High-rolling investors have positioned themselves bullish on MercadoLibre MELI, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in MELI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for MercadoLibre. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $53,600, and 7 calls, totaling $1,501,057.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1620.0 to $2160.0 for MercadoLibre over the last 3 months.

Analyzing Volume & Open Interest

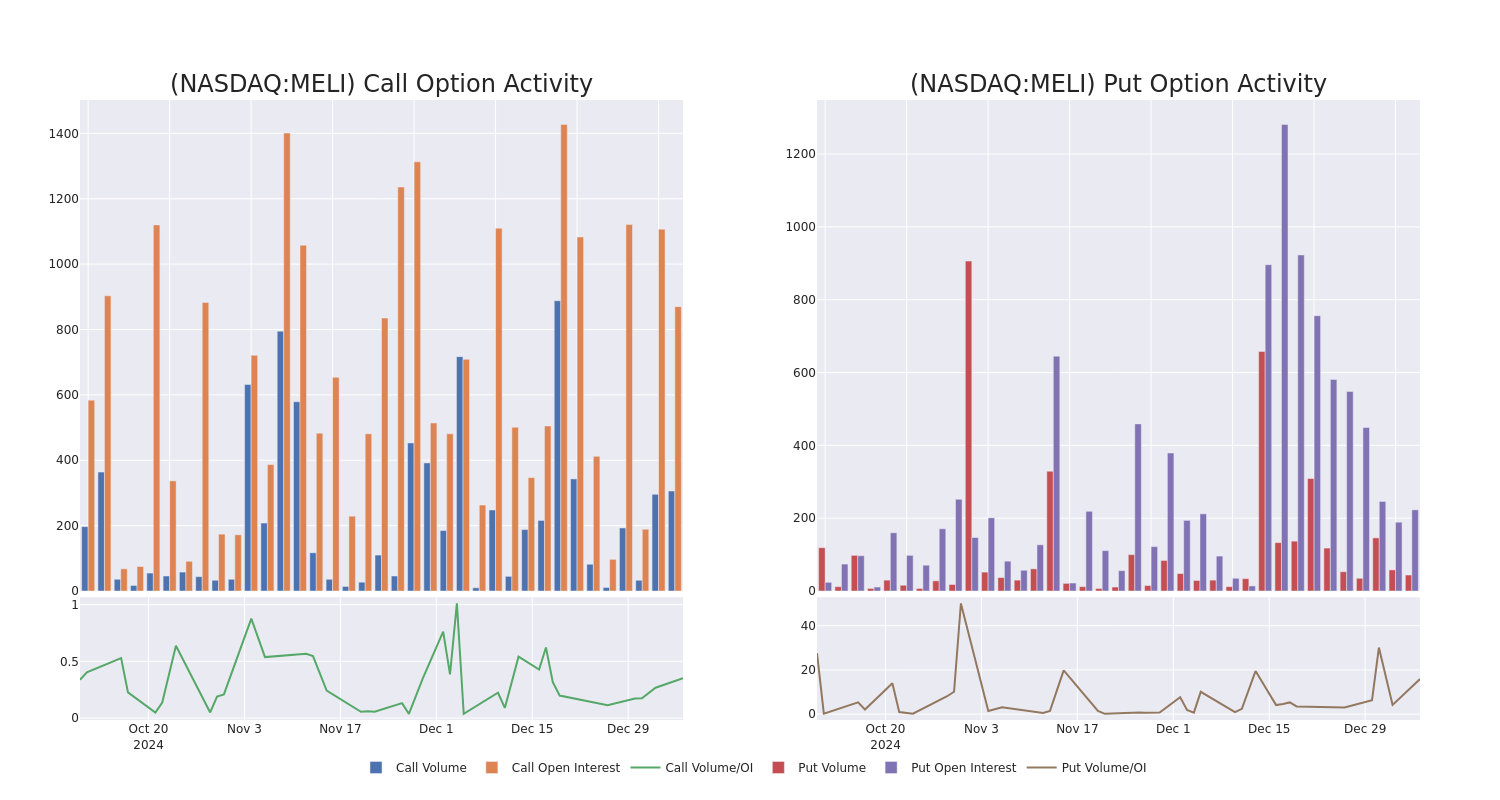

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale activity within a strike price range from $1620.0 to $2160.0 in the last 30 days.

MercadoLibre 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | TRADE | BULLISH | 01/16/26 | $401.0 | $386.1 | $396.53 | $1620.00 | $793.0K | 45 | 20 |

| MELI | CALL | TRADE | BEARISH | 03/21/25 | $110.0 | $101.3 | $104.0 | $1840.00 | $270.4K | 113 | 26 |

| MELI | CALL | TRADE | BEARISH | 03/21/25 | $108.6 | $101.6 | $103.0 | $1840.00 | $206.0K | 113 | 26 |

| MELI | CALL | TRADE | NEUTRAL | 01/16/26 | $185.8 | $166.2 | $175.0 | $2160.00 | $122.5K | 1 | 0 |

| MELI | PUT | SWEEP | BEARISH | 02/21/25 | $67.0 | $58.6 | $67.0 | $1730.00 | $53.6K | 15 | 0 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

After a thorough review of the options trading surrounding MercadoLibre, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

MercadoLibre's Current Market Status

- With a trading volume of 15,832, the price of MELI is down by -0.76%, reaching $1785.67.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 44 days from now.

Professional Analyst Ratings for MercadoLibre

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $2100.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Wedbush has decided to maintain their Outperform rating on MercadoLibre, which currently sits at a price target of $2100.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.