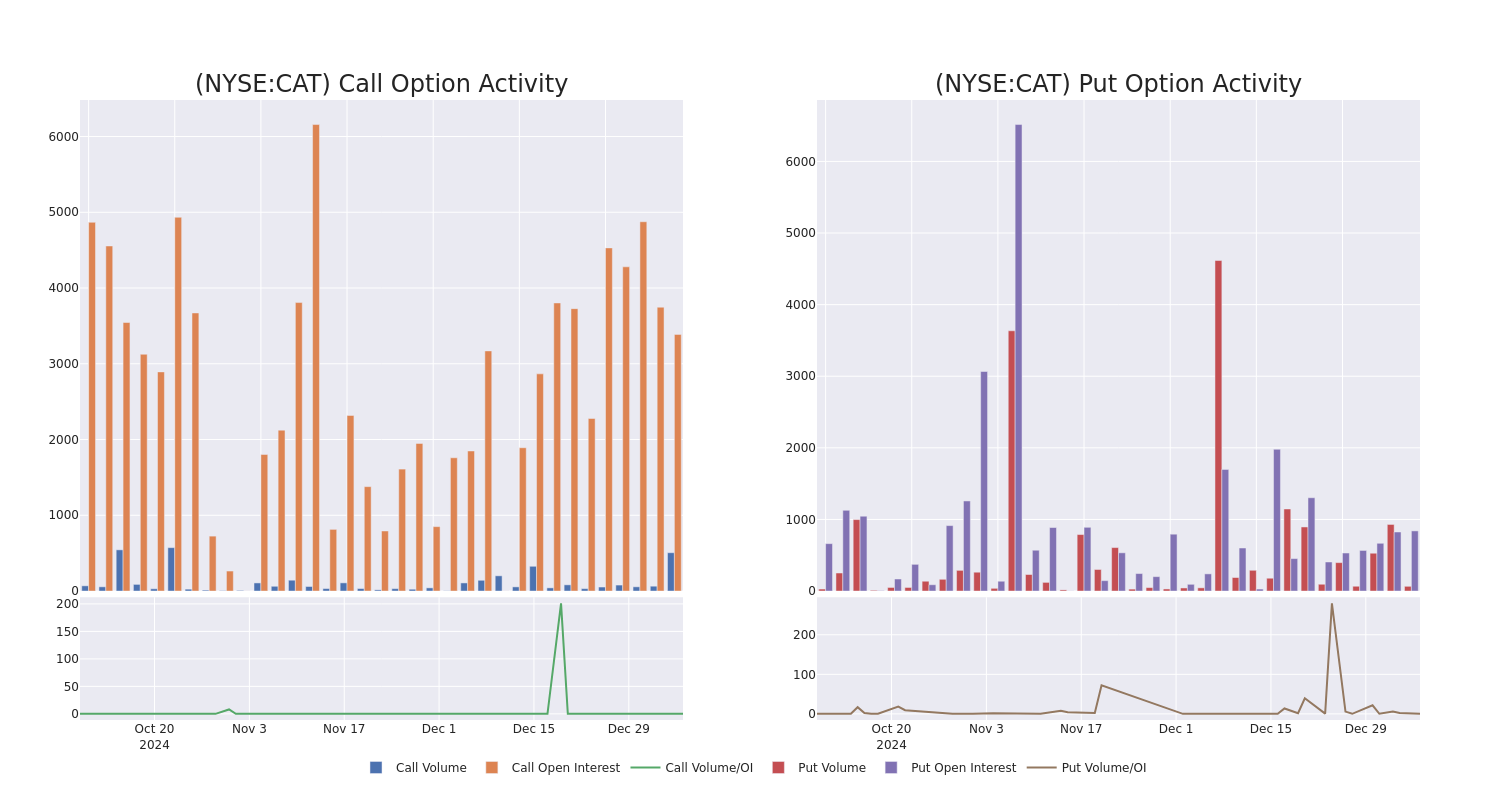

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Caterpillar's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Caterpillar's whale activity within a strike price range from $240.0 to $372.5 in the last 30 days.

Caterpillar 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | TRADE | BEARISH | 02/21/25 | $15.65 | $14.15 | $14.69 | $370.00 | $146.9K | 249 | 192 |

| CAT | CALL | TRADE | NEUTRAL | 01/17/25 | $120.35 | $118.2 | $119.1 | $250.00 | $59.5K | 1.0K | 9 |

| CAT | CALL | TRADE | NEUTRAL | 06/20/25 | $95.65 | $93.8 | $94.72 | $280.00 | $56.8K | 150 | 0 |

| CAT | CALL | TRADE | NEUTRAL | 01/17/25 | $69.1 | $66.15 | $67.55 | $300.00 | $47.2K | 1.6K | 0 |

| CAT | CALL | TRADE | NEUTRAL | 01/17/25 | $119.35 | $115.7 | $117.45 | $250.00 | $46.9K | 1.0K | 4 |

About Caterpillar

Caterpillar is the world's leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Its reporting segments are: construction industries (40% sales/47% operating profit, or OP), resource industries (20% sales/19% OP), and energy & transportation (40% sales/34% OP). Market share approaches 20% across many products. Caterpillar operates a captive finance subsidiary to facilitate sales. The firm has global reach (46% US sales/54% ex-US). Construction skews more domestic, while the other divisions are more geographically diversified. An independent network of 156 dealers operates approximately 2,800 facilities, giving Caterpillar reach into about 190 countries for sales and support services.

Where Is Caterpillar Standing Right Now?

- Currently trading with a volume of 102,360, the CAT's price is up by 1.13%, now at $367.9.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 28 days.

What The Experts Say On Caterpillar

3 market experts have recently issued ratings for this stock, with a consensus target price of $482.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Truist Securities has decided to maintain their Buy rating on Caterpillar, which currently sits at a price target of $471. * An analyst from JP Morgan has decided to maintain their Overweight rating on Caterpillar, which currently sits at a price target of $515. * An analyst from Citigroup has decided to maintain their Buy rating on Caterpillar, which currently sits at a price target of $460.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Caterpillar with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.