Whales with a lot of money to spend have taken a noticeably bullish stance on Advanced Micro Devices.

Looking at options history for Advanced Micro Devices AMD we detected 123 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 29 are puts, for a total amount of $9,677,722 and 94, calls, for a total amount of $7,942,802.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $65.0 to $200.0 for Advanced Micro Devices over the last 3 months.

Analyzing Volume & Open Interest

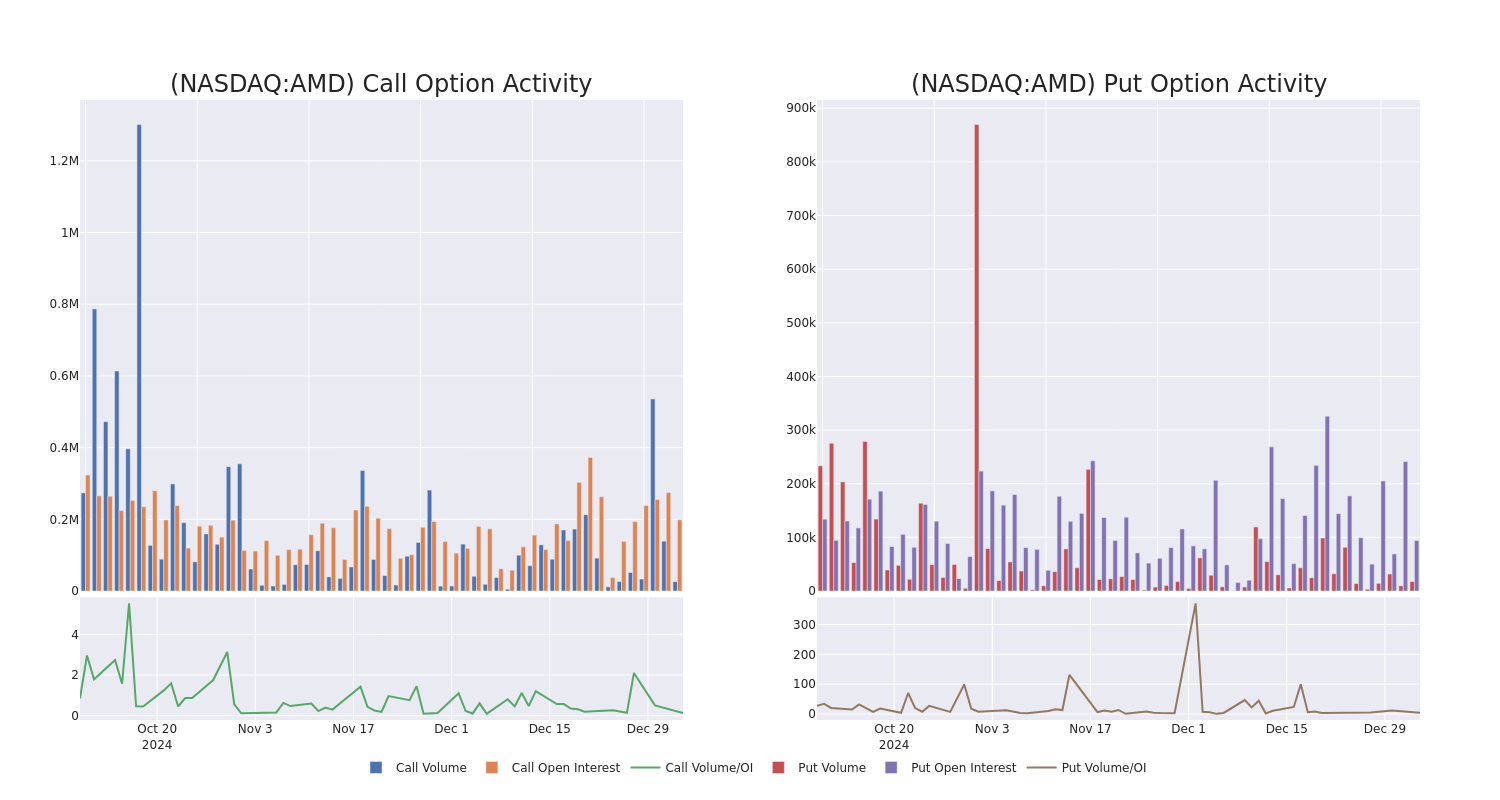

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Advanced Micro Devices's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Advanced Micro Devices's substantial trades, within a strike price spectrum from $65.0 to $200.0 over the preceding 30 days.

Advanced Micro Devices Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | SWEEP | BEARISH | 01/16/26 | $43.4 | $43.25 | $43.25 | $100.00 | $1.1M | 9.3K | 9.7K |

| AMD | CALL | SWEEP | BULLISH | 03/21/25 | $4.8 | $4.75 | $4.8 | $150.00 | $235.1K | 26.5K | 4.0K |

| AMD | CALL | SWEEP | BULLISH | 01/16/26 | $42.6 | $42.4 | $42.6 | $100.00 | $213.0K | 9.3K | 13.6K |

| AMD | CALL | SWEEP | BULLISH | 01/16/26 | $42.5 | $42.25 | $42.44 | $100.00 | $191.2K | 9.3K | 12.9K |

| AMD | CALL | TRADE | BULLISH | 08/15/25 | $14.9 | $14.75 | $14.9 | $145.00 | $149.0K | 1.0K | 114 |

About Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications. AMD's traditional strength was in central processing units and graphics processing units used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array leader Xilinx to diversify its business and augment its opportunities in key end markets such as data center and automotive.

After a thorough review of the options trading surrounding Advanced Micro Devices, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Advanced Micro Devices Standing Right Now?

- With a volume of 38,019,563, the price of AMD is up 3.69% at $130.0.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 22 days.

What Analysts Are Saying About Advanced Micro Devices

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $156.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Advanced Micro Devices, which currently sits at a price target of $158. * An analyst from B of A Securities downgraded its action to Neutral with a price target of $155.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Advanced Micro Devices, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.