Financial giants have made a conspicuous bearish move on Celsius Holdings. Our analysis of options history for Celsius Holdings CELH revealed 13 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $332,959, and 7 were calls, valued at $354,345.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $50.0 for Celsius Holdings over the recent three months.

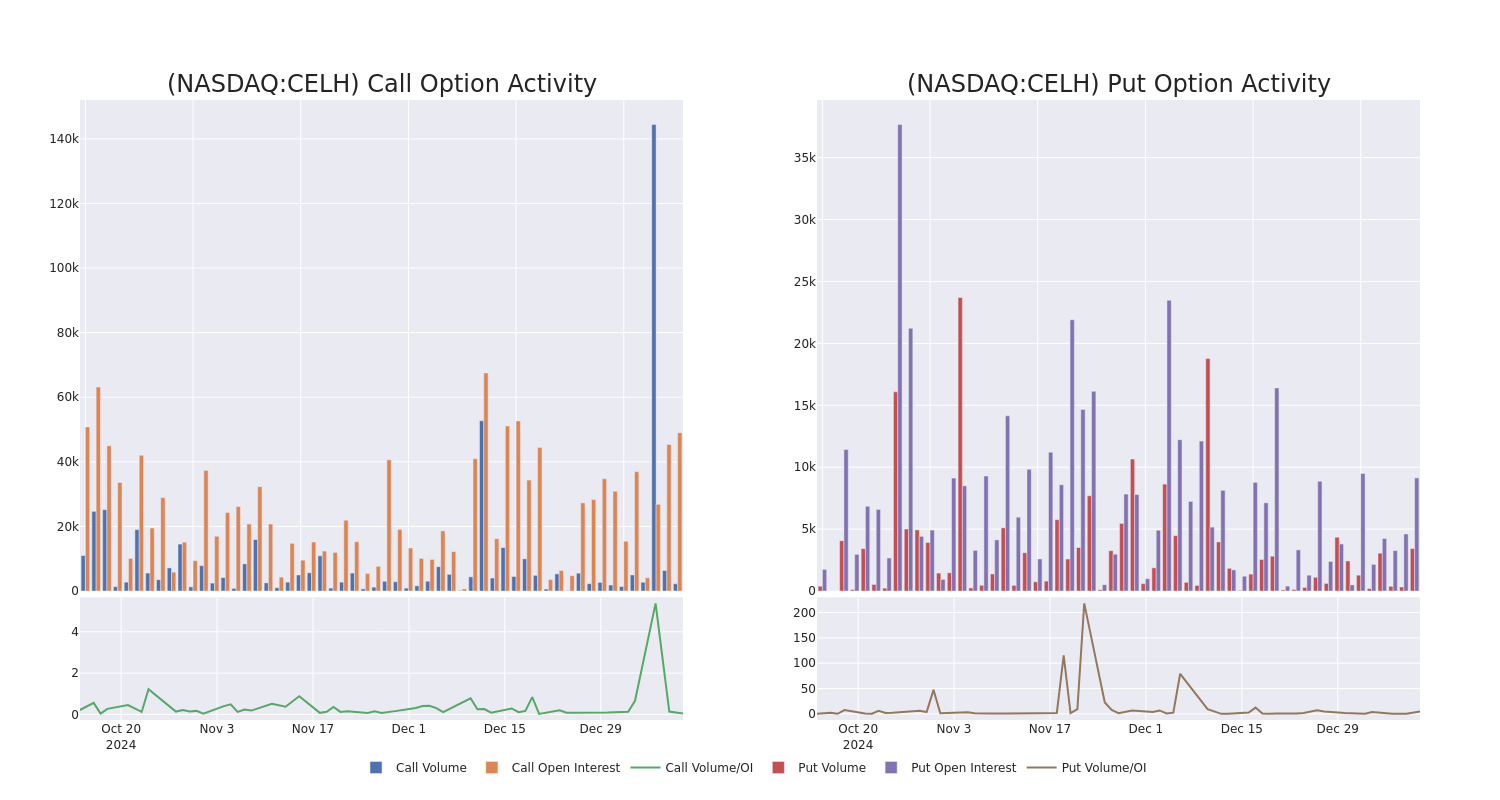

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Celsius Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Celsius Holdings's substantial trades, within a strike price spectrum from $20.0 to $50.0 over the preceding 30 days.

Celsius Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | CALL | TRADE | BULLISH | 01/16/26 | $7.25 | $7.0 | $7.15 | $30.00 | $128.7K | 6.0K | 209 |

| CELH | PUT | TRADE | BEARISH | 01/16/26 | $10.8 | $10.75 | $10.8 | $33.33 | $108.0K | 5.5K | 100 |

| CELH | PUT | SWEEP | BULLISH | 03/21/25 | $3.8 | $3.75 | $3.75 | $27.50 | $69.0K | 943 | 235 |

| CELH | CALL | TRADE | BEARISH | 01/31/25 | $1.17 | $1.0 | $1.02 | $30.00 | $61.2K | 1.5K | 600 |

| CELH | PUT | SWEEP | BEARISH | 01/16/26 | $3.3 | $3.2 | $3.3 | $20.00 | $46.8K | 1.7K | 143 |

About Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius' products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm's portfolio includes its namesake Celsius Originals beverages, Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius dedicates its efforts to branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Celsius Holdings's Current Market Status

- Currently trading with a volume of 5,163,219, the CELH's price is down by -6.57%, now at $27.11.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 48 days.

Expert Opinions on Celsius Holdings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $37.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $38. * An analyst from Deutsche Bank downgraded its action to Hold with a price target of $32. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Celsius Holdings, targeting a price of $42. * An analyst from Roth MKM persists with their Buy rating on Celsius Holdings, maintaining a target price of $38. * In a cautious move, an analyst from JP Morgan downgraded its rating to Overweight, setting a price target of $37.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Celsius Holdings with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.